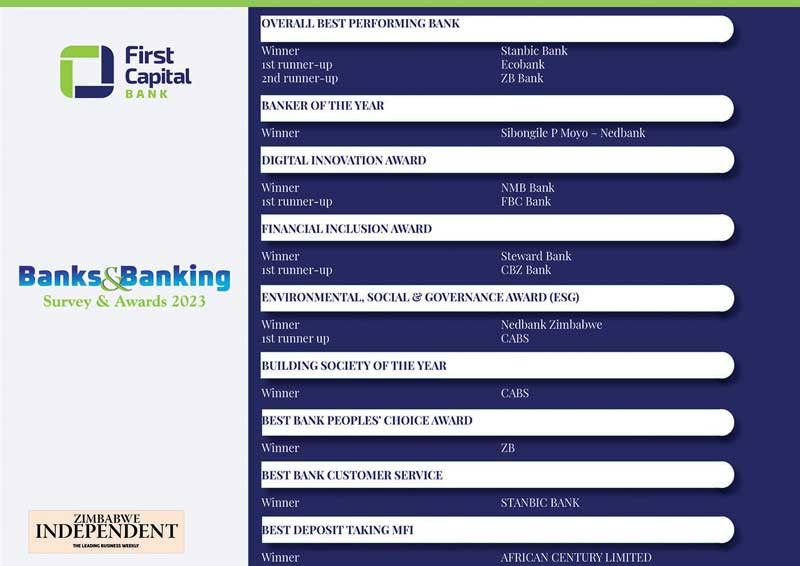

STANBIC Bank Zimbabwe was last night crowned the country’s best bank in the 2023 Zimbabwe Independent Banks & Banking Survey, while Nedbank Zimbabwe managing director Sibongile Moyo was voted the best banker.

The survey, one of Southern Africa’s best analysis of banking systems, is run by the Independent in partnership with First Capital Bank.

This year, three new categories were introduced, whose winners were voted for by the public.

ZB Bank Ltd won the Best People’s Choice award, while Stanbic picked its second award as the Best Bank for Customer Service and African Century Limited won the award for the Best Deposit Taking Micro-Finance Institution Supporting Small to Medium Enterprises.

This year’s edition was held under the theme “Achieving Economic Growth through Sustainable Finance”.

The award caps a fine year for Stanbic, which impressed the panel of distinguished financial analysts, through its aggressive growth in digital footprint.

The panel said it was also impressed by the bank’s ability to maintain high-level cost discipline, and efficiencies in lending in a volatile economic environment.

- Feli Nandi for Zimind, Nedbank listed companies awards ceremony

- Delta shines as headwinds torment ZSE firms

- Nedbank Zim heads for VFEX

- Editors Memo: Merry Christmas and a big thank you!

Keep Reading

“Stanbic Bank managed a healthy interest income underpinned by uplift in average lending book which jumped by a huge margin, reflecting heightened appetite for foreign currency funding,” said Erccro Consulting Inc, which carried out the survey.

“The bank commands a huge market share in foreign currency denominated transactions owing to its brand profiling. Foreign shareholder support has ensured favourable credit terms, thereby creating compelling customer demand and preference.”

Stanbic reported a ZW$372,9 billion inflation adjusted profit during the six months to June 30, 2023, a 572% growth from ZW$55,5 billion during the comparable period in 2022.

The panel awarded CABS, Zimbabwe’s biggest mortgage lender, the Building Society of the Year accolade, after significant interventions to bolster Zimbabwe’s housing capacity while striking deals with regional and international financiers to make strategic interventions on a market with a housing backlog of 1,2 million. These include the European Investment Bank, Afrexim Bank, Trade Development Bank and Norsad Capital.

The panel was also impressed by the building society’s investments in digital banking.

“Digital transformation continues to be a critical element in the society’s efforts to provide customers with convenience on transaction platforms and capabilities,” Erccro said in its citation. “A culture of innovation that entails process optimisation and automation continues to be championed within CABS with an aim of improving customer experience as well as bringing efficiencies in business operations. During the period under review, CABS completed the construction of a digital branch at Eastgate Mall to smoothen the digitalisation journey.”

During the half year to June 30, 2023, CABS’ net surplus increased to ZW$428,82 billion, compared to ZW$ 5,59 billion in the prior comparable period. The rise was underpinned by a ZW$375 billion foreign exchange gain, compared to a restated ZW$28,76 billion during the same period in 2022. Net interest income increased by 41% to ZW$53,06 billion, from ZW$37,66 billion during the prior comparable period, driven by growth in the loan book.

Steward Bank was awarded the Financial Inclusion Award after pressing ahead with its strategy to open fresh ground in unbanked pockets of the market, leveraging on its digital accounts opening platform, which saw it open 130 000 accounts during the period under review.

The panel said Steward Bank’s contribution to the National Financial Inclusion Strategy was significant.

“The bank also partnered with solar energy providers for solar financing with the mandate being to address the UN sustainable goal Number 7, which seeks to provide affordable and reliable clean energy to the society,” Erccro said.

“Driven to achieve financial inclusion of SMEs, the bank rolled out various products to cater for their needs, which led to a proportionate part of its loan book being directed to SMEs.

“From a digital credit access perspective, more than 900 000 loans were disbursed through Kashagi digital loans platform with a third of the loans being availed to women,” the panel added.

NMB Bank, last year’s winner of the Best Bank accolade, was this year awarded the Digital Innovation Award.

“The group set up a technology company, XPlug Solutions Limited which was launched in July 2023. The subsidiary was setup on the backdrop of the successful in-house development of technology solutions for the banking subsidiary,” the panel said. “These solutions range from mobile apps, USSD, internet banking solutions, digital customer on-boarding, agency banking, workflow, Robotics Processes Automation solutions and cyber security management tools.”

Nedbank scooped the Environmental, Social and Governance award after impressing adjudicators with its special focus on community support initiatives. The bank supported local hospitals in Harare and Bulawayo with two neonatal intensive care incubators at Sally Mugabe and United Bulawayo Hospitals, in addition to the incubators donated in 2022.

Nedbank also continued to support talented youths in STEM programmes through the fully-funded Nedbank university bursary programme.

Commenting on Nedbank managing director Moyo’s award, the panel said: “Key inflation adjusted financial highlights included total income jump of 409%, profit before tax growth of 608% and a spike in total comprehensive income by 700%. Loans and advances moved 310%, whilst deposits were 84% high and a 118% increase in total assets”.

This year, the Independent introduced three new awards, whose winners were voted by the public.