A FORTNIGHT ago, the column provided a detailed analysis of macro-economic developments, emphasising key issues such as political economy, money supply, exchange rates and inflation.

This week, it continues to offer vital insights, now focusing on urgent developments in the public sector, external trade and foreign currency inflows — factors that influence the economic landscape and require immediate attention from all economic agents.

Public sector developments

Zimbabwe continues to face mounting fiscal pressures amid a collapsed fiscal space, leading it to implement tax hikes and increase borrowing to raise revenues.

Regarding the latter, the latest International Monetary Fund (IMF) report estimates Zimbabwe’s total public debt for 2024 at US$23,3 billion (72,9% of GDP), including external debt of US$16,7 billion (52,5% of GDP).

This debt is driven by accumulating arrears and penalties to official external creditors since the 2000s, now estimated at US$7,4 billion (23,2% of GDP) as of December 2024.

Additionally, the government continues to fall behind on payments to its creditors and suppliers, including exporters, posing a significant threat to debt sustainability.

For example, the IMF report shows that by the end of 2024, it had accumulated arrears totaling US$47,4 million to external commercial creditors and suspended servicing US$425 million in domestic debt obligations.

- Village Rhapsody: How Zimbabwe can improve governance

- Village Rhapsody: Engage men to end gender-based violence

- Village Rhapsody: How Zimbabwe can improve governance

- Zim maize output to drops by 43%

Keep Reading

Furthermore, inconsistencies in the official debt figures reported by the Public Debt Management Office (PDMO) and the IMF undermine the credibility of official debt data.

The IMF reports a total public debt of US$23,3 billion by the end of 2024, compared to the PDMO figure of US$21,5 billion, resulting in a discrepancy of nearly 10%.

That said, statistics from the PDMO show that the Treasury spent approximately US$358 million, including US$75 million in cash payments for blocked funds, and US$417,97 million on domestic and external debt servicing in 2024.

For context, the Treasury projected that nearly 10% of the 2025 national budget will be allocated for debt servicing alone. This will come at the expense of public service delivery and infrastructure development.

Fiscal pressures are expected to intensify in 2025, with US$738 million in Treasury bonds scheduled to mature. This situation will require the re-profiling of these bonds due to limited fiscal space.

From a business perspective, the government’s failure to fulfill its obligations, including debt servicing, surrender requirements and payments to suppliers, has engendered a liquidity crisis.

Consequently, funds are being trapped in government accounts, which hamper companies’ capacity to settle their own debts with local suppliers and to remunerate their employees punctually.

In short, public debt unsustainability is bad for the economy, as it crowds out economic development and private-sector investment, depletes national reserves, and fuels long-term interest, tax and inflation rates.

Meanwhile, towards the end of October 2025, the government, through the National Joint Negotiating Council, announced a Special Presidential Bonus for civil servants.

In addition to their regular annual bonus, civil servants will receive an additional US$150 bonus each, disbursed in two equal instalments starting in November 2025.

This measure aims to acknowledge the dedication of civil servants and contribute to their welfare, especially considering the ongoing challenges of low pay in the sector. I am convinced that this bonus will not destabilise ZiG’s exchange rate, as it is fully paid in foreign currency.

For many civil servants, who are often low-paid, this direct injection of cash could boost their spending power during the festive season and generate positive multiplier effects for the economy.

Nonetheless, I recognise that this special bonus was not initially included in the 2025 national budget, and its implementation might necessitate adjustments in government spending priorities, potentially diverting funds from high-impact projects to support recurrent expenses.

I hope that this initiative will be viewed as a step towards fairer treatment of civil servants and a positive move to support their well-being.

External trade performance

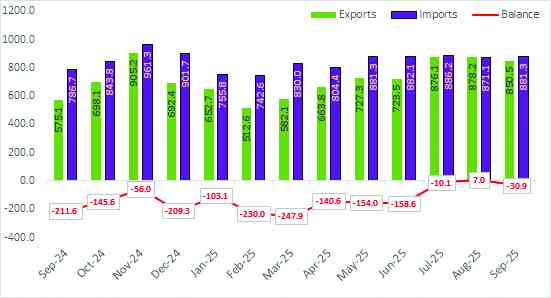

The latest official goods trade data published by the Zimbabwe National Statistics Agency (ZimStat) show that Zimbabwe exported merchandise worth US$850,5 million in September 2025, a 3,2% decrease from US$878,2 million in the previous month.

Cumulatively, January-September 2025 goods exports are valued at about US$6,5 billion compared to US$5,1 billion for the same period in 2024.

The top exports for September 2025 were semi-manufactured gold (49%), tobacco (14,8%), nickel mattes (12,5%) and ferro-chromium (4,5%).

Further data analysis indicates that mineral commodities were the main export, comprising at least 77% of the month’s total export revenues. Only four countries purchased a staggering 84% of goods exported: The United Arab Emirates (49,8%), South Africa (18,5%), China (15,1%) and Mozambique (4,2%).

Although month-over-month (MoM) export revenues declined slightly in September 2025, merchandise exports for that month grew by a significant 47,9% year-over-year, rising from about US$575,1 million in September 2024.

The small MoM drop in September 2025 goods exports is due to a 3,7% decline in gold exports for that month; gold remains the country’s primary export earner.

Additionally, the year-over-year (YoY) increase in September 2025 goods exports reflect a sharp global gold price rally, with average global gold price jumping by an impressive 45% between September 2024 and September 2025.

This underscores Zimbabwe’s over-reliance on primary commodities, making it vulnerable to fluctuations in global commodity prices. I, therefore, urge responsible authorities and exporters to focus on value addition and beneficiation, as well as increasing export diversification.

ZimStat trade data also show September 2025 goods imports at US$881,3 million, slightly up 1,2% from US$871,1 million in August 2025.

Cumulatively, Zimbabwe has spent about US$7,5 billion on foreign-produced goods, compared to US$7,1 billion for the same period in 2024.

The top goods imports for September 2025 were mineral fuels, oils, and products (22,6%), machinery and mechanical appliances (13,8%), vehicles (8%), and cereals (6,1%). The main sources of imports were South Africa (35,6%), China (14,4%), Bahrain (8,7%), and the Bahamas (6,9%).

Overall, the country recorded a US$30,9 million goods trade deficit (imports exceeding exports) in September 2025, reversing a US$7 million surplus from the previous month.

This results in a cumulative goods trade deficit of US$1,1 billion for January-September 2025, a 42,1% decrease from US$1,9 billion during the same period in 2024.

I expect the prevailing higher global mineral commodity prices to help reduce the trade deficit in the last quarter of 2025, ceteris paribus.

Foreign currency inflows

Zimbabwe is enjoying increased foreign currency inflows driven by rising mineral commodity prices and higher diaspora remittances. The official Reserve Bank of Zimbabwe (RBZ) data shows cumulative foreign currency (forex) inflows of US$9,2 billion by the end of the third quarter of 2025 (3Q25), up 8,2% from US$8,5 billion recorded in the same period in 2024.

Of this 3Q25 total, ZimStat’s September 2025 trade data indicates that goods exports alone made up a remarkable 70,7% (US$6,5 billion), primarily supported by semi-manufactured gold exports valued at US$3,1 billion.

Furthermore, analysis of the latest official data indicates diaspora remittances as another key source of forex inflows. As of the end of 2024, annual diaspora remittances amounted to about US$2,58 billion, up 195% from US$922 million in 2019, with authorities projecting US$2,72 billion for 2025 and forecasting US$2,75 billion for 2026.

Available official RBZ data shows that in the first half of 2025 (1H25), diasporans have sent home about US$1,09 billion, up 8,4% from US$1,01 billion in 1H24.

Despite the high poverty levels and deep inequality in Zimbabwe, diaspora remittances play a crucial role in bridging the income gap between the rich and the poor.

These remittances deliver immediate, tangible benefits, often surpassing other foreign exchange sources like export revenues, because they go directly to many beneficiaries, minimizing delays and cutting out high agent fees.

Given Zimbabwe’s obstacles in accessing concessional global capital due to its unsustainable public debt, diaspora remittances offer a vital and accessible alternative to raise much-needed funds.

It is imperative that responsible authorities, such as the Treasury, implement innovative, prudent and inclusive incentives to motivate the diaspora to channel their inflows from immediate consumption into long-term investments.

Such investments are essential for expanding production capacity, strengthening infrastructure and fostering sustainable economic growth to uplift the nation as a whole.

- Sibanda is an economist employed at Maxiquantus Capital Investments and Advisory. His perspectives are independent and do not necessarily reflect the views of his employer.—[email protected].