In April, the Zimbabwe Stock Exchange (ZSE) experienced a notable decline, with market capitalisation falling by 7%, reversing March’s modest 1% gain.

The All-Share Index shed 6,48%, led by a 6,96% drop in the Top 15 Index. The Top 10 Index was down 6,88%, the Medium Cap Index declined 5,27%, while the Small Cap Index remained largely flat at 100.11.

Monthly turnover rose to ZiG268 million, up from ZiG245 million in March. Delta led trading activity with ZiG89 million, followed closely by Econet at ZiG83 million.

However, Delta Corporation’s turnover was significantly lower than the ZiG141 million posted in March, while Econet Wireless saw a notable increase from the previous month’s ZiG70 million. Combined, the two counters accounted for 64% of April’s turnover, down from 86% in March.

Market breadth remained negative, with 20 counters closing in the red against 11 gainers. Among the biggest losers were blue-chip stocks Econet, which dropped 21%, and Delta, which fell 11%.

In contrast, the best performers were from the small-to-mid cap segment, with GB Holdings soaring 98% and Hippo gaining 30%. Seed Co recorded the steepest decline, shedding 40% of its value during the month.

Tight liquidity conditions, driven by limited availability of the ZiG currency, continue to weigh heavily on the ZSE.

Share prices increasingly diverged from company fundamentals, with many blue-chip counters trading below their intrinsic value. The limited circulation of ZiG and associated macro-economic constraints have subdued market activity, leaving little room for a short term recovery.

- Inaugural Zim investor indaba highlights

- Stop clinging to decaying state firms

- ZB explores options to tackle inflation

- Zim operations drive FMB Capital

Keep Reading

Still, long-term investors may find opportunities to accumulate undervalued quality stocks at attractive prices. Understanding the broader macro-economic context and its impact on ZiG remains crucial, as it directly influences activity on the local currency-denominated bourse.

Meanwhile, the Victoria Falls Stock Exchange (VFEX) extended its gains, with market capitalisation rising 9,39% in April, building on a 3,5% increase in March.

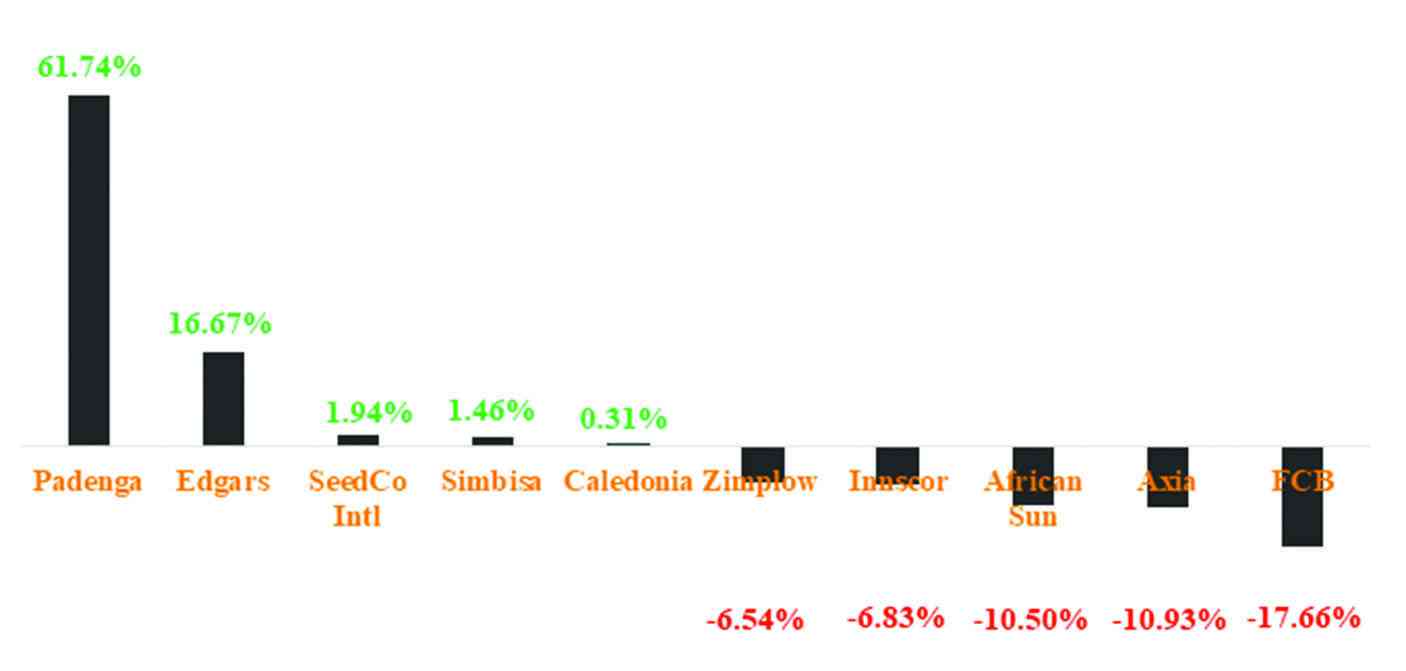

Turnover surged by 54,69% to US$3,9 million from US$2,5 million the previous month. Leading the charge in April were Innscor (US$1,64 million), Axia (US$689 842), Simbisa (US$689 400) and Padenga (US$333 146).

Padenga Holdings emerged as a standout performer for the second consecutive month, rallying 62% in April after a 17% gain in March.

In February, it was the fifth largest gainer, up 5%, continuing a clear upward trajectory that mirrors the performance of gold prices on the global market.

From a market cap of US$93 million at the beginning of February, Padenga surged to an impressive US$273 million by the end of April — nearly tripling its value.

Yes, you heard that right. This gold producing counter is now interchanging with Innscor for the second largest market weight on the VFEX — a remarkable development.

Once a niche player in Zimbabwe’s agro industry, Padenga has successfully reinvented itself as a gold mining powerhouse.

For the year-ended December 2024, the company reported revenue growth of 43,3% to US$223 million and an extraordinary 392% jump in net profit to US$40,2 million. The transformation was largely driven by its wholly-owned mining subsidiary, Dallaglio, which accounted for 86% of group revenue (US$195,5 million).

Gold production rose by 29,2% to 2 740 kilogrammes, boosted by strong global prices, which averaged US$3 133 per ounce in early 2025. Earnings per share jumped 257% to 3,53 US cents.

Without a doubt, this is an exceptionally rewarding period for Padenga’s shareholders, who have every reason to be pleased with the performance of their portfolios.

While the ZSE continues to face challenges, the VFEX is showing strong momentum — an encouraging sign that is likely to draw increased interest from investors looking to explore this foreign currency denominated exchange.

With upcoming listings such as the Eagle REIT, Pfuma REIT and the mineral commodity exchange platform in the pipeline, the VFEX appears poised for an exciting period ahead.

- Taimo is an investment analyst with a talent for writing about equities and addressing topical issues in local capital markets. He is an active member of the Investment Professionals of Zimbabwe community, pursuing the Chartered Financial Analyst charter designation.