CHINA’S real estate market has been a topic of global interest due to its rapid growth and occasional concerns about a potential bubble. However, contrary to popular belief, China's government has been employing strategic measures to manage the real estate market and ensure affordable accommodation for its citizens. The extent to which the bubble stretched can be likened to Zimbabwe, and therefore fair to evaluate if it is plausible for Zimbabwe to strategically manage property prices like China.

A real estate bubble occurs when property prices rise significantly above their intrinsic value, mainly driven by speculative investments and excessive lending. Such bubbles can lead to economic instability, social inequality, and unaffordable housing for many citizens. Recognising these risks, China has implemented various policies to prevent an uncontrollable surge in property prices. However, it is worth noting that, unlike Zimbabwe where the government tends not to interfere in real-estate market and let supply and demand factors run the game, China is a socialist market economy, which believes in collective ownership of economic resources. Its government is charged with redistributing wealth and narrowing the gap between the poor and the rich. Following the recent bubble in property prices, China's government has implemented regulations that include restrictions on multiple property purchases, higher down-payment requirements, and limits on mortgage lending.

By discouraging speculative behaviour, the government aims to stabilise property prices. As most new homes in China are sold before they are built, local housing authorities get to set a regulatory ceiling on these projects. Similarly, existing home prices are also controlled through a reference rate mechanism from the government which substitutes market-based pricing. China's central bank closely monitors financial institutions' lending practices related to the real estate sector. By managing credit availability, authorities aim to prevent speculative investments that could contribute to an unsustainable real-estate bubble. China's approach towards managing its real-estate market reflects a delicate balancing act between economic growth objectives and social stability concerns.

While allowing controlled growth in property prices through strategic measures, the government remains committed to ensuring affordable accommodation for its citizens.

This is, however, contrary to capitalist states like Zimbabwe and most western countries. Analysts have begun throwing commentaries on the deflation in China’s property prices as reflective of an economic recession. This is devoid of the type of society China is, compared to most parts of the world, which are mainly or rather only concerned about profit-making. From this derivation, therefore, a capitalist nationwould rather praise a property market bubble than ensure affordability.

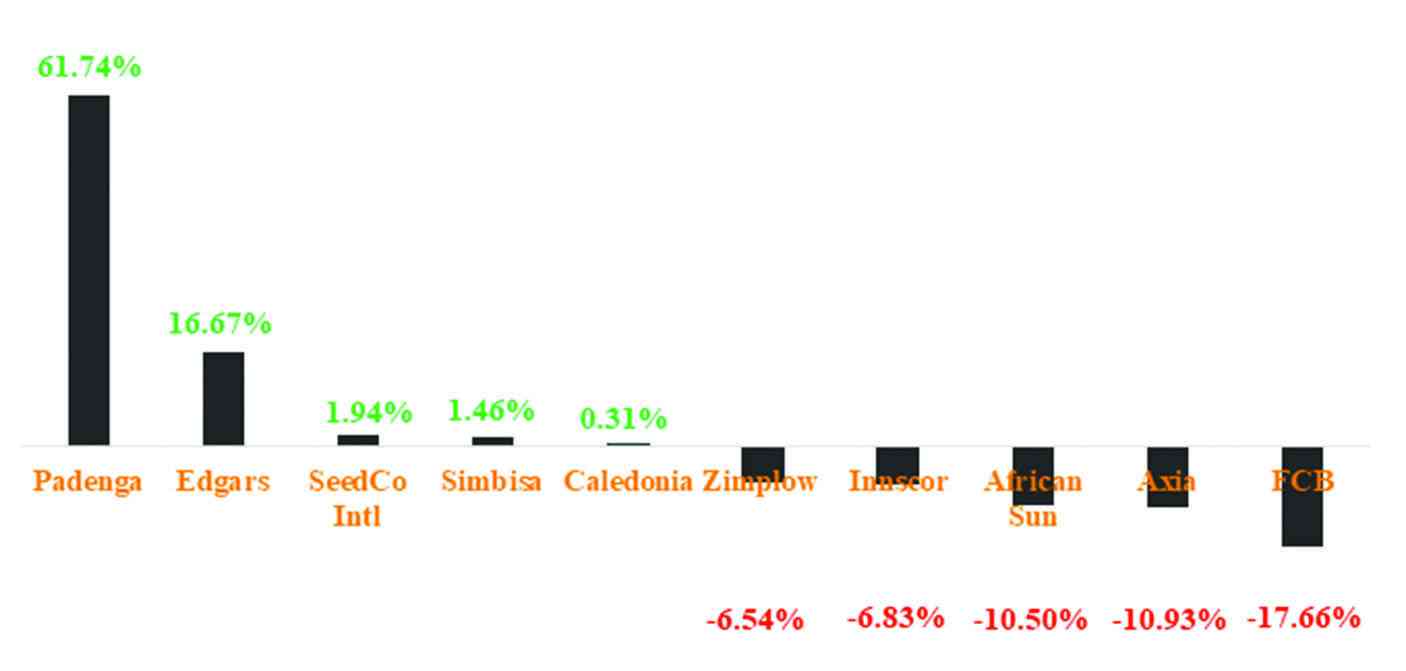

Zimbabwe is one country, which has registered a bubble in the real-estate sector for decades, as demand for properties outweighs supply, as opposed to low mortgage-interest rates in other nations. The value of properties in Zimbabwe is higher than regional average, despite having poor infrastructure and low disposable incomes, as well as a non-functional properties financing system. Rising property prices have led to growing wealth inequality within Zimbabwe, and recently China.

As many find themselves priced out of the housing market, exacerbating social tensions and potentially hindering long-term economic stability, China enforced measures to deflate the sector while Zimbabwe has let market-forces decide. However, it is important to understand the backbone of different economies before deducing a plausible course of action. Zimbabwe is an emerging economy, which relies on a diversified portfolio for economic balance, while China is a developed economy that relies more on the tertiary sector, particularly technology, and therefore can afford to declare “a house is a place to live, not an investment”.

On the other hand, many international investors have poured money into Chinese real estate markets seeking high returns amid low-interest rates globally. A sharp correction could result in significant losses and potentially impact global financial markets.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- The brains behind Matavire’s immortalisation

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

Keep Reading

- Duma is a financial analyst and accountant at Equity Axis, a leading media and financial research firm in Zimbabwe. — [email protected] or [email protected], Twitter: TWDuma_