THE Statutory Instrument (SI) 107 of 2023 seeks to introduce a charge on foreign payments with funds obtained either from the Dutch foreign currency auction or from the interbank market.

These collected amounts will be put aside and will contribute towards repayment of our foreign debt, but before we get too deep into the crux of the SI let us look at where it started.

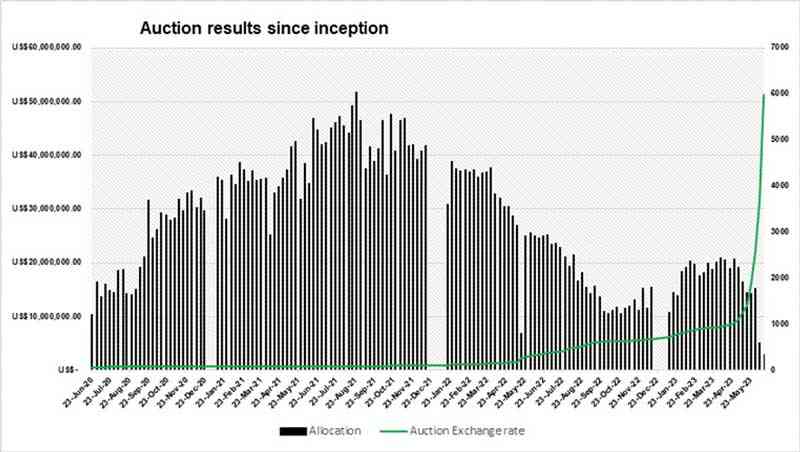

The foreign currency auction system introduced by the Reserve Bank of Zimbabwe in June 2020 has been at the centre of most discussions for quite some time now.

With its weekly foreign currency allocation having fallen drastically, its relevance is now questionable and its impact a shadow of its former self. It somehow ends up being part of every discussion and debate on the economy.

The auction has split opinion down the middle. Some strongly believe that it is a noble idea that has allowed for the importation of essential materials and goods needed to keep the country moving, while others say it is an unnecessary cost on exporters, who shoulder the burden by financing it through their export surrenders.

Even those who are not direct importers or exporters still have an opinion since the auction influences the official exchange rate in the country.

Those who devote their energy to see the demise of the auction occasionally point out that for the most part, the auction rate is usually half of the alternative or parallel market rate which is market determined.

This provides arbitrage opportunities for those economic agents with access to obtaining “cheap forex” from the auction and usually an unfair advantage over their counterparts without access.

- Current banking crisis: Is the glass half-empty or half-full?

- Will new decree move the needle?

Keep Reading

We have also observed that nearly every year, there is a period of convergence between the official exchange rate and the parallel exchange rate, although the gap is asymptotical to zero. Supporters of the auction system like to point out this convergence each time the trend starts and throw terms like “price discovery” to solidify their point.

Since its inception, over US$4 billion has been disbursed to finance imports via this auction system. At its peak, the auction would allocate as high as US$50 million per week.

Zimbabwe has been fortunate enough to generate substantial foreign currency over the past years with 2022 foreign currency receipts of almost US$12 billion. Nevertheless, US$4 billion is still a substantial amount, especially when you ask if there is anything to show for it.

Over time the foreign currency auction has evolved and changed shape a couple of times, including the introduction of the Small to Medium Enterprise (SME) auction alongside the main auction. Recently the main auction was limited to a maximum of US$5 million allocation per week as the wholesale interbank market was introduced.

Essentially, banks now purchase foreign currency from the central bank and sell it to their clients, which some analysts described as a free market determination of the exchange rate.

Now comes SI 107 titled Exchange Control or Control of Payments. Essentially in the instrument, the government is gazetting a one per centum charge or US$50 000 per transaction, whichever is lower, on specified outbound foreign currency payments.

In the instrument, outbound foreign currency payments are defined as foreign currency payments for imports that are financed by funds obtained from the auction system or the interbank market operated by financial institutions.

The rationale for the charge is to protect the domestic currency since there is a view that these foreign payments somehow exert downward pressure on the Zimdollar.

In addition, the collections will be put in a sinking fund to retire the nation’s debt. A sinking fund represents money that is set aside to pay off debt and is seen as a positive credit enhancer by the lender.

Right now, Zimbabwe owes foreign creditors in excess of US$14 billion and efforts are currently underway to implement an arrears clearance and debt resolution plan. The government will rely on the financial institutions for the collection of these charges and there are harsh penalties for those who fail to remit the funds.

An additional 15% penalty on the unremitted funds will be applicable to the financial institutions after the 10th day from the day of the transaction.

To show the seriousness of the matter, a six months imprisonment of the directors might be necessitated in the extreme cases of failure to remit the funds. The biggest worry is that SI 107 is a temporary measure with a duration of six months, and the question is will it move the needle? Had the instrument been implemented when the foreign currency auction system was introduced back in June 2020, now the sinking fund would have US$40 million, which is less than 0,3% of our external debt stock. Mind you, this is over a three-year period.

As if that is not enough, the chargeable foreign currency payments will not include payments for fuel and electricity. This essentially reduces the funds that will get into our sinking fund pot. Nevertheless, an effort to retire the debt is always better than nothing at all, especially when we do so by taxing the beneficiaries of “cheap forex”.

- Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.