EXECUTIVES at Zimbabwe’s state-owned diamond and mineral marketing companies have plunged the country’s mineral wealth into turmoil after signing a multi-million-dollar deal with a loss-making Dubai-based firm without conducting due diligence, the Zimbabwe Independent can exclusively reveal.

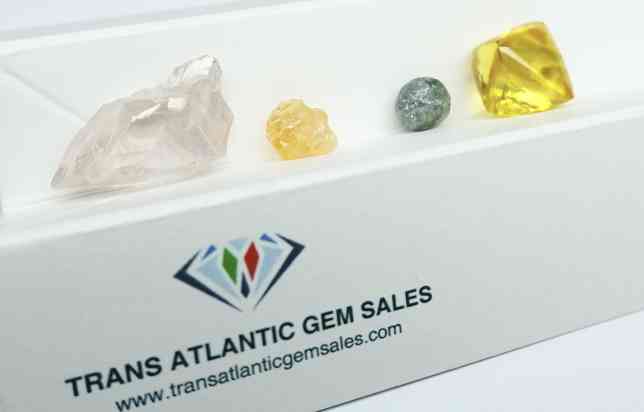

The secretive tripartite agreement, sealed in August between the Zimbabwe Consolidated Diamond Company (ZCDC), the Minerals Marketing Corporation of Zimbabwe (MMCZ) and TransAtlantic Gem Sales FZCO (TAGS), was meant to facilitate offshore diamond sales.

But the deal, now engulfed in allegations of corruption, recklessness, and gross negligence, was only subjected to due diligence after the contract had already been signed, exposing TAGS as a financially-crippled company.

Highly-placed sources said the agreement was pushed through without the required board resolutions from either ZCDC or MMCZ, breaching basic corporate governance and accountability standards.

“In their rush for profit, the executives neglected standard protocols, a lapse that would soon come back to haunt them,” a source familiar with the matter told the Independent.

“No due diligence was done and it was only realised when the first diamond parcel was supposed to be shipped out when an MMCZ official raised questions on the financial standing of TAGS.”

The revelations sent shockwaves through government circles, prompting an emergency intervention from the Office of the President and Cabinet (OPC), which moved swiftly to try and block the transaction.

However, with the contract already binding, the OPC’s powers to reverse the deal are limited.

- Byo Arts Festival in turmoil…One year later, festival has yet to pay artists…Organisers play cat and mouse with artists

- Court grants businessman’s ex-girlfriend peace order

- Let the music play at JamAfro Festival

- Billionaire UAE prince targets Zim aviation, real estate business

Keep Reading

“Unfortunately, there is a contract in place and OPC cannot really do anything,” the source added, noting that 1,6 million carats of diamonds are already prepared for shipment under the “now-controversial” arrangement.

Following the alarm, a delegation from MMCZ and ZCDC was dispatched to Dubai to assess the financial standing of TAGS.

It was during this visit that an MMCZ official, demanding transparency, conducted a long-overdue due diligence, and what they uncovered was deeply worrying.

A letter from MMCZ general manager Nomusa Moyo to ZCDC chief executive Douglas Zimbango, dated October 7, 2025, and seen by the Independent, lays bare the extent of the risk.

According to the letter, TAGS had been operating at a loss for the past two consecutive years, its “current liabilities are more than current assets,” making it a “highly-geared” company with a “questionable” solvency status.

Moyo also warned that the company’s bank statements showed “very low balance”.

She concluded that TAGS might “fail to remit proceeds realised from the sales and efforts to recover the proceeds might prove to be difficult”.

Her fears were validated by TAGS’s audited financial statements for the year ending February 28, 2025, which reveal a net loss of US$507 675, following a US$783 046 loss the previous year.

The company’s current assets of US$447 145 were eclipsed by current liabilities of US$1 304 068, painting a dire picture of a company struggling to stay afloat.

In his response dated October 9, Zimbango conceded the risks, but sought to calm fears, insisting the agreement contained enough safeguards to protect national interests.

He pointed to “robust safeguards” within the contract, including clauses ensuring TAGS “holds no ownership of the diamonds” and maintains full insurance coverage.

Zimbango also proposed an escrow account mechanism to secure sales proceeds, describing it as “the most cost-effective and operationally practical” arrangement.

Attached to his response was a letter from TAGS founder Anthony Peter, who pledged to open a dedicated joint-signatory account with ZCDC, requiring authorisation from both parties for any fund movement.

But senior government sources say the damage has already been done. The decision to sign a binding deal with a financially unstable partner, and only perform due diligence afterward, has placed Zimbabwe’s diamond wealth in serious jeopardy.

Officials fear that the country could face both financial loss and international embarrassment if the Dubai firm fails to remit proceeds from diamond sales.

“The stakes are high,” a source at the OPC said.

“There is grave concern within government circles that Zimbabwe’s precious diamond wealth may be lost to a dubious deal, signed in haste and now threatening to inflict immense financial and reputational damage.”