THE People’s Own Savings Bank (POSB) has allocated US$26,42 million for agriculture financing for the 2025/26 season, targeting farmers and agribusinesses through a range of key initiatives.

Central to this package is a government-backed farming mechanisation programme with Belarus.

Since March, POSB has been facilitating the sale of government-procured tractors from the Eastern European nation to local farmers.

“The total value of agriculture-related financing being channelled through POSB for the 2025–2026 season is US$26 421 865,” POSB chief executive officer Garainashe Changunda told businessdigest.

“This is inclusive of the government-backed Belarus mechanisation programme for tractors and other equipment, for which POSB is acting as a financing agent and facilitator.

“We are targeting all categories of farmers and agribusinesses under this initiative through three complementary facilities.

“Through our POSB Agribusiness Loan Facility, we are supporting both individual clients, including communal (smallholder) farmers, small-scale commercial farmers and specialised producers such as horticulture farmers, and corporate clients, which cover medium-scale and large-scale commercial farmers, agribusiness companies, and out-grower schemes,” he added.

The financing drive follows a report by Finance, Economic Development and Investment Promotion minister Mthuli Ncube in October, which indicated that the agricultural sector grew 73,9% to become a US$10,3 billion industry in 2025, largely due to improved rainfall. This positive trajectory is expected to continue into the 2025/26 season.

- Budget dampens workers’ hopes

- Govt issues $24 billion Covid-19 guarantees

- Letter to my People:They have no answers for Nero’s charisma

- ZMX to enhance farm profitability

Keep Reading

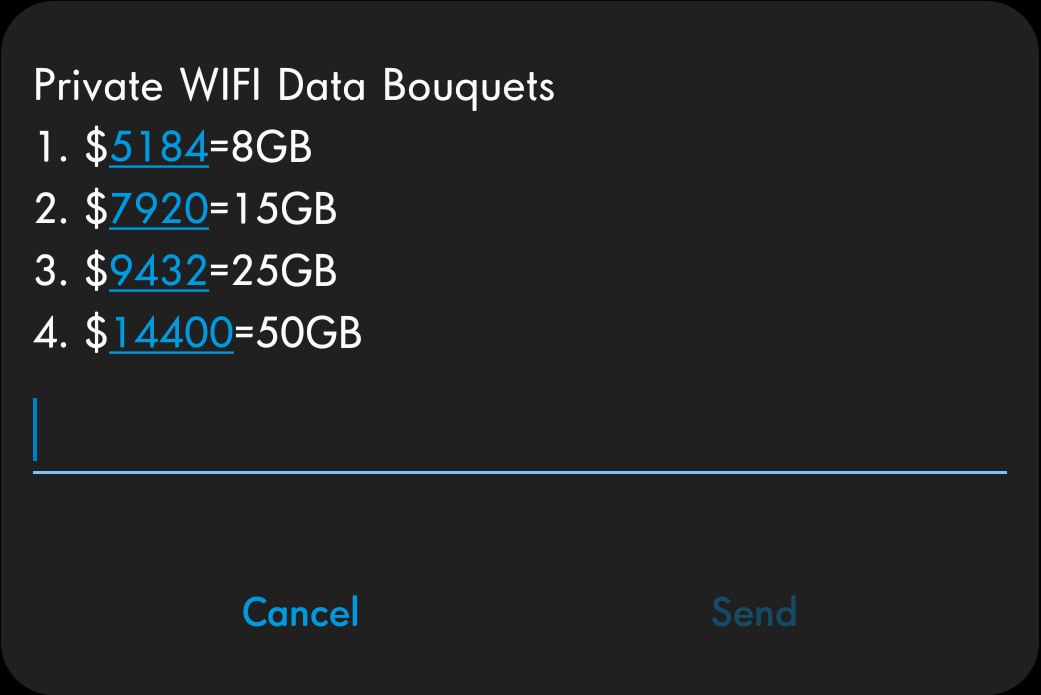

“We are also rolling out the Belarus Mechanisation Facility to individual farmers, agribusinesses, cooperatives, and irrigation schemes so that farmers across the spectrum can access subsidised Belarus tractors and other farming equipment to speed up mechanisation,” Changunda added.

In addition, POSB is among several banks selected to implement the Title Deeds Mortgage Loan Scheme for beneficiaries of the Land Reform Programme

“We are one of the banks selected to implement the Title Deeds Mortgage Loan Scheme for Land Reform Programme beneficiaries, including A1 Temporary Permit and A2 Settlement holders, to help convert their tenure documents into bankable title deeds and strengthen their collateral base for future financing,” Changunda said.

“The terms of the loans offered vary with the type of loan and client situations. For example, individual agribusiness loans can take up to 24 months, while title deed mortgages can take up to 20 years.”

He noted that government plans to issue title deeds to approximately 384 000 resettled farmers by June 30, 2026.

Meanwhile, POSB’s loan book recorded strong growth, with loans and advances rising 31,1% to ZiG953,79 million (US$34,72 million) in the half-year ended June 30, 2025, compared to the same period in 2024.

This growth was largely driven by individual loans, which reached ZiG520,93 million (US$19,33 million), and microfinance loans amounting to ZiG278,27 million (US$10,32 million). Corporate, mortgage and SME lending accounted for the balance.

The bank also strengthened its investment portfolio, with money market assets surging 70% to ZiG457,98 million (US$16,99 million), driven by increased placements in interbank markets.

The strategy reflects POSB’s focus on expanding lending while maintaining liquidity through low-risk investments.

Combined growth in lending and money market investments lifted POSB’s total assets to ZiG3,11 billion (US$115,44 million) during the period, representing an increase of nearly 15% from the end of 2024.