Premium

Fresh spat over Geo Pomona deal

The sources, in separate briefings questioned the “legality” of Harare City Council to continue levying tariffs from residents for a service that it would no longer be providing.

Premium

RBZ mounts crackdown as POS machines flood parallel market

RBZ governor John Mushayavanhu told the Independent that the apex bank cautioned banks to monitor how recipients, who received POS machines, use the electronic gadgets.

By Freeman Makopa

May. 3, 2024

CBZ-ZB merger is a rumour: Vingirai

Business Digest

By Melody Chikono | May. 3, 2024

‘Zim lagging behind on gender policy implementation’

According to the report, the prevalence of gender-based violence is high, and incidences of several forms of GBV remain unchanged.

By Melody Chikono

May. 3, 2024

DWP congress to unlock opportunities for tourism

By Staff Writer

May. 3, 2024

Workers commemorate May Day in despair

By Staff Writer

May. 3, 2024

ZimInd to host capital markets conference

By Melody Chikono

May. 3, 2024

WB mobilising US$20m for women

By Tafadzwa Mhlanga

May. 3, 2024

Rest, good sleep contribute to better health, happiness

By Admin

Feb. 17, 2023

Everyone eligible is encouraged to donate blood, help save lives

By The Independent

Jun. 10, 2022

Cottco seeks US$45m Afreximbank war chest

By Mthandazo Nyoni

May. 3, 2024

Exporters make headway in foreign markets

By Melody Chikono

May. 3, 2024

Hope for lifting ban on OM, PPC chips

By The Independent

Aug. 26, 2022

Without planes, AirZim board won’t perform wonders

By The Independent

Aug. 5, 2022

Power crisis needs urgent attention

By The Independent

Jul. 29, 2022

Don’t print cash for projects

By The Independent

Jul. 22, 2022

Exploring the vibrant world of sports betting in Ethiopia

While the allure of sports betting is undeniable, it's crucial to approach it with caution and responsibility.

By Theindependent

Mar. 11, 2024

Satewave churns out power solutions for Zim

Satewave Technologies director Xiao Feng said the company has several solar solutions to address the current power challenges.

By Staff Writer

Aug. 15, 2023

Liquid Tech to increase tariffs by 50%

By Staff Writer

Mar. 31, 2023

Jotter: Students develop an integrated learning app

By Staff Writer

Mar. 17, 2023

Innovative crowd-investing app ‘PiggyBankAdvisor’ launched

By Staff Writer

Mar. 17, 2023

Meta gives up on NFTs for Facebook and Instagram

By The Verge

Mar. 15, 2023

Reasons To Buy Bitcoin From A Trading Platform

Another fundamental reason behind getting the coins from this particular space is that it provides

By Theindependent

Mar. 2, 2023

Why do banks not want people to rely upon cryptocurrencies?

Cryptocurrency transaction volume is much less than the fiat currencies, leading to a lack of liquidity in the market.

By Theindependent

Feb. 9, 2023

Heritage Golf Academy shines in Botswana

The Heritage Junior Golf Challenge which included golfers from South Africa saw the academy win 15 trophies and 7 medals in a show of hard work, determination and passion.

By Staff Reporter

May. 3, 2024

By Munyaradzi Madzokere

May. 3, 2024

By Sports Reporter

Apr. 26, 2024

New council aims to elevate Zim fashion

By Khumbulani Muleya

May. 3, 2024

Go well Groeblinghoff

By Friedrich Naumann Foundation.

Apr. 26, 2024

Multichoice Talent Factory opening doors

By Yvonne Feresu

Apr. 26, 2024

Bantu Spaceship takes local sounds on a global tour

The band will be going on a European tour in June and July where they are set to perform in France, Germany and Switzerland.

By Khumbulani Muleya

Apr. 26, 2024

International day of jazz: Local concert on the cards

By Khumbulani Muleya

Apr. 19, 2024

Moozy captivates audience at homecoming showcase

By Khumbulani Muleya

Apr. 12, 2024

Herbicides: Bad news for local food security

By The Independent

May. 27, 2022

Dumpsite: Gweru feels the heat

By The Independent

May. 13, 2022

Zim to pay 100% of international hunting revenue to communities

By The Independent

Jun. 10, 2022

.

Videos

Tapera Chikandiwa, Founder Of High Achievers Coach Education Centre In Conversation With Trevor

By The NewsDay

May. 3, 2024

Gugulethu Siso, Founder and CEO of Thumeza Fintech In Conversation With Trevor.

By The NewsDay

May. 3, 2024

Phibion Gwatidzo, Chairman of Baker Tilly Central Africa In Conversation With Trevor

By The NewsDay

May. 3, 2024

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

Job Sikhala, Zimbabwean Opposition Politician In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

ExtremeWeather: Parts of Harare experienced flash floods on Sunday

By The NewsDay

Dec. 21, 2023

Harare motorists negotiate the city’s treacherous roads

By The NewsDay

Dec. 21, 2023

Dock sheep tail to maintain weight

The most common way of docking tails is by using an elastic and expandable latex ring. The rubber ring is expanded with an elastrator and put over the tail, where it is released.

By Kudakwashe Gwabanayi

Mar. 22, 2024

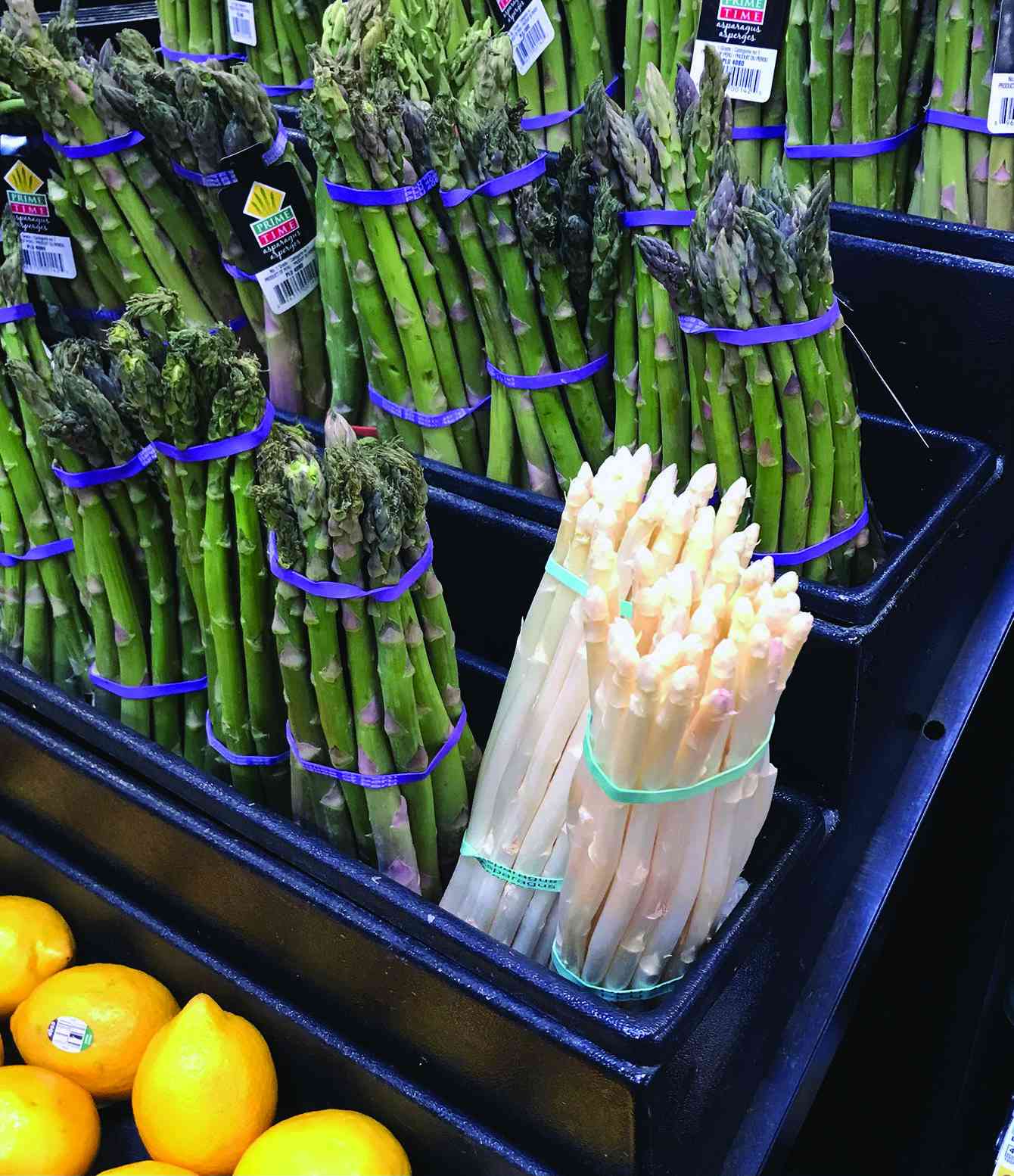

Asparagus worth your while (II)

By Kudakwashe Gwabanayi

Mar. 1, 2024

Why it makes sense to farm meat goats

By Shane Brody

Jul. 7, 2023

How to start a fish farming business

By Kudakwashe Gwabanayi

May. 26, 2023

Climate change is real, be alert

By Kudakwashe Gwabanayi

May. 12, 2023

Sofar hosts concert at Chapungu Sculpture Park

The landscaped garden is a cultural landmark and was established by the late stone sculpture visionary Roy Guthrie.

By Style Reporter

May. 6, 2024

Full house at Mvurwi’s new club official opening

The duo did not disappoint as they gave a scintillating performance in front of the packed Mzansi Lounge.

By Style Reporter

May. 6, 2024

VFEX suspends BNC stocks

By Tatira Zwinoira

May. 5, 2024

Teachers divided over job action.

By Miriam Mangwaya

May. 5, 2024

BCC, TTI streamline parking management

“Clearer visibility of the call centre phone numbers on all tickets issued by TTI for members of the public to contact when clamped or when they have a complaint [sic].”

By Silas Nkala

1h ago

Zacc engages media in gaft fight

Murapa also noted that the National Anti-Corruption Strategy expects the media and the anti-corruption bodies to collaborate so that journalists distribute accurate information.

By Daniel Moyo

1h ago

Village heads, chief smoke peace pipe

By Nizbert Moyo

May. 7, 2024

427 Chinese firms set up shop in Zim: Research

By Silas Nkala

May. 7, 2024

Bulawayo road rehab chews US$2m

By Innocent Magondo

May. 7, 2024

Drought caught us off-guard, govt admits

The El Niño-induced drought has affected the southern African region where some countries have banned maize exports.

By Harriet Chikandiwa

51m ago