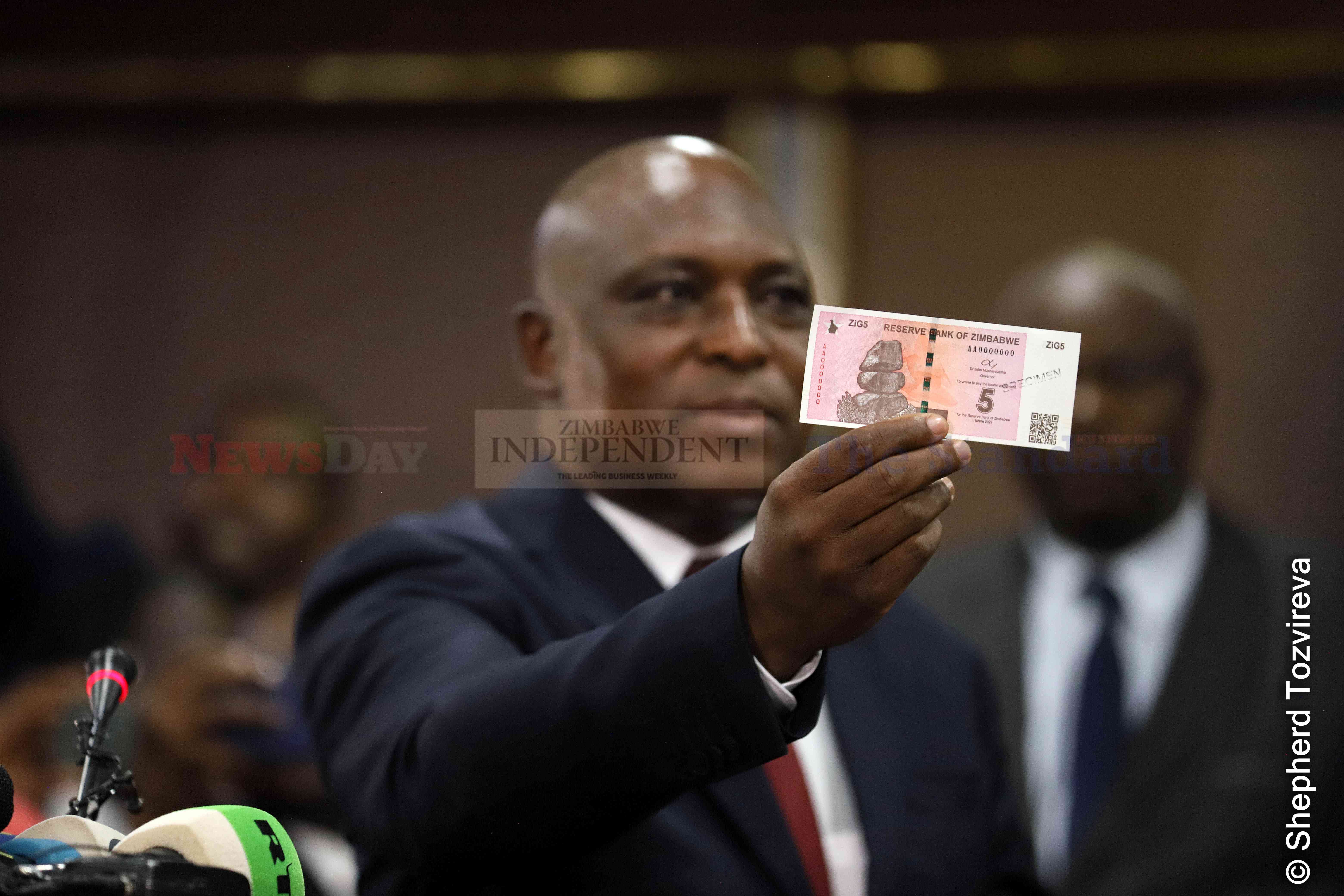

The ZiG was introduced following the rapid depreciation of the Zimbabwe dollar (ZWL).

‘New currency averted systems crash’

It replaced the Zimbabwe dollar (ZWL), which had to be decommissioned after depreciating rapidly against the US dollar, complicating an already dire economic situation.

Advisory sees hefty spinoffs in RTG deal

By Shame Makoshori

Apr. 19, 2024

Telecoms note sharp investment decline

Business Digest

By Melody Chikono | Apr. 19, 2024

‘Inflation forecast unrealistic’

As such, monthly inflation rates are expected to be well below 1%, while annual inflation is projected to close the year below 5%.

By Mthandazo Nyoni

Apr. 19, 2024

Fair game in Zim, China trade

By Julia Ndlela

Apr. 19, 2024

Rest, good sleep contribute to better health, happiness

By Admin

Feb. 17, 2023

Everyone eligible is encouraged to donate blood, help save lives

By The Independent

Jun. 10, 2022

Lenders, investors face huge losses

By Mthandazo Nyoni

Apr. 19, 2024

Mineral exports further deteriorate

By Melody Chikono

Apr. 19, 2024

Hope for lifting ban on OM, PPC chips

By The Independent

Aug. 26, 2022

Without planes, AirZim board won’t perform wonders

By The Independent

Aug. 5, 2022

Power crisis needs urgent attention

By The Independent

Jul. 29, 2022

Don’t print cash for projects

By The Independent

Jul. 22, 2022

Exploring the vibrant world of sports betting in Ethiopia

While the allure of sports betting is undeniable, it's crucial to approach it with caution and responsibility.

By Theindependent

Mar. 11, 2024

Satewave churns out power solutions for Zim

Satewave Technologies director Xiao Feng said the company has several solar solutions to address the current power challenges.

By Staff Writer

Aug. 15, 2023

Liquid Tech to increase tariffs by 50%

By Staff Writer

Mar. 31, 2023

Jotter: Students develop an integrated learning app

By Staff Writer

Mar. 17, 2023

Innovative crowd-investing app ‘PiggyBankAdvisor’ launched

By Staff Writer

Mar. 17, 2023

Meta gives up on NFTs for Facebook and Instagram

By The Verge

Mar. 15, 2023

Reasons To Buy Bitcoin From A Trading Platform

Another fundamental reason behind getting the coins from this particular space is that it provides

By Theindependent

Mar. 2, 2023

Why do banks not want people to rely upon cryptocurrencies?

Cryptocurrency transaction volume is much less than the fiat currencies, leading to a lack of liquidity in the market.

By Theindependent

Feb. 9, 2023

De Souza banks on speed, agility.

Zimbabwe U20 rugby team head coach, Shaun De Souza is happy with the team’s preparations and looking forward to their tournament opener against Tunisia.

By Austin Karonga

Apr. 19, 2024

By Austin Karonga

Mar. 28, 2024

By Kevin Mapasure

Mar. 28, 2024

By Munyaradzi Madzokere

Mar. 22, 2024

Book Review: African decolonisation in Southern Rhodesian Politics, 1950–1963

By Anotida Chikumbu

Apr. 12, 2024

Moozy captivates audience at homecoming showcase

By Khumbulani Muleya

Apr. 12, 2024

Forbes 30 Under 30 Summit Africa spotlights Zim vegan cuisine

According to forbes.com, featured speakers will include government officials, venture capitalists, CEOs and celebrities.

By Khumbulani Muleya

Apr. 5, 2024

Women take over the stage at Sofar

By Staff Writer

Mar. 28, 2024

Japanese pop culture comes to life in Harare

By Khumbulani Muleya

Mar. 22, 2024

Fawezi wraps up GBV prevention initiative

By Khumbulani Muleya

Mar. 15, 2024

New children’s book a magical adventure

By Khumbulani Muleya

Mar. 15, 2024

Herbicides: Bad news for local food security

By The Independent

May. 27, 2022

Dumpsite: Gweru feels the heat

By The Independent

May. 13, 2022

Zim to pay 100% of international hunting revenue to communities

By The Independent

Jun. 10, 2022

.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

Job Sikhala, Zimbabwean Opposition Politician In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

ExtremeWeather: Parts of Harare experienced flash floods on Sunday

By The NewsDay

Dec. 21, 2023

Harare motorists negotiate the city’s treacherous roads

By The NewsDay

Dec. 21, 2023

Solomon Guramatunhu Day 1

By The NewsDay

Dec. 14, 2023

Sengezo Tshabangu - In Conversation With Trevor

By The NewsDay

Dec. 5, 2023

Welcome to Alpha Media Holdings Zimbabwe - NewsDay - The Standard - The Zim Independent

By The NewsDay

Dec. 5, 2023

Dock sheep tail to maintain weight

The most common way of docking tails is by using an elastic and expandable latex ring. The rubber ring is expanded with an elastrator and put over the tail, where it is released.

By Kudakwashe Gwabanayi

Mar. 22, 2024

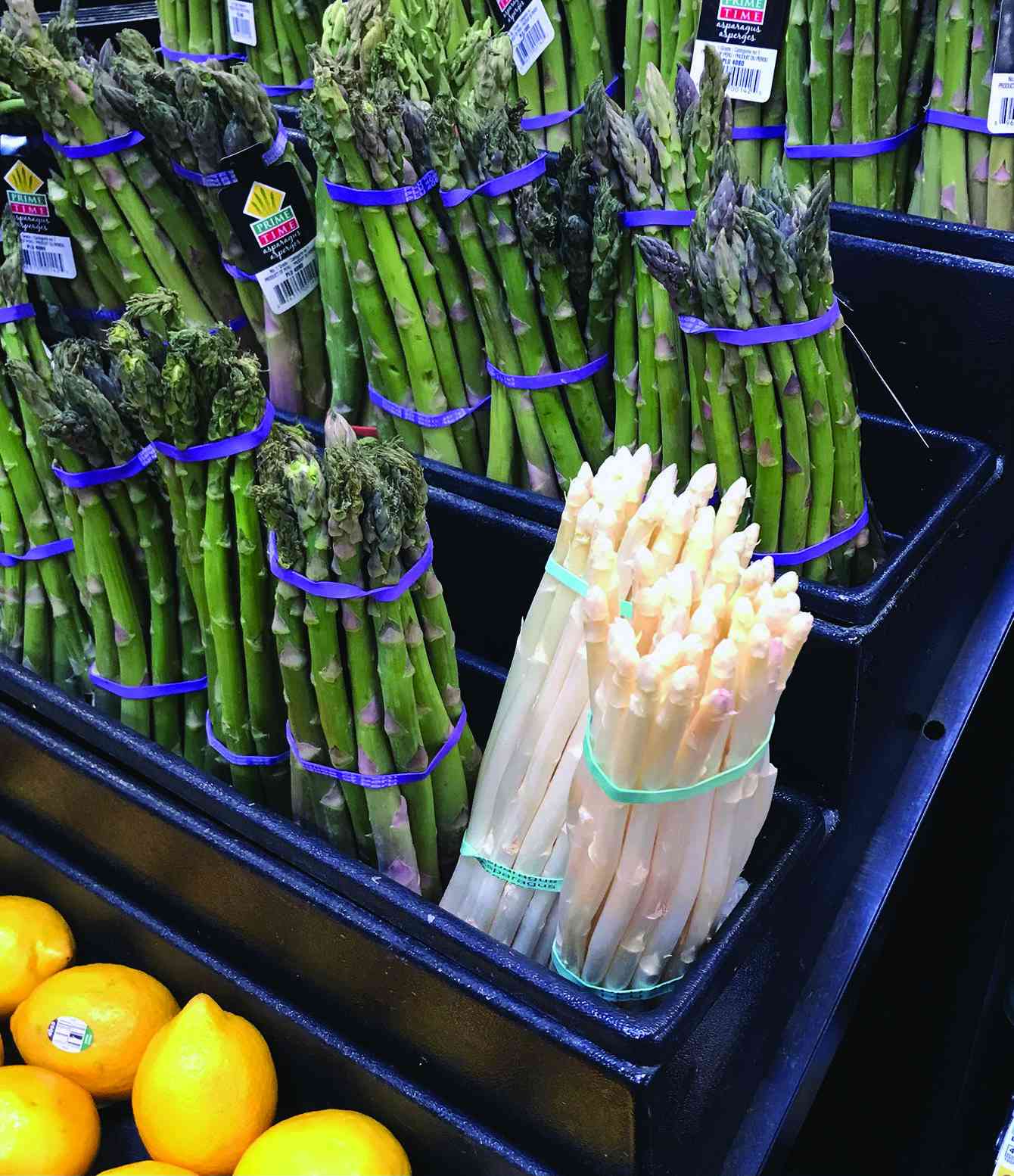

Asparagus worth your while (II)

By Kudakwashe Gwabanayi

Mar. 1, 2024

Why it makes sense to farm meat goats

By Shane Brody

Jul. 7, 2023

How to start a fish farming business

By Kudakwashe Gwabanayi

May. 26, 2023

Climate change is real, be alert

By Kudakwashe Gwabanayi

May. 12, 2023

Prophet lauds Tanzania, Zimbabwe relationship

Madzibaba Jonah usually goes around the continent and Asian countries where he joins other apostolic members in prayer.

By Style Reporter

6h ago

Wash boost for indigenous churches

Council for Churches in Africa's founding president Arch-bishop Rocky Moyo said his organisation is engaging indigenous churches so that they conform to the laws of the country.

By Style Reporter

Apr. 24, 2024

Mahachi pays tribute to late SA gospel icon

By Style Reporter

Apr. 23, 2024

Richest Forex Traders in Tanzania

By The Standard

Apr. 22, 2024

We’ll be Zim’s industrial hub again: Coltart

Coltart called on visitors to Zimbabwe’s second largest city to understand its history, people, culture and arts.

By Silas Nkala

21h ago

Binga South MP, minister clash over boreholes

Cumanzala, however, said villagers in the constituency had dismissed the minister’s claims.

By Patricia Sibanda

21h ago

Councillor pleads for waste pickers

By Patricia Sibanda

Apr. 24, 2024

Food vendors overrun Byo streets after hours

By Innocent Magondo

Apr. 24, 2024

SA turns on heat on Zim smugglers

By Rex Mphisa

Apr. 24, 2024

Zim Folk Fusion hosts diverse sounds

According to organisers, the monthly concerts seek to cultivate a vibrant connection with Zimbabwe's rich musical heritage while also using music to celebrate cultural diversity in the community.

By Khumbulani Muleya

11h ago

By Problem Masau

21h ago

By Sindiso Dube

21h ago