Zupco sinks in US$28m debt...Transporters threaten to withdraw service

Local News

By Tinashe Kairiza | 19h ago

The Independent’s calculations based on information received showed operators could be owed about US$24 million for March and April.

Mangudya talks profits as MIF begins operations

In his address to staff, Mangudya indicated he would push to drive most of them to profit under his plan to create value.

By Freeman Makopa

19h ago

Inside Geo Pomona's multi- million-dollar waste project...all is well with HCC, says Dilesh Nguwaya

We have the knowledge and capacity to manage municipal solid waste in line with modern trends, technologies and practices.

By Tinashe Kairiza

18h ago

‘Abandoning coal will backfire’

By Freeman Makopa

19h ago

Rest, good sleep contribute to better health, happiness

By Admin

Feb. 17, 2023

Everyone eligible is encouraged to donate blood, help save lives

By The Independent

Jun. 10, 2022

Hope for lifting ban on OM, PPC chips

By The Independent

Aug. 26, 2022

Without planes, AirZim board won’t perform wonders

By The Independent

Aug. 5, 2022

Power crisis needs urgent attention

By The Independent

Jul. 29, 2022

Don’t print cash for projects

By The Independent

Jul. 22, 2022

Exploring the vibrant world of sports betting in Ethiopia

While the allure of sports betting is undeniable, it's crucial to approach it with caution and responsibility.

By Theindependent

Mar. 11, 2024

Satewave churns out power solutions for Zim

Satewave Technologies director Xiao Feng said the company has several solar solutions to address the current power challenges.

By Staff Writer

Aug. 15, 2023

Liquid Tech to increase tariffs by 50%

By Staff Writer

Mar. 31, 2023

Jotter: Students develop an integrated learning app

By Staff Writer

Mar. 17, 2023

Innovative crowd-investing app ‘PiggyBankAdvisor’ launched

By Staff Writer

Mar. 17, 2023

Meta gives up on NFTs for Facebook and Instagram

By The Verge

Mar. 15, 2023

Reasons To Buy Bitcoin From A Trading Platform

Another fundamental reason behind getting the coins from this particular space is that it provides

By Theindependent

Mar. 2, 2023

Why do banks not want people to rely upon cryptocurrencies?

Cryptocurrency transaction volume is much less than the fiat currencies, leading to a lack of liquidity in the market.

By Theindependent

Feb. 9, 2023

Braydon Amm set for British Junior Open

A gofundme platform has been opened to help raise funds to enable the golf prodigy to travel to the UK for the event.

By Munyaradzi Madzokere

17h ago

Guthrie’s legacy carved in stone

By Khumbulani Muleya

May. 3, 2024

New council aims to elevate Zim fashion

By Khumbulani Muleya

May. 3, 2024

Go well Groeblinghoff

It was Barbara’s vocation to work with political parties, and strategy workshops and training sessions for elected officials benefited from her consummate leadership.

By Friedrich Naumann Foundation.

Apr. 26, 2024

Multichoice Talent Factory opening doors

By Yvonne Feresu

Apr. 26, 2024

Bantu Spaceship takes local sounds on a global tour

By Khumbulani Muleya

Apr. 26, 2024

International day of jazz: Local concert on the cards

By Khumbulani Muleya

Apr. 19, 2024

Herbicides: Bad news for local food security

By The Independent

May. 27, 2022

Dumpsite: Gweru feels the heat

By The Independent

May. 13, 2022

Zim to pay 100% of international hunting revenue to communities

By The Independent

Jun. 10, 2022

.

Videos

Tapera Chikandiwa, Founder Of High Achievers Coach Education Centre In Conversation With Trevor

By The NewsDay

May. 3, 2024

Gugulethu Siso, Founder and CEO of Thumeza Fintech In Conversation With Trevor.

By The NewsDay

May. 3, 2024

Phibion Gwatidzo, Chairman of Baker Tilly Central Africa In Conversation With Trevor

By The NewsDay

May. 3, 2024

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

Job Sikhala, Zimbabwean Opposition Politician In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

ExtremeWeather: Parts of Harare experienced flash floods on Sunday

By The NewsDay

Dec. 21, 2023

Harare motorists negotiate the city’s treacherous roads

By The NewsDay

Dec. 21, 2023

Dock sheep tail to maintain weight

The most common way of docking tails is by using an elastic and expandable latex ring. The rubber ring is expanded with an elastrator and put over the tail, where it is released.

By Kudakwashe Gwabanayi

Mar. 22, 2024

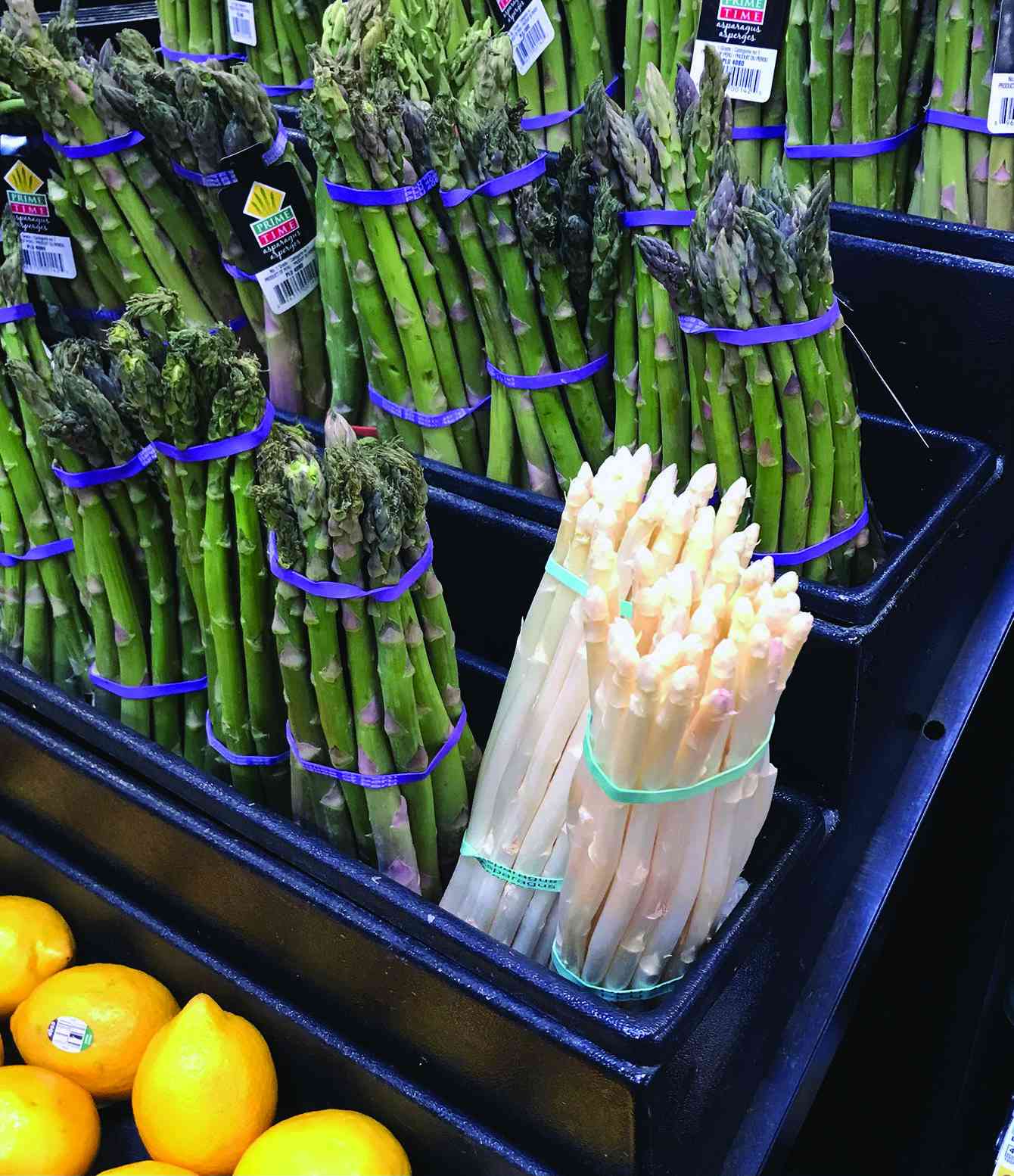

Asparagus worth your while (II)

By Kudakwashe Gwabanayi

Mar. 1, 2024

Why it makes sense to farm meat goats

By Shane Brody

Jul. 7, 2023

How to start a fish farming business

By Kudakwashe Gwabanayi

May. 26, 2023

Climate change is real, be alert

By Kudakwashe Gwabanayi

May. 12, 2023

Macheso ready to meet Mvurwi

Macheso usually visits Mvurwi during the tobacco-selling season at the giant Shamwari Joe Hotel.

By Simbarashe Sithole

May. 9, 2024

Sofar hosts concert at Chapungu Sculpture Park

The landscaped garden is a cultural landmark and was established by the late stone sculpture visionary Roy Guthrie.

By Style Reporter

May. 6, 2024

Full house at Mvurwi’s new club official opening

By Style Reporter

May. 6, 2024

VFEX suspends BNC stocks

By Tatira Zwinoira

May. 5, 2024

ZiG downs Zimra system

Zimra press officer Gladman Njanji said he would revert back to Southern Eye two days ago following enquiries about the glitch.

By Rex Mphisa

9m ago

Jail him for life, rape victim pleads

In her written submission, the girl said she felt a lesser human, and will possibly stay like that for a lifetime.

By Rex Mphisa

14m ago

Govt gives BCC 3 weeks to audit books

By Silas Nkala

19m ago

Ex-minister in land dispute setback

By Desmond Chingarande

May. 9, 2024

Byo charity receives global award

By Margaret Lubinda

May. 9, 2024

ED appoints Harare Commission of Inquiry

After completing its findings the Commission will submit a report to the President “within three months of completion of the Inquiry”.

By Ropafadzo Makosi

4m ago

By Sharon Buwerimwe

14m ago