THE year is 2017 and Econet Wireless is faced with thechallenge of securing enough foreign currency to service its foreign financial obligations.

This leads to the company floating a debenture linked to a rights issue worth US$130 million.

Fast forward to the following year, Ecocash Holding, then Cassava Smartech is unbundled from Econet Wireless and takes with it half of the debt from the debenture.

Along the way, there is an early redemption of part of the debenture, leaving debentures worth US$30,3 million on each of the companies' balance sheets, which were set to mature in April 2023.

Over the six-year tenor of the debentures, the foreign currency situation in the country did not improve, worse off the debenture issuer could not access forex from the auction system.

To avoid defaulting on its debenture, which would negatively affect the company’s credit rating, it was forced to do what it knows best, which was to turn to its shareholders for support.

It has been almost four months since the idea of a renounceable rights issue to redeem these debentures first hit the market, and it now seems so certain that the exercise will go on.

To ensure a smooth rights issue TN Asset Managers were appointed as the underwriter for the exercise and the major shareholders of both Econet Wireless and Ecocash Holdings already subscribed their rights.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

To cut long story short, an investor with 100 Econet shares who wants to maintain her ownership in the company and does not wish to be diluted, can do so by purchasing an additional 17,122 shares at a price of US$0,0755 each, which is essentially taking up their rights.

Those who have been part of the company long enough and have their debentures also have the option to subscribe their rights using their debenture at a price of US$0,06252 per each debenture.

The biggest winners in this whole exercise, in my opinion, are not those investors now subscribing to their rights but those who bought additional Econet shares when the initial cautionary statement came out.

During that time, Econet had a market capitalisation of ZW$643 billion and using a decent exchange rate of US$1:ZW$1400 at the time, we were looking at US$460 million.

Had the rights issue been successfully carried out at these prices, Econet shareholders would have been diluted by 6% versus the current 17% and those investors who bought additional Econet shares in the open market at that time were able to cover their backs.

Once the news that the rights issue will be purely in US$ hit the market, the share price started appreciating.

I suspect that it is at this time that the market realised that since the shares rank pari pasu it made sense to buy them in the open market in ZW$ rather than subscribe rights.

During that time the local currency was losing value to the US$ almost on a daily basis.

Although information like dilution ratio and rights price was not yet availed to the market at the time, those who bought immediately after the second cautionary statement were also winners in my opinion.

Now that the full circular is out, other investors are still not sure if they are better off taking their rights in foreign currency or going to the open market.

Unfortunately, its decision is no longer as clear and easy as it was four months ago when the ZW$ was depreciating on a daily basis.

With parallel market rates having somewhat stabilised between ZW$6000 - ZW$7000 for every single dollar, careful analysis needs to be taken for which course of action to take.

Considering the scenario of an investor with 100 shares and ignoring all transaction costs, she will require US$1,30 to subscribe to her 17,122 shares and that amount does not change.

Alternatively, at a current market price of ZW$500 per share, buying 17,122 shares in the open market would cost US$1,43 assuming an exchange rate of ZW$6000 for every US$ making the rights issue cheaper.

If you change that exchange rate to ZW$7000 and holding everything else constant, immediately the open market transaction will fall to US$1,23, which is cheaper than the rights issue exercise.

The more the exchange rate moves in favour of the US$, the less the rights offering stop making sense and vice versa.

The other pivotal variable in the analysis will be the share price change of the counters.

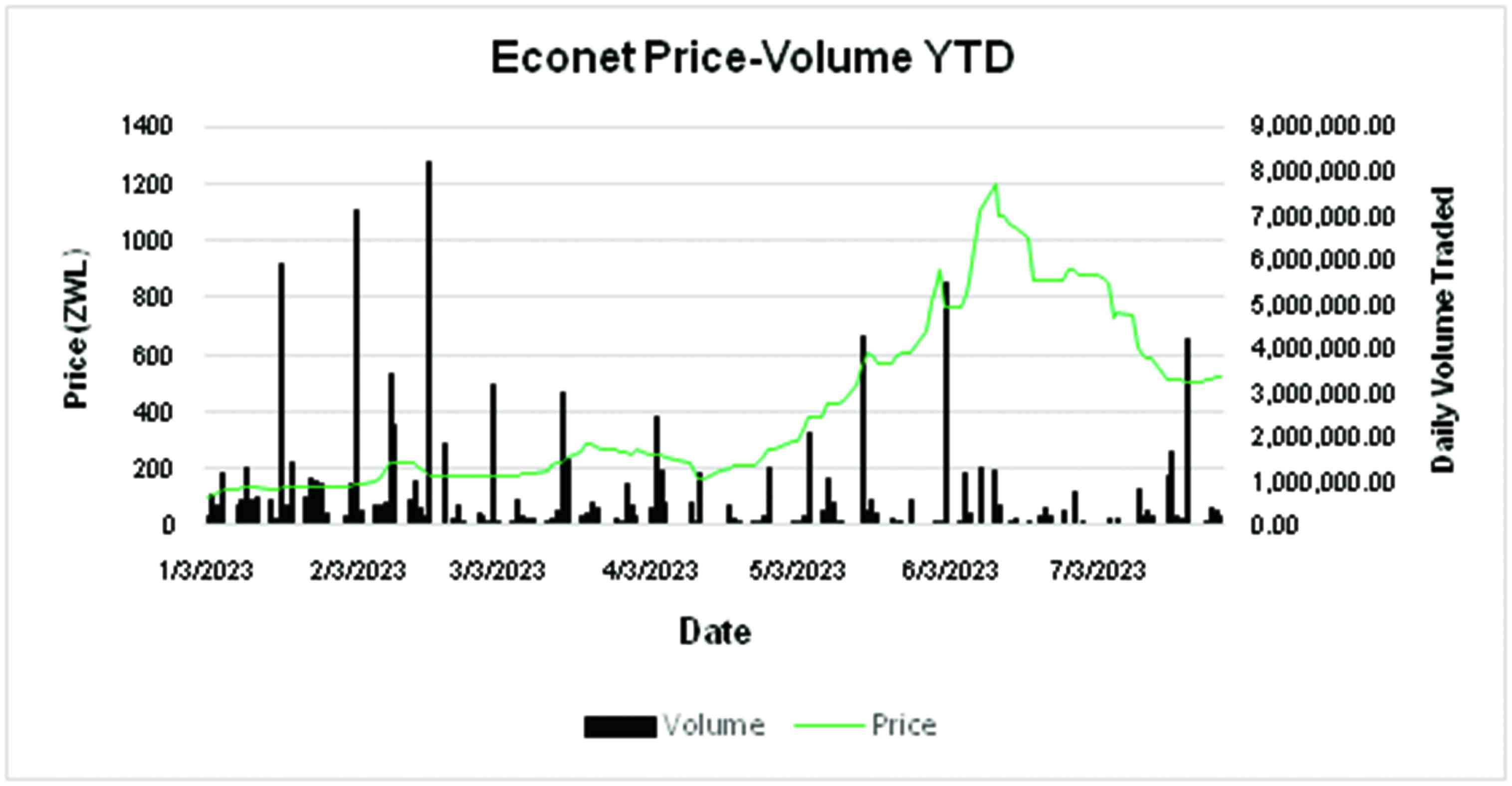

I have calculated Econet’s volatility as measured by the standard deviation of daily share price movements to be 6% since the beginning of the year.

If the Econet share price appreciates from the current levels of ZW$500 ceteris paribus subscribing to the rights will make sense since you will be picking shares at a fixed price whilst the open market price is going up and the opposite is also true.

In closing up, I opine that US$ rights issue subscription on the Zimbabwe Stock Exchange (ZSE) is more of a risk appetite game more than anything.

Risk-averse investors who do not want to dilute their position will subscribe to their rights by purchasing US$ today and subscribing to their rights.

The more sophisticated and risk-loving investors might want to bet on the exchange rate and share price movement by waiting for the right time to jump into the market if they havenot already done so.

- Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.