ONE of the kindergarten songs that keeps playing in Piggy’s mind whenever he looks at the currency situation in Zimbabwe is “Chitty Bang”.

It is basically a play school rhythm that speaks of a cheat who tries to “make a dollar out of fifteen cents”.

While we cannot label economic agents that take advantage of arbitrage opportunities in Zimbabwe as cheats, the point is that Chitty Bang has not only tried but has succeeded in coming up with the dollar.

Foreign currency parallel market trading activities in Zimbabwe also remind Piggy of the greatest speculative mania of all time; Kuwait's Souk al-Manakh stock bubble in the early 1980s.

The Souk Al-Manakh emerged parallel to the official stock market. It was an over the counter (OTC) exchange where the securities of 45 companies registered in Gulf countries outside Kuwait were traded.

The market was established a few months after the official stock exchange was founded in Kuwait in 1977. The Al-Manakh market was housed in an air-conditioned parking garage that had formerly been a camel trading venue and specialised in highly speculative and unregulated non-Kuwaiti companies. At its peak, its market capitalisation was the third highest in the world, behind only the USA and Japan.

A look at history and the cause of the crisis reveals that in the Arab states those days, only sheiks could grant corporate charters and only corporations could become publicly traded companies.

In addition, the royal family of Kuwait did not freely grant corporate charters for companies and there was basically a shortage of stocks to trade.

- Zimbabwe has much to learn from Rwanda’s progress

- Zimbabwe has much to learn from Rwanda’s progress

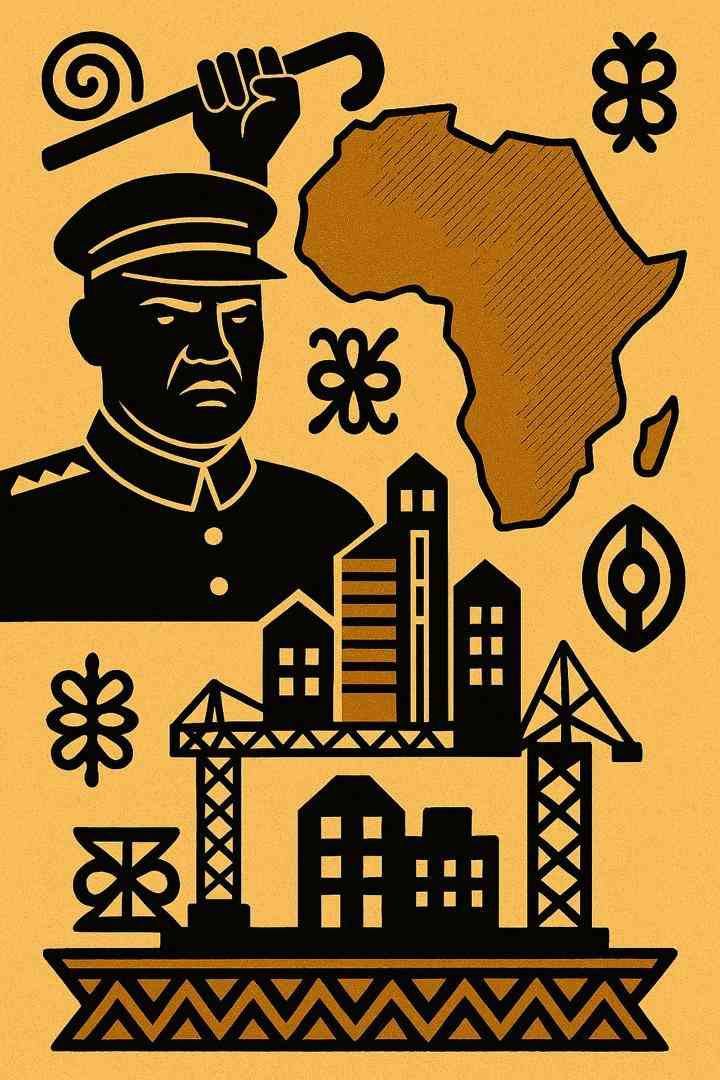

- Cartoon: October 11, 2022 edition.

- China-Stanbic job fair gets overwhelming response from job seekers

Keep Reading

This shortage and the new unparalleled wealth (from oil) that was looking for vehicles of speculation gave rise to an over-the-counter market where shares in companies domiciled elsewhere in the Gulf (Bahrain and UAE) were traded.

The speculation was excessive, and the value of certain shares rose to 300% of their original value. Trading was so lucrative that even students were able to amass fortunes.

However, rather than paying cash for the shares, many investors used post-dated cheques, hoping that the value of purchased shares would rise before the cheques fell due.

The crash of the unofficial stock market finally came in August 1982, when a dealer presented a post-dated cheque from a young passport office employee for payment and it bounced.

Kuwait's financial sector was shaken by the crash, as was the entire economy. In fact, the crash prompted a recession that rippled through society.

Now, more like the Kuwait situation, a parallel foreign exchange market has been in existence in Zimbabwe. There has literally been a stampede for foreign currency from every corner of the economy given the heavy reliance on imports (from critical raw materials, spare parts, electronic consumables to cars). This chaotic currency situation in Zimbabwe has led to several exchange rates for different forms of money, such as for the physical USD cash or Nostro balances.

As a result, arbitrage opportunities have been presented to the so-called “money changers” or “forex dealers”.

While the Government of Zimbabwe has moved in and put in place several measures to stabilise the local currency unit (ZWL), the parallel foreign exchange market in Zimbabwe remains.

That said, without a concrete solution of the currency and liquidity issues in Zimbabwe, the stampede for forex will remain.

In fact, Chitty Bang will most likely continue spinning or “burning” some money. The good thing though is that Chitty Bang has helped boost sales volumes, at least in the consumer-facing businesses (airtime, beer, and food). Econet, Innscor Africa, Delta Corporation and Simbisa Branda are good picks in this environment.

For more insights and investment tips, join a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

Matsika is the managing partner at Mark & Associates Consulting and founder of piggybankadvisor.com. — +263 78 358 4745 or [email protected]/ [email protected].