Finance, Economic Development and Investment Promotion minister Mthuli Ncube yesterday presented the ZWL$58,2 trillion 2024 national budget.

According to the Treasury chief, the economy is projected to slow down to 3,5% from the projected 5,5% growth this year, due to El Nino effects and a decline in commodity prices.

He said total revenue is estimated at ZWL$53,9 trillion, made up of ZWL$51,2 trillion tax revenue and ZWL$2,7 trillion non-tax revenue.

The total budget financing gap amounts to ZWL$9,2 trillion, comprising a budget deficit of ZWL$4,3 trillion (1,5% of GDP) and amortisation of loans and maturing government securities estimated at ZWL$4,9 trillion, which will be financed through domestic and external borrowing.

Before the presentation, Treasury promised a pro-poor budget.

Yesterday, the minister focused more on revenue collection with sweeteners soured by a raft of taxes and levies.

While the “sin tax” had been traditionally reserved for tobacco and alcohol, the Treasury chief expanded that to sugar, introducing a levy of US$0,02 per gramme of sugar contained in beverages, excluding water, with effect from January 1.

He proposed to increase passport and selected fees charged by the Central Vehicle Registry with effect from January 1.

- Driver’s licence disc shortage: Mhona blames sanctions

- 3,7m queue for govt food aid

- Hundreds of vehicles face deregistration

- Govt introduces digital route permits for public service buses

Keep Reading

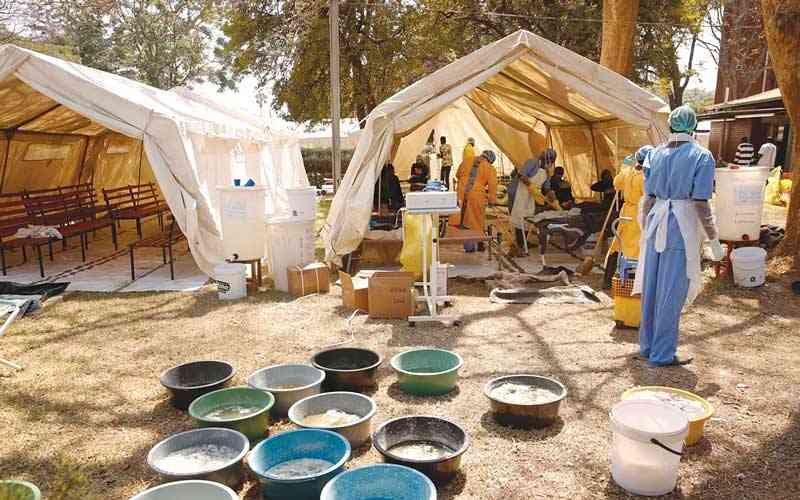

The health sector is on the brink of collapse weighed down by under-funding which has seen an exodus of professionals frustrated by lack of basic sundries. Under such an environment, the Health ministry should have been capacitated with a meaningful allocation.

Instead, the ministry was allocated ZWL$6,3 trillion.

While the vote is the second largest after the Primary and Secondary Education ministry, the allocation is 10% of the total purse and below the 15% prescribed under the Abuja Declaration.

The tax free was increased to ZWL$750,000 from ZWL$500 000 with tax bands ending at ZWL$270 million per annum, above which tax will be levied at a rate of 40%, with effect from January 1.

The tax-free threshold bonus was revised to ZWL$750 000 from ZWL$500 000 with effect from November 1, 2023.

The review is a drop in the ocean amid inflationary pressures.

The contentious 2% intermediated money transfer tax (IMTT) will remain. Also to remain is the 2% IMTT on cash withdrawals of US$1 000 and above despite pleas by bankers.

The Treasury chief missed that all together.

In his seminal work, The Wealth of Nations, economist Adam Smith argued that taxation should follow four principles of fairness, certainty, convenience and efficiency.

Fairness in taxation should be compatible with taxpayers’ conditions such that they are able to pay in line with their needs.

Certainty entails that taxpayers are clearly informed about why and how taxes are levied.

On the sugar tax, the Treasury chief said the consumption of high sugar content beverages was linked to increased risk of non-communicable diseases, adding that other Sadc countries had also introduced the same tax head.

Countries are at different stages of development and copying and pasting of a policy without looking at the environment is a futile exercise.

In the end, the Treasury chief was more concerned about achieving a healthy budget deficit on course to a balanced budget.

And the hard-pressed Zimbabweans became collateral damage.