TAX consultant, WTS Tax Matrix Academy (WTS Tax) has identified tax gaps between monetary and tax policies in the adoption of the Zimbabwe Gold (ZiG) currency.

Since the introduction of ZiG, the fiscalisation of the Zimbabwe Revenue Authority (Zimra) systems into ZiG has been a slow and troublesome process for taxpayers.

At a tax indaba on the impact of ZiG on tax, held on Wednesday in Harare, WTS Tax research consultant Simba Mambara said one gap between monetary and tax policies was on the Intermediated Money Transfer Tax (IMTT).

“The IMTT stipulates that it is 2 ZWL (Zimbabwe dollar) cents per transaction, but the legislature is still silent on the stipulations on the new currency. That creates a gap within the legislation and as we speak it will be difficult for banks to collect the IMTT because there is no legal provision to back that,” he said.

“There is still a gap in the rates that are supposed to be used. On the ZiG transactions, we would have expected that there would be some transitional provisions around that. We would have wanted to expand the purview of the Reserve Bank of Zimbabwe because this was more of a tax issue rather than a monetary issue.”

He said as tax experts, they believed that the future should hold better coordination between the monetary policymakers and the tax policymakers to avoid gaps.

Another gap identified was on the conversion of tax transactions made during the auction system era, an era during which the exchange rate was constantly changing.

“Some other tax issues that we have are the issue of Section 37A (of the Finance Act). We appreciate the fact that the section refers to the auction rates in as far as the conversion of any expenditure or income on the prevailing rate during the year. They were made when the auction system was still there,” Mambara said.

- Zimra seizes CCC campaign vehicle

- ZDI defends AK-47 rifles 'smugglers'

- Firearms smuggling suspect weeps in court

- Fresh calls to scrap 2% tax

Keep Reading

“We were given the provisions of the average prevailing rate on the 5th of April, but with the removal of the auction system, there appears to be some sort of gap within the legislature in as far as what we need to use for those transactions for conversion.”

He recommended that Section 37A be amended to accommodate the ZiG.

“Naturally, it is more of a legal issue, but considering that the current currency Is backed by reserves, gold, and other commodities, we should see some sort of shift ordifference in the exchange rate due to the fluctuates of the previous currency,” Mambara said.

He pointed out that during the 2019 transitions from a multicurrency system to the Zimdollar, there was clear guidance which is what was needed now for ZiG

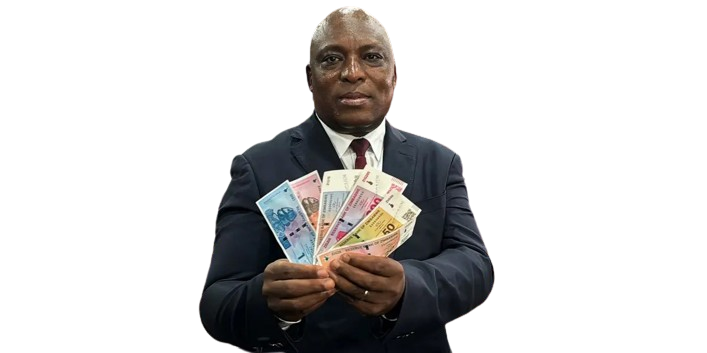

At the recent post monetary policy review breakfast meeting held in Bulawayo, hosted by NewsDay’s sister paper, Zimbabwe Independent, the Reserve Bank of Zimbabwe governor John Mushayavanhu promised to address the tax gaps.

“You raised the issue of Zimra not being ready. Thank you for raising that. I think we are also going to have a conversation with Zimra,” he said.

“I need to say we may have taken it for granted that converting to a new currency was simply a case of converting ZWL by a factor of ZiG1:ZWL2 500 then think it’s done, until we realised that when banks were trying to convert it was a complicated process.”

He added: “For banks, they use core banking systems that are sold to them by vendors and its only the vendors who can give you the conversion scripts. It was a nightmare.”