WHEN companies fail, everybody loses. In addition, government misses on the opportunity of collecting tax revenues meant for the economic development of the country.

Corporate failures can have far-reaching consequences for economies, societies, and governments, impacting employment, investor confidence, and public finances.

In Zimbabwe, a country with a history of economic challenges and political instability, corporate failures have been a recurring phenomenon, leading to job losses, financial distress, and reduced tax revenues for the government.

This instalment seeks to analyse corporate failures in Zimbabwe over the past four decades and examine their implications on tax collection and government finances.

What is corporate failure?

Corporate failure is the inability of a corporatised organisation to align itself with its strategic agenda of growth and development in order to attain its market, economic, financial and legal objectives.

There are several determinants of corporate failures, but the most important include, but are not necessarily restricted to the following: Leadership quality, risk appetite, poor corporate governance, excessive debt, inadequate strategic decision-making, lack of innovation, internal control weaknesses, failure to adapt to changing market conditions, etcetera.

In many cases, corporate failures can be prevented or mitigated through effective governance, risk management, and accountability mechanisms

- Village Rhapsody: Govt must ensure that devolution works

- Village Rhapsody: Govt must ensure that devolution works

- Millers tussle over salary deal

- Poetry educates, entertains, says Chitungwiza poet

Keep Reading

Corporate failure theories

There are three broad theories to explain and shed light on corporate failure.

These are:

Agency theory: Agency theory posits that conflicts of interest between principals (shareholders) and agents (management) can lead to agency problems and corporate failures. In the context of Zimbabwe, agency issues such as managerial self-interest, lack of accountability, and weak corporate governance practices have been identified as contributing factors to corporate failures. When managers prioritise their own interests over those of shareholders and stakeholders, it can result in poor decision-making, financial mismanagement, and ultimately, corporate collapse.

Stakeholder theory: Stakeholder theory emphasizes the importance of considering the interests of all stakeholders, including employees, customers, suppliers, and the community, in corporate decision-making. In Zimbabwe, corporate failures often have negative consequences for a wide-range of stakeholders, leading to job losses, supplier disruptions, and social unrest. When companies fail to prioritise stakeholder interests and engage in unsustainable practices, it can erode trust, damage reputation, and undermine long-term viability.

Resource dependency theory: Resource dependency theory suggests that organisations depend on external resources, such as capital, technology, and human resources, to survive and thrive. In Zimbabwe, corporate failures can be attributed in part to challenges in accessing critical resources, including foreign currency, credit, skilled labour, and infrastructure. When companies face resource constraints and external shocks, such as hyperinflation, political instability, and economic sanctions, it can disrupt operations, strain finances, and increase the likelihood of failure.

Corporate failures 1980-2024

The period from 1980 to 2024 was marked by numerous corporate failures in Zimbabwe across various sectors, including manufacturing, mining, agriculture, and finance.

Factors contributing to these failures included economic downturns, hyperinflation, political instability, corruption, mismanagement, poor corporate governance and regulatory weaknesses. Some notable cases of corporate failures in Zimbabwe during this period include:

The rural bus operators collapse: During the period 1980 to 1985, virtually all rural bus operators that had been in operation before political independence in 1980 collapsed due to a whole host of reasons. It is not untrue to say that it was an industry wide collapse where some entrepreneurs, like Mucheche Bus Service and Mushandira Pamwe Buses tried to bounce back through their patronage ties with the ruling party. They did, for a decade or so post 1985. Ben Mucheche re-started as Mucheche Investments, using his IBDC links, but that initiative collapsed in 1997 during what was termed “the black Friday financial crisis”.

There had been wide ranging protests against the government by war veterans. Then in October 1997, President Robert Mugabe yielded to pressure from veterans of Zimbabwe's liberation war and approved unbudgeted, one-off pension distributions of 50,000 Zimbabwean dollars to all bona fide veterans, over 50 000 of them — plus additional monthly pensions of 2,000 Zimbabwean dollars. At the time, ZW$11.6 equalled US$1. The amount paid to the veterans totalled ZW$3.5 billion, a staggering US$302 million.

Around the same time, the Mushandira Pamwe Buses re-start collapsed. Maiziveyi Bus Service, Kambasha Bus Service, Kumuka Bus Service, Matongo Bus Service, Nyamweda Buses, Farayi Uzumba Buses(who was known to have been a big war effort funder), Modern Express, Surrender Buses, Mverechena Buses, Matambanadzo Bus service and others who represented the huge pool of pre-independence entrepreneurial efforts, had already collapsed between 1980 and 1985.

The banking sector collapse: The banking sector in Zimbabwe experienced a wave of failures and closures in the early 2000s due to a combination of factors, including poor governance, insider lending, and macroeconomic challenges. The banks that failed included, Time Bank of Zimbabwe Limited, CFX Bank Limited, CFX Merchant Bank, National Discount House Limited, African Renaissance Bank (AFRE), BCCI, UMB Bank, ENG Capital and Barbican Bank, Intermarket Banking Corporation Limited and Intermarket Building Society. These bank failures led to loss of depositor funds, financial instability, and erosion of public trust in the banking system, never mind the negative implications on the fiscus. The erosion of the public trust in the banking system is widespread and prevalent to this day, with the banking public choosing to keep their funds away from banks, in essence, distorting banker – client relationships.

The manufacturing industry decline: The manufacturing sector in Zimbabwe has faced significant challenges, including power shortages, foreign currency shortages, and policy uncertainties, leading to plant closures, job losses, and reduced production capacity. Corporate failures in the manufacturing industry have had ripple effects on supply chains, employment, tax collection and economic growth.

Industrywide companies that have collapsed: This list is far from being exhaustive but the companies listed here represented some of the giants in the yesteryear of the industrial landscape that collapsed side by side the economic decline of Zimbabwe. These include, Aman Investments, Apex Corporation, Asmara Company, Auto Electrical, Barragen Private Limited, Belmont Leather, Biticon, Blue Ribbon, Builders' Depot, C & M Investments, Cairns Foods, CMS Leatherware, Coppleridge, David Whitehead, Durawood and many others.

The causes of these corporate failures were amongst other things, failure to adapt to the fast changing economic environment, failure to access foreign currency, lack of proactive leadership, high gearing, increased competitive environment, poor corporate governance and failure to manage hyperinflation.

These corporate failures have had far reaching effects on the Zimbabwe economy in terms of reputational damage, financial losses and erosion on shareholder value, legal and regulatory repercussions, possible fines and sanctions, increased scrutiny and oversight and loss of investor confidence for Zimbabwe as a viable investment destination.

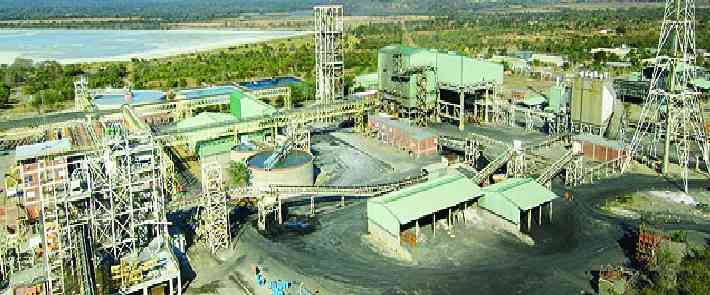

Mining sector distress: The mining sector in Zimbabwe, particularly the gold and diamond industries, has been affected by issues such as smuggling, illegal mining, and lack of investment in infrastructure and technology. Corporate failures in the mining sector have reduced government revenues from mineral exports and undermined the sector's contribution to the economy.

The last few months, Mimosa and Zimplats have been hard hit by declining metal prices and to avert corporate failure, they have embarked on either retrenching employees or offering staff voluntary redundancy packages to cut costs.

This is being done across the board all the way to managerial level. No doubt, this will have implications on disposable incomes, employment, tax collection and ultimately, the economic growth of Zimbabwe.

Be that as it may, averting the corporate failure by any means necessary, is the best strategy going forward.

Implications on tax collection

The prevalence of corporate failures in Zimbabwe has had significant implications on tax collection for the government, affecting revenue streams, fiscal sustainability, and public service delivery.

Some key implications of corporate failures on tax collection include:

Revenue losses: Corporate failures result in reduced profits, business closures, and job losses, leading to decreased corporate income tax revenues for the government. When companies fail to meet their tax obligations or go bankrupt, it can erode the tax base, limit revenue generation, and strain government finances.

Tax arrears and non-compliance: Corporate failures often lead to tax arrears, non-compliance, and tax evasion as companies struggle to meet their financial obligations and prioritise debt repayment. When companies default on tax payments or engage in fraudulent practices, it undermines tax collection efforts, weakens tax administration, and hampers government efforts to mobilise resources for public services.

Increased reliance on indirect taxes: In response to declining corporate tax revenues, governments may resort to increasing indirect taxes, such as value-added tax (VAT) and excise duties, which the struggling public cannot afford in the first place.

Conclusion

Business failures have a high consequences on employment, lost productivity, purchasing power (unpaid wages) and finance (unpaid debts), and poverty increase.

The governments ought to create enabling environments for businesses to thrive so that there is a steady stream of tax collection for the benefit of the economy.

- Ndoro-Mkombachoto is a former academic and banker. She has consulted widely in strategy, entrepreneurship and private sector development for organisations that include Seed Co Africa, Hwange Colliery, RBZ/CGC, Standard Bank of South Africa, Home Loans, IFC/World Bank, UNDP, USAid, Danida, Cida, Kellogg Foundation, among others, as a writer, property investor, developer and manager. — @HeartfeltwithGloria/ +263 772 236 341.