The Zimbabwe 2024 budget has made some strides in introducing gender initiatives, aiming to promote gender responsiveness. However, despite these efforts, the budget still falls short in adequately addressing various essential areas that cater to the needs of men, women, boys, and girls.

This omission undermines the overarching objective of achieving gender equality and enhancing the overall well-being of individuals, particularly those who face higher risks of experiencing additional inequalities due to factors such as socio-economic status, race and ethnicity, age, disability, and sexual orientation.

The introduction of new tax increment measures in the 2024 national budget has resulted in a situation where the budget initiative losses outweigh the gains, particularly concerning gender equality. The budget allocation towards addressing the needs of women is insufficient, considering the needs. Furthermore, there are inadequate provisions for social protection and healthcare, which disproportionately affect women who bear the greatest burden in these areas.

Zimbabwe’s economic toil has been exacerbated by high inflation and exchange rate disparities, yet the budget lacks effective policies to address inflationary and exchange rate disparities, perpetuating illicit economic activities and neglects many vulnerable people , particularly women who are active participants in the informal economy. This paper is a snapshot of some of the gender implications of the 2024 national budget.

Slowdown in economic growth

According to the national budget statement the economic growth for Zimbabwe is going to decline to 3.5% in 2024.

The impact of slow economic growth on gender can be intricate and varied, encompassing factors such as increased informality resulting from reduced formal employment.

Research has indicated that women in the informal sector face various violations associated with informality, including low wages, unpaid care work, excessive working hours, poor working conditions, and a lack of legal protection. Consequently, they experience heightened vulnerability in terms of social security and decent work deficits due to reduced disposable incomes and government revenue.

- Young women enter fight for gender equality

- Neo-liberalism, debt management

- African Sun shines on rising star

- ‘Let’s nurture gender equality mindset from childhood’

Keep Reading

Blended inflation drops

The national budget did not provide solid solutions to the exchange rate disparities in the country, which is one of the main sources of high inflation rates and increased cost of living. Exchange rate disparities affect both women and men, eroding the purchasing power of the local currency and leading to limited ability to purchase necessities. Studies show that women have been known to be the primary consumers of these necessities hence they are affected more than men.

Allocation insufficient

The 2023 National Budget recorded gender sensitive expenditures amounting to Z$3.5 trillion, against a revised budget provision of Z$2.4 trillion, representing 28% of the total budget outturn of Z$12.4 trillion, with the 2024 National Budget providing resources for gender sensitive programmes amounting to Z$27 trillion, representing 45% of the total budget of Z$59.5 trillion.

In as much as there have been set out facilities to empower women, women still face challenges to access these facilities.

The current facility offered by government to women is only up to US$500 and only caters from projects that are already running. There is need for the facility to also accommodate start-up projects the budget did not address this challenge. The Women’s bank still requires collateral from women in a society where they, in most cases, do not own any assets that can be used for this purpose.

The bank has not remodelled their financing arrangements towards innovative packages that promote collateral substitution.

Gender mainstreaming measures

According to UN Women prevalence of severe food insecurity in the adult population was (69%) for females and (66%) for male in 2022 and the number of people living below the Poverty Datum Line has increased from 30% in 2017 to 42% in 2023.

These statistics show the crucial need for social protection expanded social protection in the country. Zimbabwe’s social spending averaged 0.5% of Gross Domestic Product (GDP) during the 2019 to 2023 period much lower than the 1.5% of GDP for Sub-Saharan African countries in 2024 Social protection is targeted to be 4 percent of the budget.

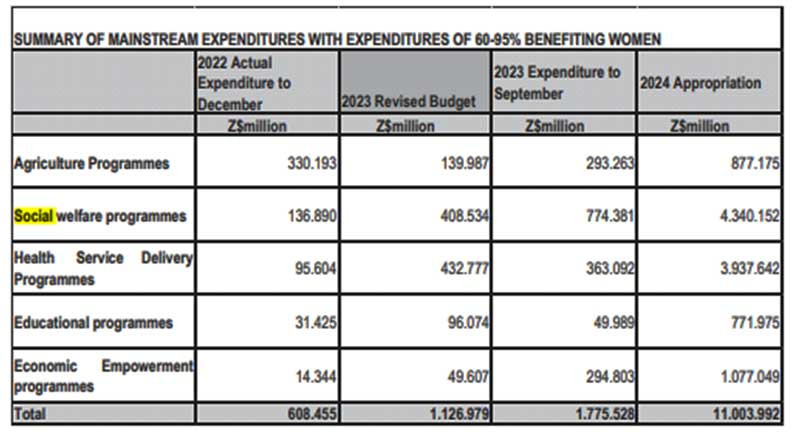

From the table above, in the 2024 gender budget statement the social protection component received 39% of the total support under the category, followed by health service delivery programme which received 36% of the resource envelop and the education service delivery component receiving only 7%, with economic empowerment component is getting 10% of the total resources allocated. Although there have been increments in the allocations the social services programmes still leave more to be desired.

Considering the high incidences of gender-based violence (GBV) and sexual harassment in Zimbabwe, the government did not prioritise the establishment of state-funded Safe Shelters, to provide a haven for victims of GBV. The budget did not also address the Civil Registration Systems strengthening by ensuring the decentralization and digitalisation of the CRVS system.

Agric gender sensitive expenditures

The gender budget statement pointed out that the smallholder irrigation development programme received support amounting to Z$18 billion for rehabilitation of smallholder irrigation schemes with the objective to mitigate against the negative impact of the envisaged El-Nino induced weather phenomenon in 2024 which is a welcome development.

The budget did not however address the issue of capacitation of extension workers and mechanisation of Pfumvudza to ensure resources are set aside to allow access by women to the equipment being rolled out under government. This means women may continue to be deprived of available agriculture resources.

Social security

The Basic Education Assistance Module (Beam) programme recorded expenditures of Z$23 billion.

The intervention in 2023 so far has benefited 1.5 million students, of which 900 000 are female students. For the year 2024, Government has made a provisional allocation of Z$605 billion under Beam in support of disadvantaged children in both rural and urban areas. However, there is need to further interrogate the number of children in need vs the amount allocated this would give a better picture of whether the resources are adequate.

To reduce the burden of unpaid care work on women related to water and sanitation programmes, resources amounting to Z$42 billion have been provided in the budget for 2024 for drilling and installation of boreholes, as well as construction of sanitary facilities Z$42 billion have been provided in the budget for 2024 for drilling and installation of boreholes, as well as construction of sanitary facilities. This is a welcome contribution and if resources are adequately distributed women whose communities would have benefited will be at an advantage.

Gender sensitive expenditures

The programme incurred expenditures of Z$363 billion in 2023, against Z$432 billion, representing 84% of the amount allocated in 2023.

The resources were mainly utilised for curative and prevention services and in 2024 the programme received financial support amounting to Z$3.9 trillion. The budget also indicated that it would introduce a sugar tax that will fund cancer needs which is a welcome development if the resources are used accordingly. However, the main issue in the health sector is the retention of staff in the health sector which has been affected by the brain drain, the budget has not address this pressing need yet these resource people are crucial for the delivery of a better health system.

Gender implications of tax initiatives

Tax increments can exacerbate existing gender gaps. If tax policies are not designed to be progressive or considerate of gender disparities, they may disproportionately burden individuals with lower incomes, who are often women. This can further widen the gender income gap and contribute to financial inequality. For instance, the recently introduced wealth tax treats everyone the same assuming people who own property that is worth USD100,000 and above are wealthy which may not always be the case.

Some women are widows who inherited their homes from their deceased spouses, while other are divorced, some people may have been out of employment after having acquired this property. The tax ignores the income status of people hence vulnerable women subjected to this tax are further pushed into poverty.

The tax on fuel and increased toll fees will contribute to tax-induced inflation, potentially leading to higher living costs and increased transportation expenses. Consequently, more women, especially those in low-income households will be negatively affected. On the other hand, the implementation of a 1% levy tax for corporate social responsibility in communities affected by mineral exploitation could potentially improve service delivery in those areas, provided the fund is effectively governed.

The 2024 national budget should have considered the implications of its initiatives such as the tax increments and resource allocations before implementation for the budget to adequately address the needs of women and men. In conclusion, while it is important to acknowledge and appreciate government efforts to introduce gender equality initiatives, it is crucial to recognise that their essence can be lost if they are not implemented correctly or if they are influenced by counter policies.

To ensure the success of such initiatives, it is necessary to prioritise effective implementation and mitigate any conflicting policies that may hinder their intended impact. Only through careful execution can we truly achieve meaningful progress in promoting gender equality.

- Zimbabwe Women’s Resource Centre and Network (ZWRCN) is a knowledge institution that collects and provides information that will lead to the transformation of women’s lives. The organisation is driven by the vision to see women enjoying the benefits of actualising their full potential in all areas of their lives. It places particular emphasis on strengthening the voice of women and girls and enabling them to influence the decisions that affect their lives. Amongst others, one of its strategic focus is to contribute towards Gender Responsive Public Services. These weekly New Horizon articles, published in the Zimbabwe Independent, are coordinated by Lovemore Kadenge, an independent consultant, managing consultant of Zawale Consultants (Pvt) Ltd, past president of the Zimbabwe Economics Society and past president of the Chartered Governance & Accountancy Institute in Zimbabwe (CGI Zimbabwe). — [email protected] or mobile: +263 772 382 852