Jonathan Chando AT the beginning of my series of articles on the Ukraine crisis, I articulated that the United States/Nato/European Union are waging a three-pronged warfare matrix against Russia, using Ukraine as the theatre of operation (proxy).

Consequently, in the succeeding instalments, I have articulated the status of the information/disinformation warfare and the military combat warfare, which the US/Nato/EU and their allies are dismally losing thus far.

This instalment will discuss economic warfare by the West against Russia and how they have hurt the West more than they have hurt Russia.

In the next instalment I will continue to discuss the Global South’s indifference to Western dictates, its consequences on a global scale and the emerging multipolar world order.

What is economic warfare

International law and geo-economics describe economic warfare as the use of, or the threat to use, economic means against a country to weaken its economy and thereby reduce its political and military power.

Economic warfare also includes the use of economic means to compel an adversary to change its policies or behaviour or to undermine its ability to conduct normal relations with other countries.

Some common means of economic warfare are trade embargoes, boycotts, sanctions, tariff discrimination, the freezing of capital assets, the suspension of aid, the prohibition of investment and other capital flows, and expropriation of the target country’s assets.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The use of economic warfare has often been used as a strategic substitute for, or alongside, combat warfare. In other words, that economic warfare can starve the enemy out, destroy the enemy’s morale, or cause a favourable regime change, independently of the winning or losing of battles between the opposed troops.

The US and its allies have been using economic warfare against countries all along. Cuba, Iran and Venezuela are examples.

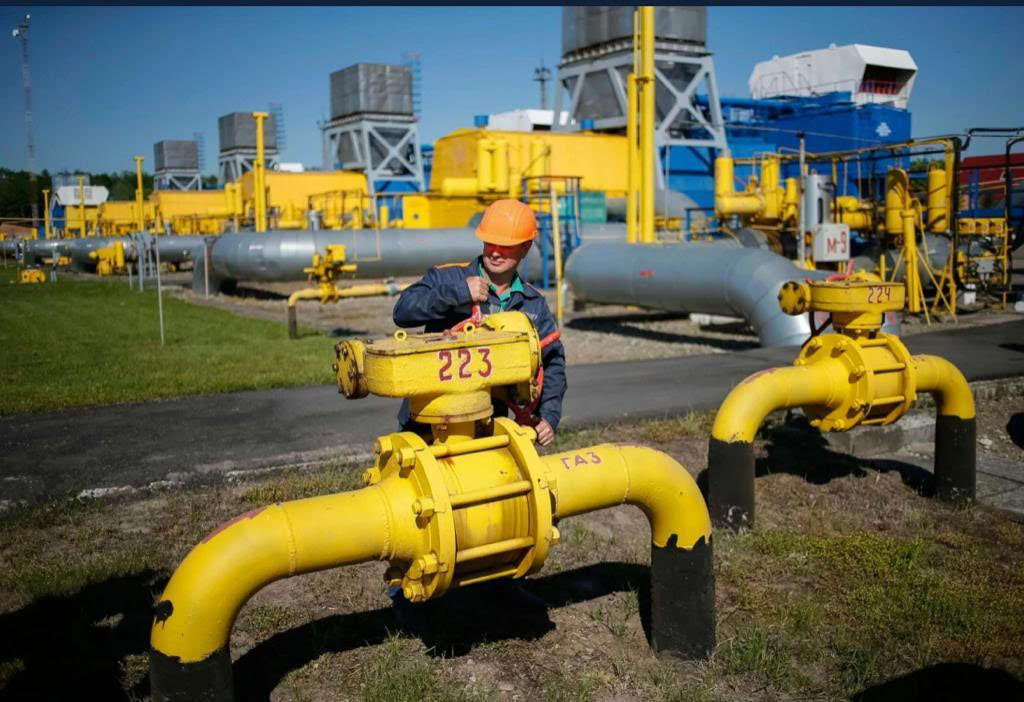

Economic warfare against Russia

Since February, the West has imposed six packages of sanctions against Russia, including targeted restrictive measures (individual sanctions), economic sanctions and diplomatic measures. These measures added to existing ones imposed on Russia since 2014 following the US sponsored coup in Ukraine and the referendum, which allowed Crimea to join Russia.

From the start of Russia’s special military operation in Ukraine, the West sought to damage or destroy Russia’s fighting power, indirectly by attacking the supply chains that produce it.

The West’s primary weapon on the economic front has been severing key banking linkages, barring Russian businesses from dollar markets, and freezing a significant portion of Russia’s foreign reserves.

Assets of the Russian Central Bank held in Western institutions were frozen, to stop it using the US$630 billion of reserves it has in foreign currencies.

Russia’s Central Bank (RCB) and all Russian major banks were also removed from the international payment system, Swift, rendering Russia unable to make forex payments for imports nor receive payments for exports, as well as making payments for international debt.

In the initial rounds of sanctions, the US/EU and their allies did not ban Russian oil and gas because of some disagreements among member states. Countries like Hungary and Germany, which are hugely dependent on Russian gas and oil, were not comfortable with a total ban on Russian gas and oil.

In the scenario of the draft of Brussels’ proposed sixth package of sanctions against Russia at the end of last month, Hungary opposed the proposal, explaining that the ban on Russian oil imports would be equivalent to dropping an “atomic bomb” on the economy.

Russia supplies 40% of gas and 29% of oil to the bloc. So far, the West appears to have opted to pursue what can be defined as a “supply-side strategy” to weaken the Russian economy but simultaneously failed to efficiently plan for the predictable costs such a strategy would inflict on itself.

In the days after Russia’s invasion began on February 24, the rouble fell from about 80 to the US dollar to a low of 120 to the US dollar. The Central Bank of Russia immediately increased the interest rate to 20% to curb anticipated rising inflation because of the sanctions.

In addition, President Vladimir Putin signed a law that compelled all gas and oil exports to be paid in roubles, instead of euros and US dollars as had been the case.

The EU and other Western countries initially refused to accept paying in roubles and accused Russia of blackmail and breach of contract. The irony is that the Western bloc had removed Russia from the Swift payment system, through which all payments for oil and gas were channelled.

Russian banks, such as Gazprom bank, which facilitated gas and oil payments had their offices and assets seized in the US/EU. This meant that payments by EU countries for the oil and gas would still be frozen in the banks, and Russia would be supplying oil and gas for free to EU countries.

The West’s economic boomerang

Russia responded by banning exports of more than 200 products to what President Putin called “unfriendly countries” (the West), including telecoms, medical, vehicle, agricultural, electrical equipment, and timber.

It also blocked interest payments to foreign investors with government bonds and banned Russian firms from paying overseas shareholders. And it stopped foreign investors who hold billions of dollars’ worth of Russian investments from selling them or moving them outside Russia.

President Putin ordered that all oil and gas payments in roubles would start on April 1, 2022. The EU had no option but to open bank accounts in roubles and make payments in euros, which would be converted by the bank into roubles.

This was a capitulation by the EU, which they tried to cover up by justifying that the payment in roubles did not violate their sanctions regime. Putin also ordered the Russian Central bank to peg the value of the rouble against gold.

After initially plummeting, the rouble rebounded, and jumped to an all-time high of 54 to the US dollar. And the banking system has gradually stabilised as panicked customer withdrawals have subsided.

Putin’s demand for payment in roubles for oil and gas turned the tables against the US/EU and their allies. The threat was declined by the EU that gas might be cut off, if payment were in roubles. It pushed the price of oil to a high of US$130 per barrel. Natural gas prices soared after Moscow returned the favour and unveiled a set of sanctions on former subsidiaries of Russian state gas giant Gazprom PJSC, Gazprom Germania GmbH in the EU and the Polish owner of a key stretch of pipeline.

The restrictions could reduce Europe’s flexibility to import gas through routes beyond Ukraine. Russia has earned more than US$100 billion (£82,3 billion) from oil and gas exports to Europe during the first 100 days of the war.

Russia’s current account surplus usually shrinks in the summer months when Western Europe does not need gas for heating. Indeed from 2007-2021 the June account averaged zero. However, this year the surplus is +US$28,2 billion, a monster surplus of the West’s own making.

Last week, Gazprom shut off gas supplies through Nord Stream 1 pipeline for “maintenance”, having already cut its output to less than 40% of capacity. Now there are growing concerns that President Putin may simply refuse to reactivate it.

Fears for gas supplies have led European nations to rapidly fill up their storage capacity before the winter. Last week the Russian Foreign ministry stated that the steps Moscow will take in response to Western sanctions could be very painful for Europeans.

While it is unclear what steps will be taken, Europe fears that it is likely to face a cold winter, if Russia decides to permanently cut off gas flows.

Germany, the European powerhouse, has been left most exposed by the sudden lack of gas after the closure of Nord Stream 1.

The German government has been forced to declare a gas crisis, asking industrial users to slash usage and encouraging councils to turn off traffic lights at night, turn off air conditioning and stop lighting up historic buildings.

Italy’s Power group Eni said last week that Gazprom would cut supplies to Italy by a third, on top of the 60% since the Ukraine conflict.

Russia briefly cut off supplies to France in June, and Paris’s Finance minister Bruno Le Maire last week described a Russian gas cut off as the most likely scenario.

Spanish Prime Minister Pedro Sanchez is facing geopolitical tensions over the country’s gas supplies on all fronts. His decision to support Morocco in a dispute over Western Sahara prompted a reduction in gas flows from Algeria, which has now been overtaken by Russia as Spain’s second largest supplier.

Russia cut off Poland and Bulgaria in late April after they refused to comply with its demands to pay in roubles. Poland had received half of its gas supplies from Russia.

In the instalment of June 8, I wrote that Putin will be in power long after most, if not all, Western leaders are removed by their citizens because of the Ukraine war.

The war in Ukraine has already started taking casualties in the European leaders. With the UK’s Boris Johnson, a staunch supporter of Volodymyr Oleksandrovych Zelensky gone, desperate efforts in Italy to prevent the fall of Mario Draghi’s government are only the latest political firestorm in Europe tied to the Ukraine conflict and the sanctions on Russia.

Italy’s Foreign minister, Luigi di Maio, suggested it will be Putin who will celebrate the fall of another Western government if Draghi does not survive a confidence vote in parliament.

In France, Emmanuel Macron has been weakened if not muted by the loss of his parliamentary majority to parties more naturally sympathetic to Russia. In Spain, the Socialists, facing elections next year, have just lost their power base in Andalusia, the most populous region.

The centre-right People’s Party achieved a new record high of 36,3 % in the latest GAD3 poll, its best result since April 2017. If repeated in an election it would be its best result since 2011.

In his annual lecture at the Ditchley Foundation on Saturday former British prime minister Tony Blair admitted that the West is “coming to the end of its political and economic dominance and that the world is going to be at least bipolar and possibly multipolar”.

He admitted that the West is losing the economic warfare against Russia.

In next week’s instalment, I will discuss the refusal of the Global South to join the West in condemning and sanctioning Russia and the impending development of the multipolar world.

Chando is a lawyer, political analyst and commentator on International Law and Politics.