TINASHE MAKICHI ZIMBABWE Stock Exchange-listed diversified group Meikles Limited has disposed of its strategic foreign asset, Cape Grace Hotel in Cape Town, South Africa, for about US$20 million, the Zimbabwe Independent can reveal.

The asset was sold to Eagle Owl JNP, a company registered in Mauritius and owned by Kasada Hospitality Fund LP, an affiliate of Kasada GP Limited, according to sources who said the buyer has the backing of the Qatar Investment Authority.

Meikles Limited was a shareholder in Mentor Africa through Cape Grace Investments (CGI) where Mentor owns hotel assets collectively known as the Cape Grace Hotel located in Cape Town, South Africa.

In 2012 CGI acquired 35% stake in Mentor Africa through a merger of Cape Grace Hotel and Mentor to gain access to assets with greater growth prospects.

In October 2021, an offer to acquire 100% shareholding in Mentor Africa was received from Kasada GP Limited.

Both shareholders of Mentor Africa authorised the negotiations while in January this year, Meikles Limited directors also approved the sale.

The proposed acquisition of Mentor Africa by Kasada GP Limited culminated in the disposal of the Meikles Group interest in Cape Grace Hotel.

“The transaction is almost complete and is awaiting some regulatory approvals,” the source said.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Meikles Limited company secretary Thabani Mpofu declined to comment on the matter.

This is another major sale by the group following the disposal of its Harare-based Meikles Hotel to United Arab Emirates billionaire, Ali Albwardy.

In the past, the Cape Grace Hotel issue was at some point subjected to scrutiny by a section of minority shareholders led by Eddie Cross.

There are indications that the latest transaction has since been given the green light by shareholders.

The Meikles Group has now discontinued operations of its department store units while its agriculture processing unit, Tanganda, has been listed separately on the ZSE.

On recent financial performance, the Meikles Limited group revenue for the quarter to December 2021 was ahead of the same period of the previous financial year by 123% and 39% in historical cost and inflation-adjusted terms, respectively.

Sales volume at the supermarkets segment increased by 32% and 29% for the quarter and nine months respectively, relative to the same period of the previous financial year.

Stores were adequately stocked ahead of the festive season.

Despite the Omicron-Covid-19-variant-induced cancellations of regional and international bookings, there was sustained growth in both room occupancy and revenue in the hospitality segment during the quarter under review.

Group profit after tax exceeded the same period of last year in both inflation-adjusted and historical cost terms.

During the period, the group’s agricultural subsidiary, Tanganda was classified as a discontinued operation and an asset held for distribution to shareholders on March 31, 2021.

Tanganda was subsequently demerged from the group in February 2022 and listed separately.

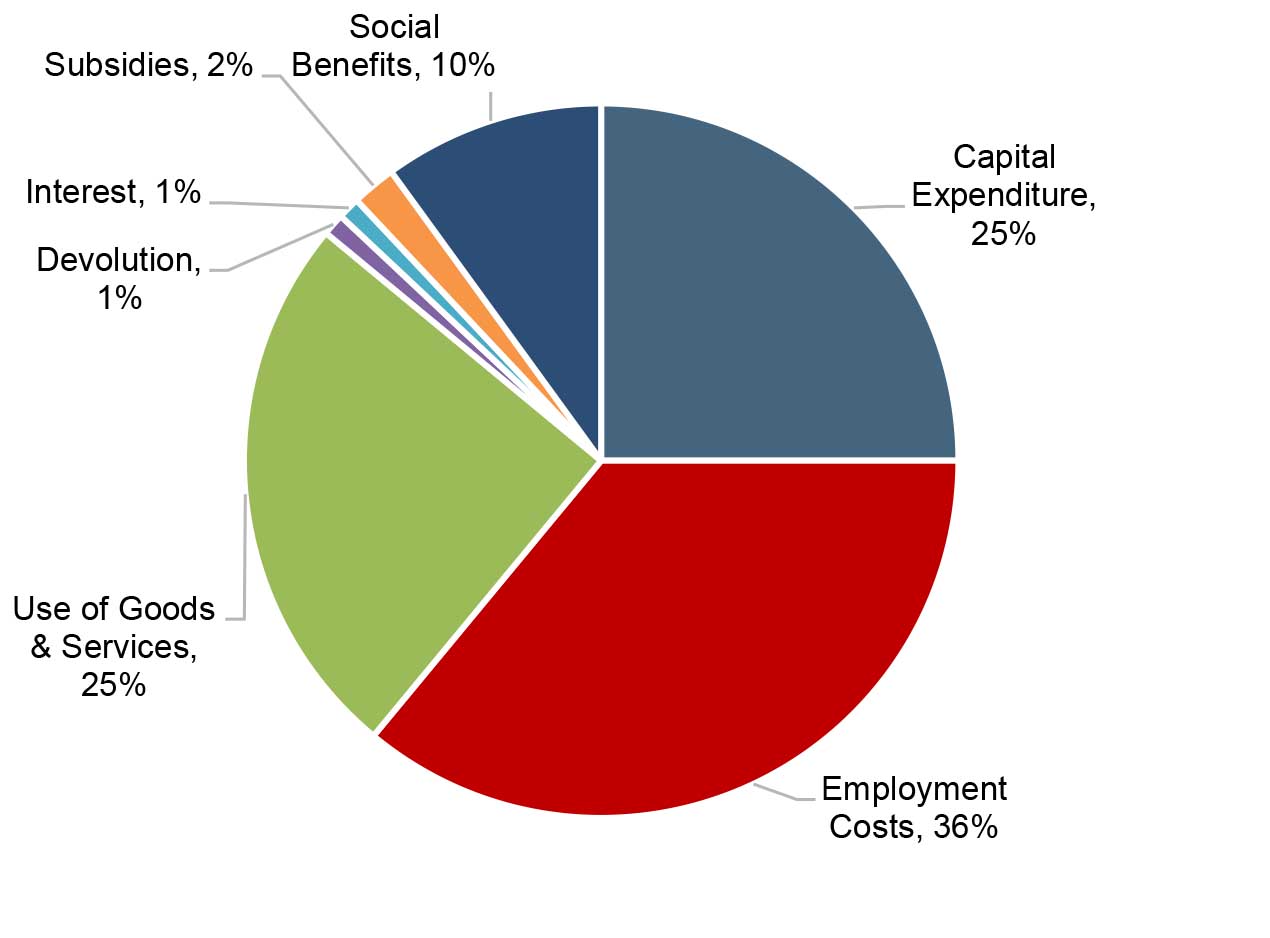

On capital expenditure, the group fared well in implementing planned capital projects during the quarter under review.

The supermarket segment completed the refurbishment of Makoni and Zengeza branches before the end of the quarter under review.

“The group remains ungeared and has adequate internal financial resources to implement its plans including access to foreign currency for its import requirements,” the group said in its financial results.