TATIRA ZWINOIRA CBZ Holdings says it will embed environmental, social and governance (ESG) practices and goals into its operations for the current year.

According to the American financial and economic literacy website, Investopedia, ESG practices are a set of standards for a company’s behaviour used by socially conscious investors to screen potential investments.

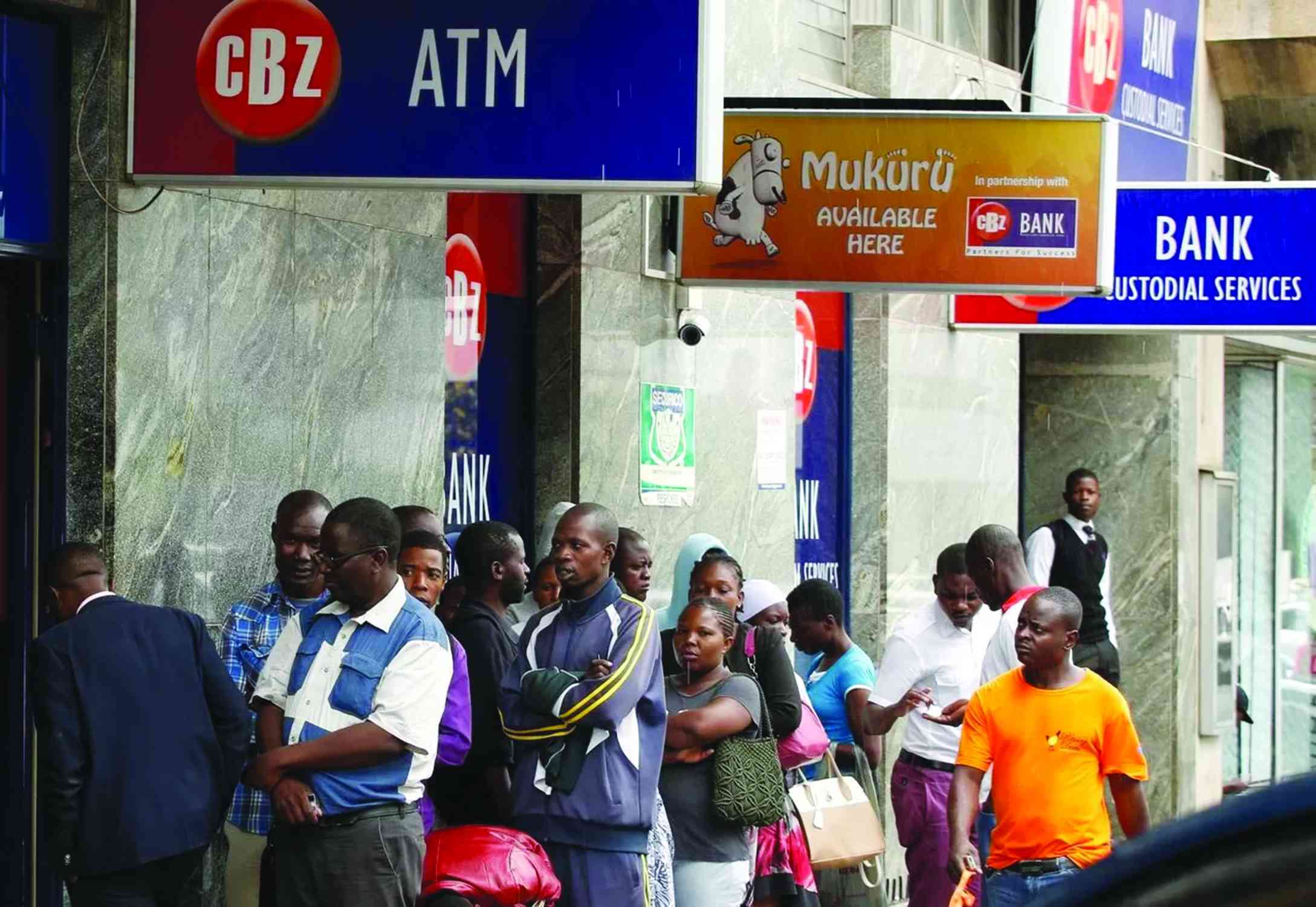

As the largest financial institution in the country, CBZ Holdings has significant investments in the economy, particularly in agriculture.

“The shift towards environmental accountability is expected to gather pace in 2022,” CBZ Holdings group chairperson Marc Holtzman said in the company’s recent financial statements for the year ended December 31, 2021.

“As a priority, the group is actively aligning operations, activities and strategies to support environmental, social and governance practices and goals.”

Under the principles of ESG practices, the environmental criteria considers how a company safeguards the environment, including corporate policies addressing climate change, for example.

Concerning social criteria, this examines how a firm manages relationships with employees, suppliers, customers and the communities where it operates.

Lastly, the governance criteria deal with a company’s leadership, executive pay, audits, internal controls and shareholder rights.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Thus, ESG practices will help CBZ Holdings put their money where their values are at a time the market remains very volatile due to low foreign investment and a broke government.

“The government also enhanced its investment in infrastructure projects, including road rehabilitation, dam construction and airport expansions, which resulted in growth of private sector investors in the financial services, construction, manufacturing and transport sectors, among others,” Holtzman said.

CBZ Holdings has become a significant lender and backer to the government’s efforts in the latter’s sourcing of domestic financing for its activities.

CBZ Holdings acquired ZW$17,12 billion (US$50,57 million) in savings bonds from the Reserve Bank of Zimbabwe last year.

This exposure in savings bonds nearly doubled the group’s money market assets to ZW$24,35 billion (US$71,93 million) from a 2020 comparative of ZW$12,18 billion (nearly US$36 million).

“In 2022, global economies are likely to start the gradual transition towards co-existing with Covid-19, implying reduced disruptions and hopefully improved business activity,” Holtzman said.

“However, the major downside risks include the possibility of extended supply chain disruptions, rising global inflationary pressures as well as disparate monetary and fiscal policies as countries transition to the next normal at different levels and scales.”

He said the group’s shift towards environmental accountability was expected to gather pace in 2022, hence, the group’s ongoing efforts to embed ESG practices and goals in operations.

CBZ Holdings experienced a near 5,5% decrease in profit after tax to ZW$7,7 billion (US$22,74 million) last year from the prior year, due to the Zimbabwean dollar’s continued depreciation.

The slight reduction in profit after tax for last year was from a 2020 comparative of ZW$8,15 billion (US$24,07 million).

At the end of last year, the value of the Zimbabwean dollar depreciated to ZW$108,66 to the US dollar, up from ZW$81,78 in 2020, thereby raising inflationary pressure.

Resultantly, the group saw its monetary loss widen by nearly 511% to ZW$7,15 billion (US$21,12 million) in the period under review, from a 2020 comparative of $1,17 billion (US$3,45 million). It also resulted in credit losses widening by about 382% to ZW$7,33 billion (US$21,65 million) last year, from ZW$1,52 billion (US$4,49 million) in the prior year, owing to the group’s increased investment into lending.

In fact, increments in money market assets and loans and advances grew the group’s total assets to ZW$190,3 billion (US$562,2 million), from a 2020 comparative of ZW$152,21 billion (US$449,67 million).