Batanai Matsika ON May 7 President Emmerson Mnangagwa imposed capital controls in an attempt to control the deterioration of the local currency unit (ZWL).

According to the statement, the Zimbabwe Government is convinced that the recent exchange rate movements are being driven by negative sentiments of economic agents as opposed to economic fundamentals. Piggy summarises the key measures hereunder.

Backlog on the auction system Government will be proceeding to make available sufficient resources to clear the backlog balance by the end of May 2022. The Reserve Bank of Zimbabwe will ensure that all foreign currency allotments are settled within a period of 14 days post-auction allotment and that the auction system only allots foreign currency that is available.

Reserve money growth targeting The quarterly reserve money growth will be further reduced to 0% per quarter.

Proportion of taxes payable in ZWL

Government reaffirmed its commitment for exporters to pay more of their taxes in domestic currency; this is currently under review.

Intermediate money transfer tax

2% will continue to apply to local currency transfers; and

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

All domestic foreign currency transfers to attract IMTT of 4%.

Forex cash withdrawal levy In order to discourage the withdrawal of cash, the cash withdrawal levy for amounts above US$1 000 has been reviewed from the current 5 cents per transaction to 20%.Settlement of foreign currency tax obligations in local currency will be at the willing-buyer willing-seller exchange rate. There is suspension of third-party country payment on foreign payments.

Suspension of lending by banks To minimise the creation of broad money and to allow current investigations, lending by banks to both the government and the private sector has been suspended until further notice.

Measures on the stock market Inter-account transfers between client sub-account with a broker are now prohibited;

Third-party funding of client sub-accounts is no longer permitted;

Transfer out of client sub-account with a broker shall only be allowed to the customers’ bank account and not to third parties; and

Capital gains tax for shares held for a period not exceeding 270 days has been reviewed from 20% to 40%. This measure is set to deter short-term speculative buying and selling of shares. The capital gains tax will remain at 20% for long term beyond 270 days.

Implications of the New Measures Stock market activity to cool off in the short term The new measures will have a negative impact on trading volumes of the local stock market given

Limited access to ZWL liquidity and An increase in trading costs (increase in CGT). That said, the new measures only serve as a circuit breaker, and Piggy envisages trading activity to gradually recover in the medium term given the limited ZWL investment options for retail and institutional investors.

Increased informalisation The punitive tax regime in Zimbabwe is the major cause of the high level of informality in the economy.

Zimbabwe is among the top five informal economies in Africa alongside Benin, Gabon, Central African Republic and Nigeria. Suspending bank lending will also give rise to backyard money lenders and loan-sharks. While the informal sector can sustain households, the main disadvantage for government is that it limits revenue collections given that informal businesses do not pay direct taxes and other social security contributions.

Slow- down in GDP growth| Suspending lending by banks and microfinance institutions will result in unintended consequences, that is, worsening the economic turmoil.

Businesses rely on borrowing for short-term financing and operational needs. Lending is required to

(i) import raw materials,

(ii) pay salaries,

(iii) working capital requirements and

(iv) machinery. This measure will impact on productivity and capacity utilisation.

In addition, formal employment levels will come down, which will in turn affect GDP growth in 2022.

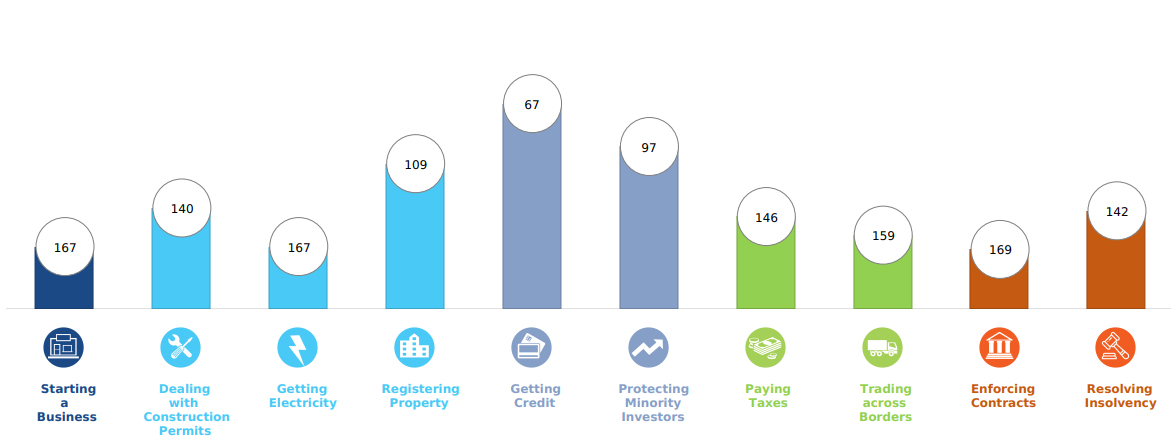

Low business rankings In terms of the ease of doing business, the country already ranks poorly according to World Bank rankings. In 2020, ease of doing business index for Zimbabwe was 54,47 score.

The suspension of lending further dents the ease of doing business rankings since availability of credit is one of the key pillars.

There are still three prices for the local currency as determined on the foreign exchange auction system, the interbank forex market and the parallel foreign exchange market.

Piggy contends that the auction rate remains a major loophole for arbitrage opportunities.

Limited FDI and lines of credit The new measures will likely trigger low levels of investor confidence given policy uncertainties and inconsistencies. The economic and political environment in Zimbabwe has been a major impediment in terms of Foreign Direct Investment (FDI) flows into the country.

In addition, the liquidity issues in Zimbabwe have also limited inflows. This is because investors cannot freely move money in and out of Zimbabwe.

While the repatriation of dividends and proceeds from the sale of assets (including shares) by foreign entities have been on the Reserve Bank of Zimbabwe (RBZ) priority list, foreign participants have not been receiving their dues.

This remains a barrier to the flow of new money into Zimbabwe. In addition, the country has also not been able to secure adequate lines of credit to capacitate local producers.

Conclusion and recommendations Piggy believes that politics will always take centre stage.

Ahead of the 2023 Presidential elections, the stakes are high and most of the damage will be felt in the economy.

This year politics will have a strong impact on the economic direction of the country as we approach an electioneering period.

Yet as events unfold, it is clear each day that the only thing that remains stable is the instability.

The era of predictable unpredictability is not going away. That said Piggy’s take is that the stock market will still serve as an avenue to preserve value this year and beyond.

However, stock picking will be of paramount importance. Exposure to cash-generative businesses that are well-managed is key.

The stock market is showing signs of cooling-off and there is strategic logic to take long-term positions in the traditional blue chips like Delta Corporation, Innscor Africa Limited, Meikles Limited and Econet Wireless.

- Get more tidbits on the stock market by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the head of research at Morgan & Co, and founder of piggybankadvisor.com. — [email protected]/ [email protected] or +263 783 584 745.