SHAME MAKOSHORI COMMERCIAL banking outfit First Capital Bank (FCB) may call off its aggressive lending stance to contain a tricky economic landscape marked by currency turbulence and exchange rate volatilities, Inter-Horizon Securities (IHS) said in a note to investors.

Zimbabwe authorities were last week forced to announce hasty policy shifts to hold back a relentless market assault, and potential slowdown.

The latest reforms included ordering banks to temporarily stop lending.

After pursuing a cautious lending approach, FCB, one of Zimbabwe’s biggest banks, appeared to be charting a new trajectory, firming up its loan-to-deposit ratio (LDR) to 42% during the year ended December 31, 2021.

This figure was 27% during the comparable period in 2020, according to IH data.

FCB has expressed its determination to continue bailing out tourism enterprises blown off balance by Covid-19 pandemic headwinds, possibly leading to the LDR rise.

IHS noted these efforts and attributed them to improved confidence following a robust monetary policy.

“First Capital Bank’s loan-to-deposit ratio greatly improved within the period growing to 42% from 27% in financial year (FY) 2020 reflecting an increased risk appetite commensurate with a somewhat more stable monetary space,” IHS said in an analysis of the statements.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“Loan composition, however, remained skewed towards short-term loans due to the current transitory nature of deposits. The non-funded income segment continued to drive revenue pulling in ZW$4,25 billion (US$24 million) at the end of the period vs ZW$2,07 billion (about US$11,5 million) in FY20.

“We believe that the operating environment to FY22 will remain challenging from a combination of both local and international shocks contributing to a slowdown in aggregate economic activity. The current spike in inflation will potentially go into fuelling sub-inflation return to banks as revisions in nominal interest rates will likely be outpaced by the current resurgence in inflation,” HIS said.

In a quarterly report, last week, FCB acting company secretary Sarudzai Binha acknowledged that the need for caution had become imperative.

And in its guidance to investors, IHS said caution would be crucial to “ensure that a sufficient buffer is maintained on its capital and liquidity position to accommodate stress factors.

“Nominal value in loans will, however, likely to be bolstered by money supply growth but in our view, the loan to deposit ratio will at best trend sideways on flaring turbulence to FY23.

“FCB is expected to remain profitable to FY22 on the basis of its recovering business interest in the tourism sector, and a balanced model in the core banking segment,” the advisory said.

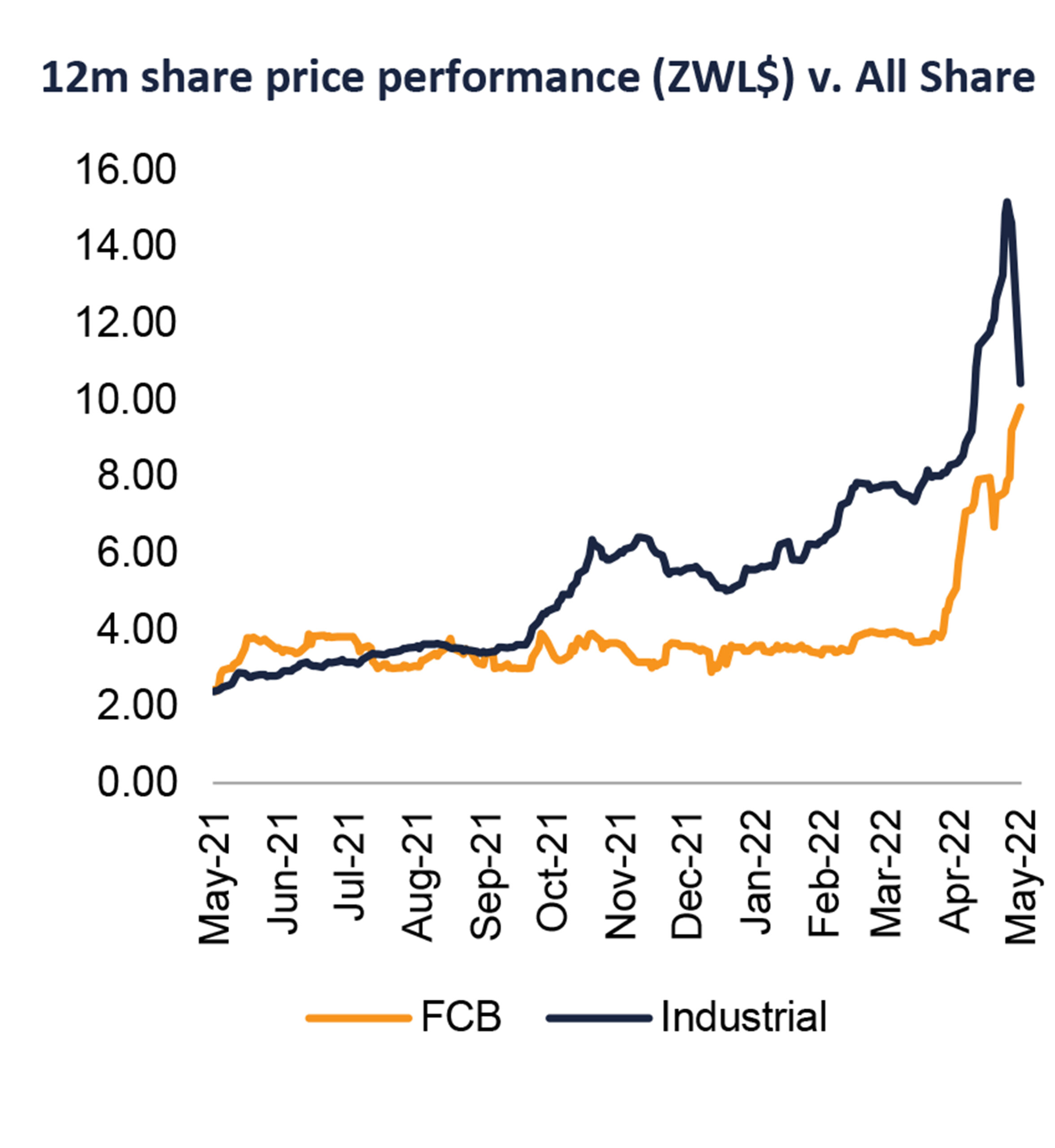

The bank is already on track for a positive 2022.

In her first quarter report last week, Binha said inflation adjusted total income rose by 37% to ZW$2,4 billion (about US$13 million), underpinned by strong performance in both net interest and non-funded income.

This figure was ZW$1,7 billion during the comparable period in 2021.

But she said an “aggressive” central bank mop up operation to stem rampaging inflation has slowed down financial sector expansion.

Along with mop up operations, “high” overnight accommodation rates of 60% were also “slowing down balance sheet expansion”. FCB emerged from the takeover of Barclays Bank’s assets by Malawian investors, who have done well to calm original anxiety around the Barclays’ exit.