TAFARA MTUTU THE Russia-Ukraine conflict, which began in February 2022, has evolved into an economic conflict that has roped in the rest of the world in many ways than previously anticipated.

Nato-member states attempted to end the conflict by imposing economic sanctions on Russia – like an exclusion from the United Kingdom(UK) financial system, a ban on Russia oil and gas imports by the US, removal of Russia from the international financial messaging system Swift and having all assets of Russian banks frozen in the UK, among other measures – which resulted in an immediate but temporary depreciation of the rouble against the United States(US) dollar.

The Russian rouble lost 42% in value between February 1, 2022 and March 14, 2022. However, Russia quickly leveraged on its oil reserves by announcing that it would start selling its oil and gas in roubles, a move that cornered Nato members in Europe like Germany, Hungary, Finland, Poland, Slovakia, and Lithuania and resulted in a rebound of the rouble from 132,34 RUB/USD to 74,08 RUB/USD in a space of five weeks.

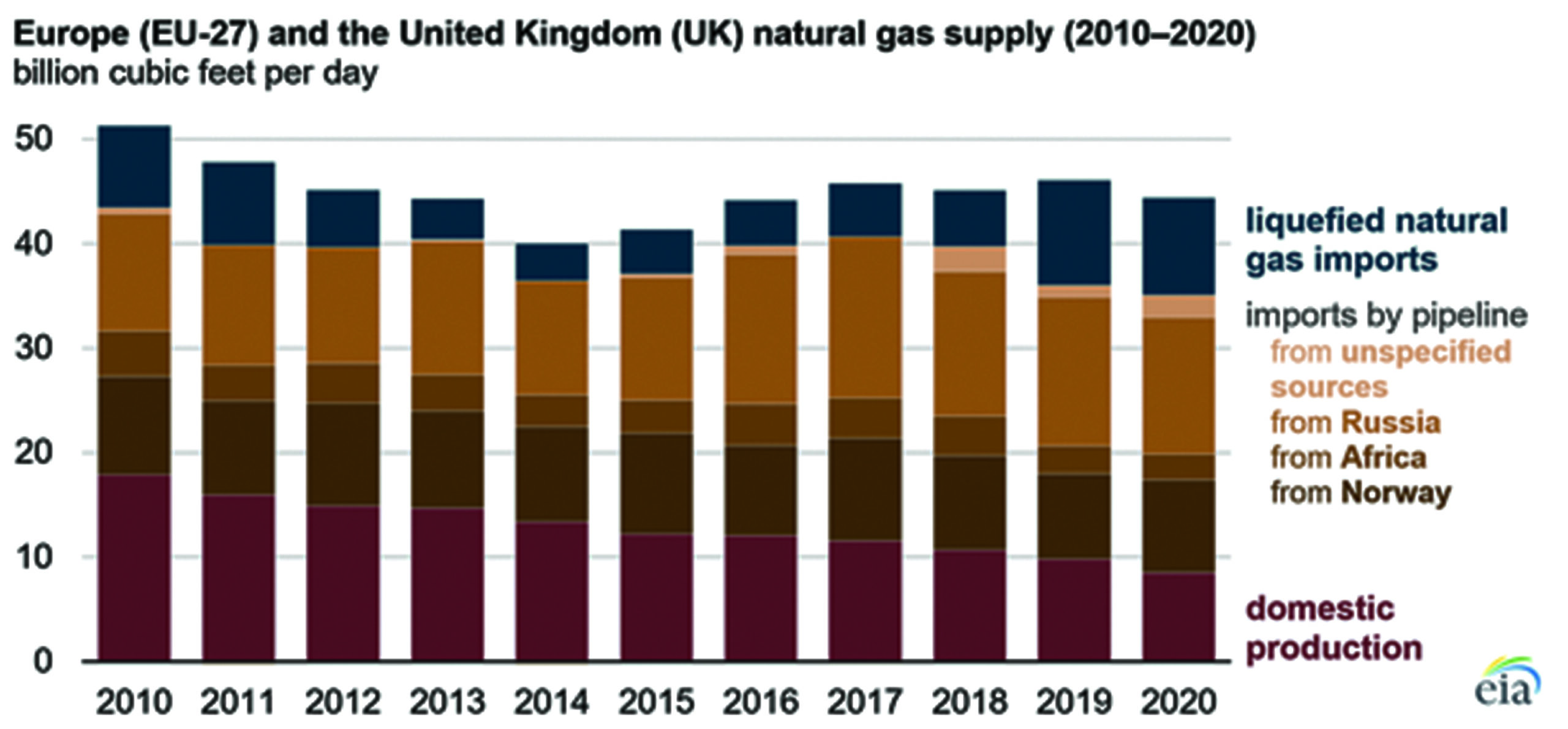

According to the US Energy Information Administration, Russia accounts for 45% of total gas imports in the European Union (EU), and 40% of the bloc’s total gas consumption.

Hungary is the first EU nation ready to accept the new terms dictated by Russia – an ominous sign of more EU nations to yield in the absence of any short-term alternatives.

The move to price oil and gas in roubles comes as a blow to the US dollar, which has long been the only currency of trade in oil and gas. This has earned the greenback the colloquial “petrodollar” term and has cemented it as a stable currency that investors flock to in times of global economic uncertainty.

The new order at Russia’s behest seems to be gaining traction and this could weaken the US dollar’s dominance as the currency of choice by the global community.

In addition to Russia’s oil sales in roubles to “unfriendly” nations, Russia has begun selling oil and coal to China in yuan since the former was slapped with sanctions and this could spell the beginning of the end of the US dollar’s dominance as the petrodollar.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

It is also interesting to note that the US is also in a tight space given that it is a net importer of oil and its relations with other oil producing nations like UAE and Venezuela are on the sour side. The country’s net importer position for oil of about 3,2 billion barrels per day puts the economy at a disadvantage because it presents a net exposure to oil that is not favourable.

Net importers of oil tend to be price-takers with limited room to dictate favourable prices with net oil exporters, among other concerns.

The Guardian reports that relations with the oil producers in the Middle East have soured to their lowest in modern times and this is likely to keep the price of oil above US$120 per barrel in the interim. The US administration has considered relaxing oil sanctions on Venezuela in exchange for oil supply up to 800 000 barrels a day, but this has been met with strong objections by voices from both political parties in the US as well as Venezuela’s opposition leader Juan Guaidó.

From an economic perspective, the sale of oil in other currencies will reduce the demand of the US dollar with an equivalent uptick in demand for currencies such as the rouble and yuan, with a possible depreciation of the US dollar relative to these currencies.

If the possibility of the greenback’s loss of its petrodollar status takes hold, many nations could be forced to rethink their currency basket that makes up their foreign reserves, and this could further push the US dollar further from grace.

This could also extend to a shift in cash movements in flights-to-safety from US dollar-denominated assets in favour of assets denominated in other currencies, but this remains a wildly remote possibility in the near future given the economic strength and influence of the US.

Measures by Moscow with regards to oil and gas sales have also set a precedent for other oil-producing nations who have realised the very real possibility of their currencies achieving “petrodollar” status.

If other oil-producing nations abandon the use of the US dollar in favour of their own currencies, this could end the US’ petrodollar dominance.

On the off chance that the US was dethroned as the petrodollar, the currency could weaken, and this could improve Zimbabwe’s odds as a competitive manufacturer in the sub-Saharan region.

The economy continues to be driven by the US dollar and local manufacturers have lamented the high USD-denominated costs that make Zimbabwe’s products regionally uncompetitive. For example, Zimbabwe has the highest price for fuel in Africa according to statistics from Global Petrol Prices and this underpins the nations’ uncompetitive exports.

A weaker USD could make Zimbabwe’s exports attractive to countries with relatively stronger currencies like the Russia’s rouble, UAE’s dirham and Saudi Arabia’s riyal in this scenario.

- Mtutu is a research analyst at Morgan & Co. — [email protected] or +263 774 795 854