BATANAI MATSIKA EDUARDO Galeano, a Uruguayan journalist, writer, and novelist, once said, we quote, “If the world is upside down the way it is now, wouldn’t we have to turn it over to get it to stand up straight?”

Piggy believes that the quote serves as a wake-up call for business leaders and policy makers on several emerging risks on the local, regional, and global front.

Some new risks, include, antibiotic resistance, nuclear terrorism, and xenophobic attacks, just to mention a few.

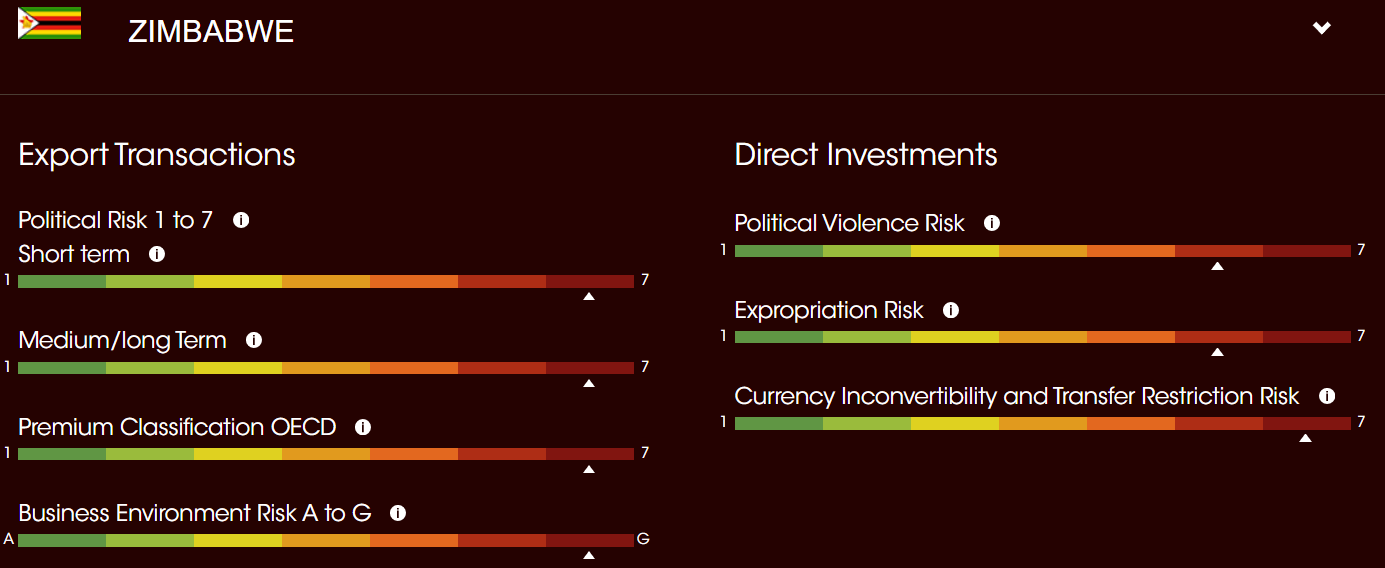

It appears the coming years will be particularly unpredictable given the interactions between the Covid-19 pandemic, uneven economic recovery, and fractious geopolitics. Looking at the Zimbabwean case, high double-digit inflation, a wide parallel foreign exchange market premium, rising poverty levels and the negative effects from the Covid-19 pandemic have led to scarring on the economic outlook.

A key question facing business leaders is whether their industry will rebound from the economic shocks or sustain lasting damage. Those that have shown themselves to be less resilient may find it difficult to regain their pre-Covid-19 standing.

For example, the tourism, travel, and hospitality sectors may see their businesses subject to long-term changes in business and individual travel preferences.

Given the intensity of these pressures, it is reasonable to question whether existing market positions will be retained without significant effort to reposition and respond to changes confronting industries.

Given the volatile operating environment in Zimbabwe, there is a strategic logic for firms to venture into international business. This ensures access to more stable markets that are not exposed to the same local risks.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Firms can use several methods to conduct international business such as:

- International trade (exporting),

- Licensing,

- Franchising,

- Joint ventures,

- Acquisition of existing operations, and

- Establishing new foreign subsidiaries.

In this article, Piggy looks at the various methods that local businesses can pursue to duck Zimbabwe-specific risks.

International trade (exporting)

- This is a relatively conservative approach that can be used by firms to penetrate the markets (by exporting);

- This approach entails minimal risk because the firm does not place any of its capital at risk; and

- If a firm experiences a decline in its exporting, it can normally reduce or discontinue this part of its business at a low cost.

Licensing

- It obligates a firm to provide its technology (copyrights, patents, trademarks, or trade names) in exchange for fees or some other specified benefits;

- It allows firms to use their technology in foreign markets without a major investment in foreign countries and without transportation costs that result from exporting; and

- A major disadvantage of licensing is that it is difficult for the firm providing the technology to ensure quality control in the foreign production process.

Franchising

- It obligates a firm to provide a specialised sales or service strategy, support assistance, and possibly initial investment in the franchise in exchange for periodic fees; and

- It allows firms to penetrate foreign markets without a major investment in foreign countries.

Joint Venture

- This is a venture that is jointly owned and operated by two or more firms;

- Many firms penetrate foreign markets by engaging in joint ventures with firms that reside in those markets; and

- Most joint ventures allow those two firms to apply their respective comparative advantages in a given project.

Acquisitions of Existing Operations

- Firms frequently acquire other firms in foreign countries as a means of penetrating foreign markets; and

- They allow firms to have full control over their foreign businesses and to quickly obtain a large portion of foreign market share.

- Establishing new foreign subsidiaries

- Firms can establish new operations in foreign countries to produce and sell their products;

- This method requires a large investment;

- Establishing new subsidiaries may be preferred to foreign acquisitions because the operations can be tailored exactly to the firm’s needs; and

- In addition, a smaller investment may be required than would be needed to purchase an existing operation.

Overall, the international business expansion method used depends on several factors, such as, the size of the targeted market, availability of resources (capital and expertise), regulatory frameworks and the competitive environment, amongst many others. That said, Piggy has consistently insisted investors on our market to take positions in export-oriented businesses and regional plays given that they have direct access to foreign currency and offer geographical diversification.

Some interesting names include ART Corporation, Ariston, Tanganda Tea, Hippo Valley, Simbisa Brands, Padenga Holdings, Seed Co Limited and SeedCo International.

Get more titbits on the stock market by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the head of research at Morgan & Co, and founder of piggybankadvisor.com. — [email protected]/ [email protected] or +263 783 584 745.