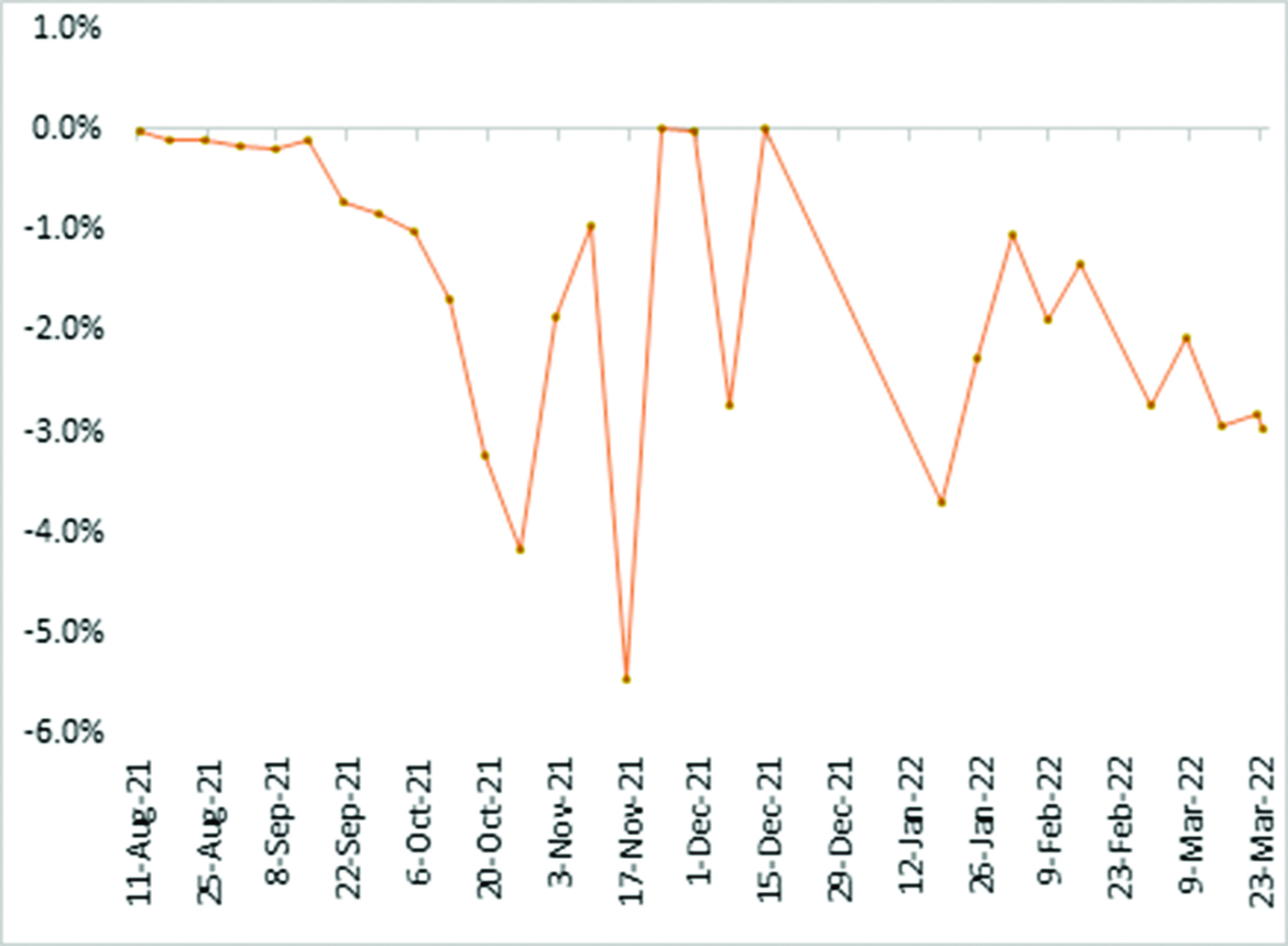

Respect Gwenzi THE rate at which the Zimbabwean dollar (Zimdollar) is depreciating on the auction market so far in the year, remains very steep.

In this week’s auction, the Zimdollar eased by 2,42% to settle at 145,9 against the US dollar. Cumulatively, the currency has lost 30% since the beginning of the year, going past the 2021 full-year loss level of about 29%.

In essence, the Zimdollar has lost as much value in just three and a week (Q1-22), as it did over the whole of 2021. This is a staggering figure highlighting the depth of challenges the Zimbabwe economy is facing. The quarterly loss is the worst since the revamp of the auction market in June 2020.

Relative stability ensued in months following the revamp, resulting in a reduction in inflation rate.

At its peak in July 2020, inflation reached 820%, achieving the record of hyperinflation.

At 30% year-to-date loss, the Zimdollar is the second worst performing currency in the world after the Sri Lankan rupee. Sri Lanka is facing one of its worst economic crises in its history.

The Russian rouble, which earlier plunged by 30% in the aftermath of Ukraine invasion, has seemingly recovered, with the evident hand of the state. The Venezuelan bolivar, which for long has been a perennial worst performer, is showing signs of recovery this year. Zimbabwe is thus in the league of the most embattled countries globally, most of which are war torn.

The top bid level moved up to 156 from 155 last week, its slowest move in five weeks. The top bid has moved up in each respective session since the beginning of the year, except in only one. Cumulatively the top bid has moved up by 30 points year to date.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The lower and lower accepted bid has moved in synch since the beginning of the year and this week moved up by one point to 135. The spread between the top and lower bid came in at 21 points, which was unchanged from last week. The interplay between the lower and upper bid has failed to give us an indication on the path the currency is likely to take.

However, the unison movement upwards reflects that the outlook is likely to remain pessimistic. The current depreciation of the Zimdollar is largely as a result of higher local currency liquidity relative to foreign currency. The currency liquidity is best measured through money supply.

The overall money supply levels in the economy grew by over 100% in 2021, a relatively smaller fraction of the growth was attributed to currency depreciation against the US dollar, given that about 40% of the total value of money supply is in foreign currency, although valued or measured using the official exchange rate for purposes of presentation.

Broad money supply (M3) grew by 113% in 2021, and this money supply growth largely emanated from government borrowing through Treasury Bills.

Data by the Reserve Bank of Zimbabwe (RBZ) shows that the volume of Treasury Bills (TBs) issued grew by 324% from ZW$18,6 billion as at January 2021, to ZW$78,9 billion as at January 2022.

These TBs were initially utilised as a monetary policy tool to control liquidity. Early into the current government’s term, Treasury did not seek fiscus support through borrowing from banks as it declared “surpluses”.

The fiscal resolve emanates from yester year experiences. At peak, Zimbabwe’s Treasury had an outstanding stock of US$8,2 billion, which meant Zimbabwe literally doubled its debt within four years between 2015 and 2018.

The consequence of the issuance of these TBS within that period was that it stoked money supply growth in the economy. In fact it is the bedrock of the Zimdollar in its reincarnation form.

As more TBs were issued, money in the financial system in Zimbabwe turned colour from the US dollar to Zimdollar. Government catalysed the process by rolling over TBs, in turn speeding up the rate at which money supply grew.

This act of roll-overs created a secondary market, where discounts were so deep to levels of about 50% and again this was very catastrophic in that it increased the rate at which money supply was growing, by an even wider rate.

This background is important as we head towards the most fluid period over a five year government term. Ahead of elections, government has shown high levels of unbridled expenditure outside of budget funds. To finance the deficits, government has resorted to issuing money (Gideon Gono) and issuing TBs (John Mangudya). This phenomenon is likely to play out at a much faster pace as it currently is getting closer to election period.

This creates huge monetary instability as the currency depreciates further and inflation returns into hyper levels.

Money supply is, however, not only one legged. It comes with the pivoting forex levels, which if growing proportionately, have the ability to stem or even stop depreciation as local unit is supported.

In 2021, the country generated close to US$10 billion in forex receipts, its highest ever and a growth of over 30% on the prior year. The growth in forex was reflective of higher commodity prices on global markets and stronger remittances in the face Covid-19, which mainstreamed money sending and payments services.

Remittances reached about US$1,5 billion, which again was a milestone as it breached the US$1 billion mark concurrently. The fact that after earning all this forex, the currency went on to fall by 30% for the year, shows that there was a rather disproportionate growth between local money (ZW$) supply and forex generated from exports. The gap would have been wider had economic growth been slower. In 2021, the economy emerged from a two-year recession, thus cushioning the spiralling of prices.

In 2022, the economy is expected to grow, but our estimate shows a much lower outturn at about 2,5%, which will not do anything to cushion the currency depreciation.

The country should brace for wider swings in the currency. The central bank, which has a grip on the auction market, will likely allow for even sharper losses, in a bid to close the gap between the auction and the parallel.

What is interesting is that both rates have been moving upwards (down) and this creates huge challenges for the RBZ. If the gap remains unabated, there are real risk for production loss and rampant rent seeking.

- Gwenzi is a financial analyst and MD of Equity Axis, a financial media firm offering business intelligence, economic and equity research. — [email protected]