TATIRA ZWINOIRA ENERGY and Power Development minister Soda Zhemu has called for multi-stakeholder consultations before fuel tax reviews are made.

In an interview with businessdigest, Zhemu said parliamentary oversight was also key during the fuel tax and levy formulation process, which falls under the purview of the ministry of Finance and Economic Development.

These checks and balances have become imperative in light of global developments that have triggered fuel price hikes in the past month.

But implications have been heavy for the Zimbabwean market, which is already ranked among the most expensive, leading to calls to review taxes and levies.

“Levies and taxes are under the purview of the ministry of Finance,” Zhemu told businessdigest on the side-lines of the International Renewable Energy Conference and Expo hosted by Alpha Media Holdings (AMH)’s The Standard newspaper in Victoria Falls last week.

“There are various stakeholders that should be consulted before there are some reviews of the provisions of the charging Act, which is the Finance Act, which also involves Parliament. But, this falls under the purview of the ministry of Finance, after consulting various stakeholders,” Zhemu said.

“They are the ones who administer the charging Act, which is the Finance Act and that Act comes into being through Parliament. The revenue that is collected by Zimra (Zimbabwe Revenue Authority), which falls under the ministry of Finance, would have been passed by Parliament.

“The Ministry of Finance also gets feedback from the public and also feedback from our ministry but there is a lot that needs to be considered before any review can be made which also involves parliament,” he added.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Zhemu said revenue generation approved by parliament for a given fiscal year, include taxes and levies, which are important for funding government operations.

He said such revenues were important for funding key operations like the ministry of Health.

Zhemu said the Ministry of Transport, for instance benefits from revenues from the carbon tax, which means a lot of considerations are required before undertaking any reviews.

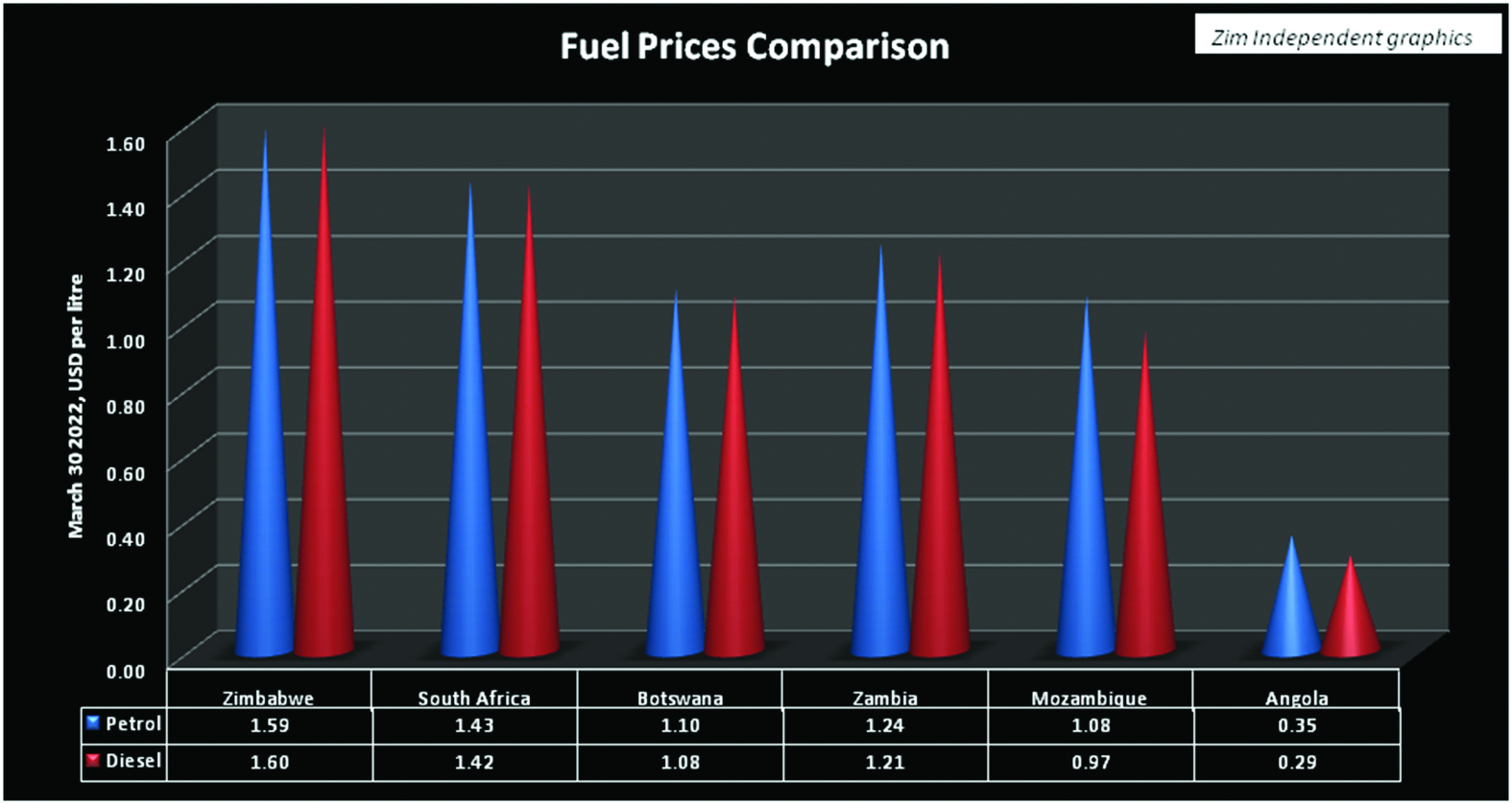

On the last fuel price review announced about two weeks ago, prices were pegged at US$1,59 and US$1,60 per litre of petrol and diesel, respectively.

Experts say fuel taxes and levies cost more than the cost of procuring the precious liquid. The average regional fuel prices range is around US$1,14 per litre of petrol and US$1,08 per litre of diesel.

These prices fall far below the prices obtaining in Zimbabwe, and consumers have been concerned about the disparities, as indicated in the graph.

While global prices remain volatile owing to supply bottlenecks, recently caused by the war between Russia and Ukraine, Zimbabwe’s final pump price is determined by government taxes and levies.

These include free on-board charges, freight, duty, the Zimbabwe National Roads Administration (Zinara) road levy, the carbon tax, the debt redemption and the strategic reserve levies.

Other charges include handling fees, clearing agency fees, financing cost, inland bridging costs and secondary transport costs.

Experts estimate that these make up more than 50% of the fuel pump price in Zimbabwe.

This has recently courted attention from authorities.

President Emmerson Mnangagwa recently ordered government ministries and departments to review these costs to help the country stabilise prices.

Apart from fuel, production costs in Zimbabwe rank among the highest in the region.

Zimbabwe Energy Regulatory Authority (Zera) chief executive officer Eddington Mazambani said while his organisation was a regulator; it did not determine fuel levies and taxes.

“The taxes and levies are unfortunately the purview of the Ministry of Finance and Economic Development,” Mazambani said.

“But, I could maybe just comment to say the taxing regime in any given country is informed by various factors, such as tax compliance and the revenue cake.

“So, truly speaking, I would rather let the Ministry of Finance comment because they are the ones who have the oversight of the revenues of the country,” he said.

As government battles to implement reforms to turn around the economy, revenue lines for Treasury have been limited to mostly taxes.

Zhemu said the government had already come up with a mechanism to make sure consumers donot feel the pinch of high fuel prices.

“Ordinarily, prices are supposed to be reviewed once in a month. But because of the volatile situation, the government has now directed that prices must now be reviewed on a weekly basis,” he said.