Batanai Matsika Piggy notes that the year 2021 was characterised by disinflation and easing of lockdown restrictions.

Total gross premiums within the insurance sector in Zimbabwe improved significantly due to aggressive premium reviews.

Claims ratios in the health insurance segment also declined following a drop in severe Covid-19 cases.

Despite financial headwinds on the healthcare front, Zimbabwe has been aggressive in terms of controlling the virus and providing access to vaccines.

As of 16 January 2022, there were a total of 226,078 Covid-19 cases, 13,729 active cases and 5,247 deaths (implying a fatality rate of 2.32%).

That said, an agricultural and mining sector rebound in 2022 should bolster disposable incomes which should increase demand for policies.

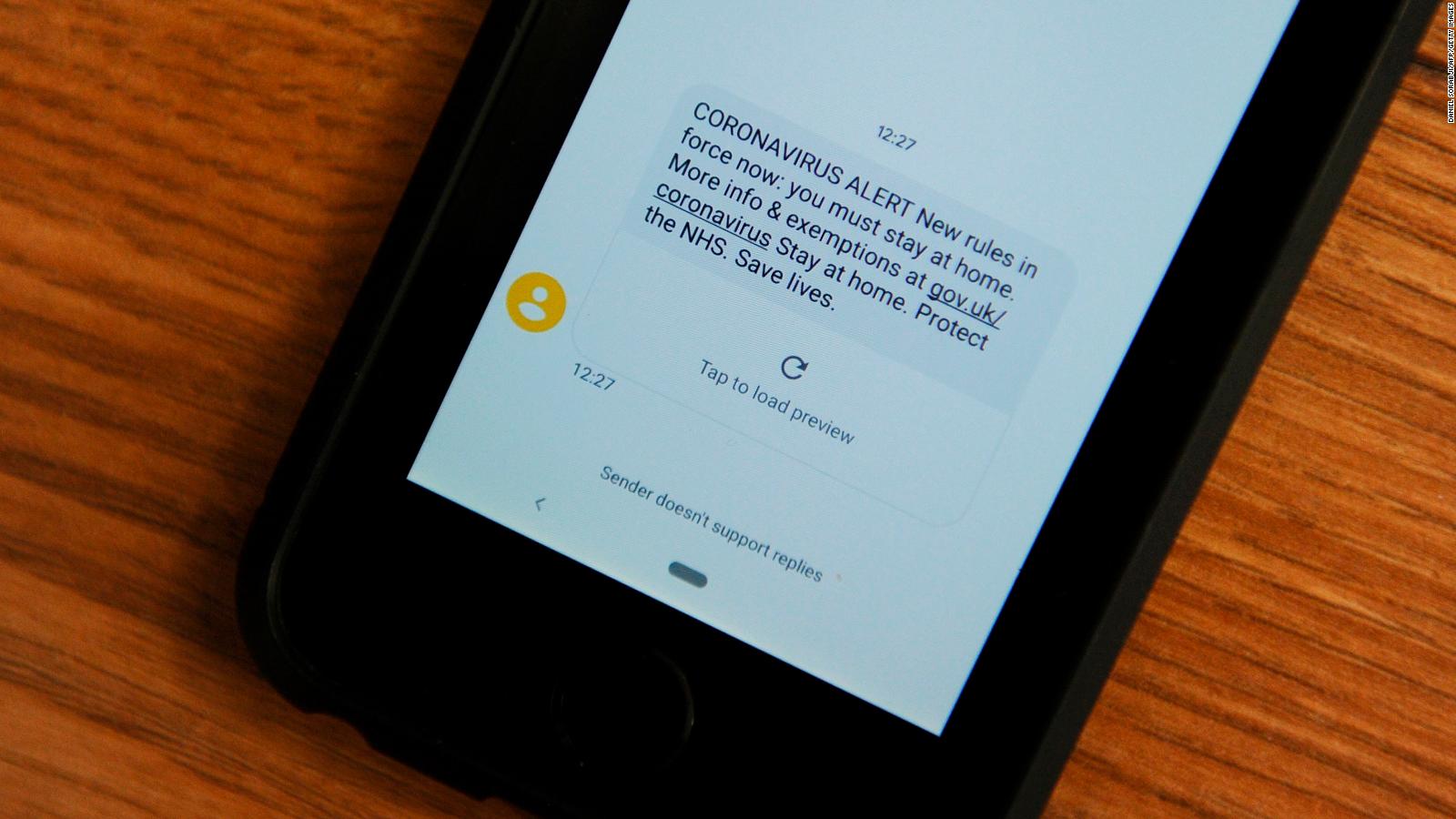

An important highlight is that the Covid-19 pandemic presented an opportunity for market players to enhance efficiencies through digitalisation.

In our view, digitalisation will in the long run reduce insurers’ costs and improve their efficiency.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

In this article, Piggy assesses what insurers are doing right and wrong in the new environment.

Right things

Digital Acceleration: The one factor that contributed to the resilience of the non-life business was digitalisation. The rapid and smooth transition to digital processes in both sales and operations largely avoided standstill in new business, which threatened to result from the many contact and mobility restrictions implemented to contain the pandemic. The pandemic accelerated the digitalisation of both supervisory processes and the insurance business value chain. For the industry, Covid-19 presented an opportunity to leapfrog digitalisation. However, as with the law of unintended consequences the automation process resulted in increased operational efficiency and excess staff. Redundancy risk leading to calls for voluntary retrenchments in the industry has heightened with corporate restructuring and streamlining of operations.

Innovation and market-relevant products: Also related to the digitisation theme is that insurance companies are improving the relevance of products in the market. Considering market conditions in Zimbabwe where most of the population is uninsured because of the unaffordability of traditional insurance products, micro-insurance is a relevant offering on the Zimbabwean market. Micro-insurance makes it possible for the population operating in the informal sector to afford insurance. Cover link is the market leader in the micro-insurance space controlling 70%. On another note, Econet Life has managed to leverage off the technology and ecosystems developed by group companies. Micro-insurance appears to be the next growth frontier and Econet Life serves primarily as an aggregator and distribution channel that is also responsible for the marketing and promotion of insurance offerings. Econet customers, for example can access funeral cover and to auto-insurance on their mobile phones.

Regional Diversification: Regional diversification initiatives by certain players in the insurance industry such as Zimre Holdings Limited, Fidelity Life Assurance and First Mutual Holdings Limited have been key in terms of tapping into new markets and reducing country-specific risk. The effect is that these companies will insulate themselves from currency risk associated with the Zimbabwean dollar by generating hard currency outside the country.

Introduction of US dollar policies: A major constraint for investors and policy holders is currency risk. ZWL policies are unattractive because value is lost over time owing to inflation. The consensus estimate for the year-end parallel market rate is ZWL500 against the US dollar, implying an inflation rate of 127%. Insurers in Zimbabwe have introduced USD policies as a strategy to mitigate the negative perceptions associated with local-currency denominated policies.

Wrong practices Digitalisation rates have been slow: COVID-19 gave the insurance sector a stark reminder of the need to become technologically advanced in times of crisis. Underwriting business is predominantly carried out on a physical basis and this did not bode well for industry players in 2020. A pure example of the adage ‘adapt or die’, insurers reliant solely on face-to-face interactions suffered most during the pandemic. The need for digitalisation is apparent now more than ever and insurers need to transition from traditional way of conducting business. Though in its fledgling stages, the digital shift has begun with companies such as Fidelity and First Mutual Holdings implementing ease of online consumer access to various products. Cassava Smartech Zimbabwe’s health insurance unit began rolling out USSD-based service registration to the public via cell phone in 2021. That said, many insurers across the region still have traditional business models and rely heavily on brokers and agents for distribution. Claims processing and policy management also largely remain reliant on in-person engagement in most companies.

Failure to tap into the informal sector: According to the International Monetary Fund (IMF), Zimbabwe has the second largest informal economy as a percentage of its total economy in the world, after Bolivia. Out of the 158 economies that were studied by the IMF, Zimbabwe has a score of 60,6%, second to Bolivia, which topped at 62,3%. The shadow economy (known by different names such as the hidden or informal economy), includes all economic activities, which are hidden from official authorities for monetary, regulatory, and institutional reasons. While the informal sector can also drive consumption of local products, the main disadvantage for government is that it limits revenue collections given that informal businesses do not pay direct taxes and other social security contributions. Further, a large chunk of those operating in the informal sector are uninterested in traditional insurance products in the personal, property and guarantee segments. There is need to tailor-make insurance products that are relevant and targeted at informal sector operators.

Poor Risk Management Operational risk is the probability of loss emanating from ineffective or failed internal processes, people, systems, or external events that can disrupt the flow of business operations.

The losses can be directly or indirectly financial. According to Insurance and Pensions Commission (Ipec), insurance fraud occurs when an insured or someone in relation to an insurance process, knowingly makes a falsified claim or misrepresents facts in relation to an insurance claim or process.

The most common types of fraud in the Zimbabwean context relate to premium fraud, exaggerated claims amounts and insurance broker fraud.

It is estimated that approximately 30 to 40% of total claims in the country are fraudulent and the insurance industry loses over US$165 million per annum through fraud.

There is a need for insurance players in Zimbabwe to invest in setting up robust risk management frameworks to mitigate operational risks. This will involve creating fraud detection units and the installation of machine learning technologies that are key in reducing human errors and fraud.

In conclusion, there is an opportunity for insurers in Zimbabwe to rapidly move towards digital premium collection channels and claim payments.

In addition, there is need to adopt remote on-boarding. These developments alongside improved household disposable incomes are expected to drive a gradual increase in insurance penetration levels in the country.

There is need to focus on product relevance, currency navigation, technological advancement, and fraud management. Further, significant benefits can also be gained from use of big data and artificial intelligence (AI).

- Regulatory sandboxes and innovation hubs are key in terms of facilitating such developments. Overall, Piggy likes FINSEC-listed Old Mutual Zimbabwe Limited (OMZIL), which is on a Historic PER of 1.4x and PBV of 0.9x and thinks investors should take positions. Get more insights and tidbits on the stock market by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the head of research at Morgan & Co, and founder of piggybankadvisor.com. — [email protected]/ [email protected] or +263 783 584 745.