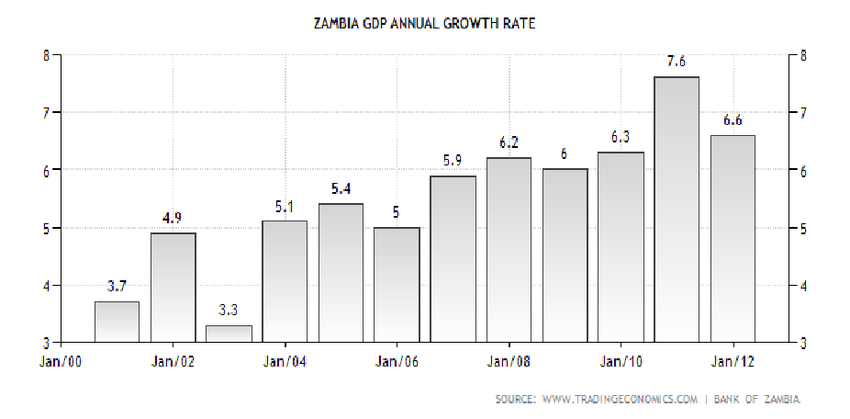

Matanai Matsika ABOUT a decade ago, Zambia was surfing a powerful wave of optimism as the copper-driven economy registered an all-time Gross Domestic Product growth rate of 10,3% in 2010. The political landscape was also stable and in 2012, Zambia joined a small club of African countries that were borrowing on international bond markets.

There was strong appetite for its debt given the solid economic numbers that were being shown by Zambia. However, economic growth then fell below 5% from 2015 onwards and in 2019 it tumbled to 1,4% and then -3,0% in 2020.

While Covid-19 played a big part, former president Edgar Lungu’s pursuit of expansionary fiscal policy for public investments resulted in widening fiscal deficits (8,3% of GDP in 2019 and 11% of GDP in 2020).

His authoritarian approach and dysfunctional politics in Zambia was also the major culprit as the expansionary fiscal policy, mainly financed by external and local borrowing also caused Zambia’s public and publicly guaranteed debt to hit 91,6% of GDP in 2019 and 104% in 2020. In November 2020, Zambia became the first African country to default in the Covid-19 era as it opted to bow out of a US$42,5 million eurobond repayment.

Enter HH Opposition United Party for National Development leader Hakainde Hichilema was declared winner of the 2021 presidential race in Zambia after roundly defeating Edgar Lungu.

Hichilema’s mammoth task on taking office was tackling an economy wracked by high debt, inflation and unemployment. Further, to attain debt sustainability, Zambia will have to stop accumulating new external debt, increase domestic revenues and curb runaway public spending. This could mean raising taxes, restrain spending and prioritising creditor repayments. That said, the recovery in international demand and copper prices has been a positive development.

Overall, Zambian presidential elections were labelled as “free and fair”. Regional blocs such as Sadc have praised the citizenry for overseeing a peaceful transition of power.

It should be highlighted that despite occasional episodes of political violence, Zambia has earned a reputation for political stability. Every transition of power has been peaceful since the former British colony adopted its multi-party system in 1990.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Democracy, human rights, free elections, inclusiveness, equality, freedom of assembly and expression and rule of law are some of the ideals that have been endorsed and are being promoted in modern day societies. However, the important question is whether democracy creates a better opportunity for economic development?

Scholars such as Milton Friedman have argued that a higher degree of rights fosters economic development.

A wealth of other studies suggests that democracy promotes economic liberalisation and that democracy is preferable for long-term and sustainable growth. However, there is no consensus on the correlations between democracy and economic growth. An interesting case study is China. From the Asian financial crisis in 1997 to the Covid era in 2019, China’s economic growth rate has never fallen below 5% and has even reached as high as 14%.

In stark contrast, however, China records a decreasing trend in its democracy index. That said, Piggy contends that not upholding democratic principles may create constraints for developing nations like Zambia and Zimbabwe and this may negatively impact on economic development.

Political risk also works against the country’s efforts to attract the much-needed foreign investment flows.

Piggy maintains that Zimbabwe needs to do all the things necessary to attract foreign and regional partners to not just grow but survive in the new global economy.

International investors today possess a plethora of investment options in the form of asset classes and projects they can invest in. Zambia, Malawi and even South Africa are competing for investment allocations from the same global investment market.

In other words, Zimbabwe’s political or economic demise can be – in a way – an advantage for other African states. Curbing corruption, improving the ease of doing business and upholding democratic ideals goes a long way in attracting capital flows into Zimbabwe. Government policies in Zimbabwe should also be modelled around boosting productivity by focusing more on factors that lead to economic growth. These include accumulation of capital stock, labour inputs and technological advancements. That said, financial services remain key catalysts in this productivity matrix. Investors on our market can play this theme through exposure in Old Mutual Zimbabwe Limited, First Capital Bank Limited and NMBZ Holdings. Get more tidbits on the stock market by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the head of research at Morgan & Co, and founder of piggybankadvisor.com. — [email protected]/ [email protected] or +263 783 584 745.