Mushshak is an Urdu (official Pakistan national language) word which translates to proficient.

Premium

Zim mulls categorising black market as money laundering

Several suspected illegal foreign currency traders were arrested in Harare’s central business district this week.

By Tafadzwa Mhlanga

9h ago

Premium

Zim secures multi-million dollar jet deal

Mushshak is an Urdu (official Pakistan national language) word which translates to proficient.

By Tinashe Kairiza

9h ago

Rest, good sleep contribute to better health, happiness

By Admin

Feb. 17, 2023

Everyone eligible is encouraged to donate blood, help save lives

By The Independent

Jun. 10, 2022

ICT minister lauds Econet’s stand at the ZITF

By Donald Nyandoro

Apr. 25, 2024

Hope for lifting ban on OM, PPC chips

By The Independent

Aug. 26, 2022

Without planes, AirZim board won’t perform wonders

By The Independent

Aug. 5, 2022

Power crisis needs urgent attention

By The Independent

Jul. 29, 2022

Don’t print cash for projects

By The Independent

Jul. 22, 2022

Exploring the vibrant world of sports betting in Ethiopia

While the allure of sports betting is undeniable, it's crucial to approach it with caution and responsibility.

By Theindependent

Mar. 11, 2024

Satewave churns out power solutions for Zim

Satewave Technologies director Xiao Feng said the company has several solar solutions to address the current power challenges.

By Staff Writer

Aug. 15, 2023

Liquid Tech to increase tariffs by 50%

By Staff Writer

Mar. 31, 2023

Jotter: Students develop an integrated learning app

By Staff Writer

Mar. 17, 2023

Innovative crowd-investing app ‘PiggyBankAdvisor’ launched

By Staff Writer

Mar. 17, 2023

Meta gives up on NFTs for Facebook and Instagram

By The Verge

Mar. 15, 2023

Reasons To Buy Bitcoin From A Trading Platform

Another fundamental reason behind getting the coins from this particular space is that it provides

By Theindependent

Mar. 2, 2023

Why do banks not want people to rely upon cryptocurrencies?

Cryptocurrency transaction volume is much less than the fiat currencies, leading to a lack of liquidity in the market.

By Theindependent

Feb. 9, 2023

Premium

Zim football is 200 years behind: Chunga

Chunga was speaking during the Chunga Academy week-long holiday coaching programme at Zimbabwe Grounds in Highfield, Harare.

By Sports Reporter

11h ago

International day of jazz: Local concert on the cards

By Khumbulani Muleya

Apr. 19, 2024

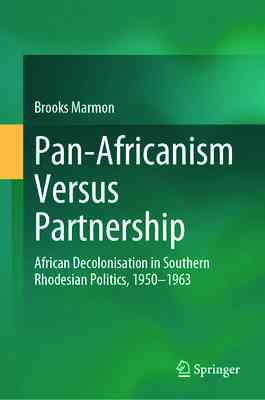

Book Review: African decolonisation in Southern Rhodesian Politics, 1950–1963

The book begins by examining how white Rhodesians sought to push-back, delay or prevent African nationalism

By Anotida Chikumbu

Apr. 12, 2024

Moozy captivates audience at homecoming showcase

By Khumbulani Muleya

Apr. 12, 2024

Women take over the stage at Sofar

By Staff Writer

Mar. 28, 2024

Herbicides: Bad news for local food security

By The Independent

May. 27, 2022

Dumpsite: Gweru feels the heat

By The Independent

May. 13, 2022

Zim to pay 100% of international hunting revenue to communities

By The Independent

Jun. 10, 2022

.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

Job Sikhala, Zimbabwean Opposition Politician In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

ExtremeWeather: Parts of Harare experienced flash floods on Sunday

By The NewsDay

Dec. 21, 2023

Harare motorists negotiate the city’s treacherous roads

By The NewsDay

Dec. 21, 2023

Solomon Guramatunhu Day 1

By The NewsDay

Dec. 14, 2023

Sengezo Tshabangu - In Conversation With Trevor

By The NewsDay

Dec. 5, 2023

Welcome to Alpha Media Holdings Zimbabwe - NewsDay - The Standard - The Zim Independent

By The NewsDay

Dec. 5, 2023

Dock sheep tail to maintain weight

The most common way of docking tails is by using an elastic and expandable latex ring. The rubber ring is expanded with an elastrator and put over the tail, where it is released.

By Kudakwashe Gwabanayi

Mar. 22, 2024

Asparagus worth your while (II)

By Kudakwashe Gwabanayi

Mar. 1, 2024

Why it makes sense to farm meat goats

By Shane Brody

Jul. 7, 2023

How to start a fish farming business

By Kudakwashe Gwabanayi

May. 26, 2023

Climate change is real, be alert

By Kudakwashe Gwabanayi

May. 12, 2023

Winky D promises to shutdown Bulawayo

The Vigilance Band and I are prepped to bring the fire. It'll be a night to remember, so don't miss out!"

By Sindiso Dube

5h ago

Prophet lauds Tanzania, Zimbabwe relationship

Madzibaba Jonah usually goes around the continent and Asian countries where he joins other apostolic members in prayer.

By Style Reporter

Apr. 25, 2024

Wash boost for indigenous churches

By Style Reporter

Apr. 24, 2024

Mahachi pays tribute to late SA gospel icon

By Style Reporter

Apr. 23, 2024

Richest Forex Traders in Tanzania

By The Standard

Apr. 22, 2024

Govt gifts Byo with textile manufacturing firm

“The project also aims at contributing to the reduction of gender-based violence, youth unemployment and gender inequality, and addressing shortage of skills, among women and youths.”

By Daniel Moyo

16h ago

Gwanda water crisis deepens

“Efforts to sink deeper the pipe that draws water are being made, but this is not a final solution, it's just a short term measure as we wait for Zinwa to bring water from Blanket Dam.”

By Silas Nkala

16h ago

We’ll be Zim’s industrial hub again: Coltart

By Silas Nkala

Apr. 25, 2024

Binga South MP, minister clash over boreholes

By Patricia Sibanda

Apr. 25, 2024

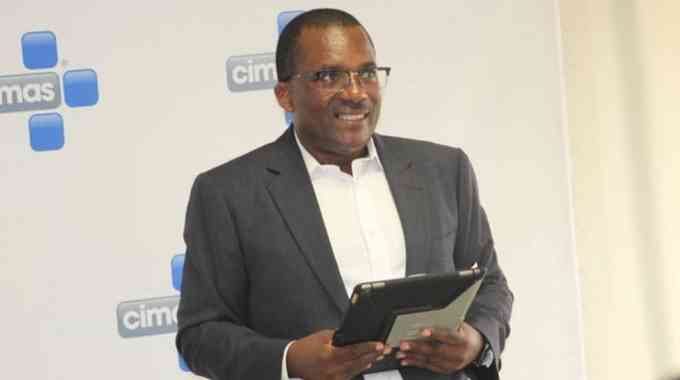

NDS1 failing to link govt, private sector: Cimas Boss

For the second year running Cimas Health Group is the platinum sponsor for the ZITF International Business Conference.

By Staff Reporter

3h ago