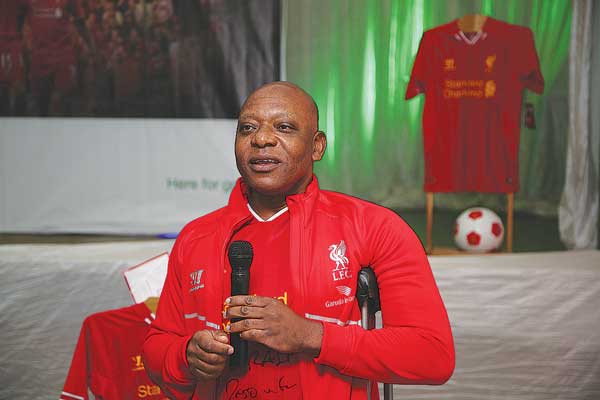

BY SHAME MAKOSHORI Standard Chartered Bank Zimbabwe chief financial officer (CFO) and executive director Christopher Mwerenga will leave the bank at the end of May, a month after the departure of chief executive, Ralph Watungwa.

StanChart is navigating through a transformation process mainly trigged by last month’s announcement that the lender would be sold by its parent, United Kingdom-headquartered Standard Chartered Bank Plc, which is moving out of a string of emerging markets.

In a statement accompanying financial statements for the year ended December 31, 2022, StanChart chairman Samuel Mushiri, said the outgoing CFO had been replaced by Geri Mangori.

“Mr Christopher Mwerenga leaves the bank on 31 May 2022 after serving the institution for 14 years as CFO and executive director,” Mushiri said.

“The bank has appointed Mr Geri Mangori as the new CFO and executive director from March 1 2022,” the StanChart boss said as he moved to calm jitters of the impending shareholder change.

“The exit is not expected to have an adverse impact on the bank’s operations as the intention is to dispose of the local unit as a going concern to a new investor,” Mushiri said.

StanChart demonstrated it still had confidence on the domestic market by announcing it had achieved the regulator prescribed US$30 million during the review period.

The bank’s inflation adjusted profit after tax rose to $1,6 billion during the review period, compared to $0,4 billion during the comparable period in 2020.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Total revenue increased to $5,2 billion, compared to $3,1 billion during the comparable period in 2020.

In March, Mubaiwa Mubayiwa succeeded Watungwa, was suspended early this year.

In March, Standard Chartered Bank Plc said it divesting from seven countries in Africa and the Middle East to focus on profitable markets.

The bank will fully exit Angola, Cameroon, Gambia, Jordan, Lebanon, Sierra Leone and Zimbabwe, likely by selling its businesses in those markets.

It said it would also close its retail banking operations in Tanzania and Ivory Coast to focus solely on corporate banking.

The move marks a major shift for Standard Chartered, which has been among the biggest European lenders to invest on the continent in recent years at a time when peers have been withdrawing.

The cuts would allow it to focus on bigger and faster growing economies in the region, such as Saudi Arabia where it has opened its first branch and Egypt.

- Follow us on Twitter @NewsDayZimbabwe