IN this article, Piggy looks at the role of international financial institutions (IFIs) and how they contribute to economic development in countries such as Zimbabwe.

Broadly speaking, an international financial institution (IFI) is one that has been established (or chartered) by more than one country, and hence is subject to international law. Its owners or shareholders are generally national governments. The most prominent IFIs are creations of multiple nations, although some bilateral financial institutions (created by two countries) exist and are technically IFIs.

Some examples include the World Bank, European Investment Bank (EIB) and the African Development Bank (AfDB).

These operate internationally, providing loans to governments for extensive projects, and streamlining balance of payments to achieve growth and development.

IFIs play a critical role in the growth and development of emerging economies as they facilitate the movement of capital from surplus units and are at the centre of international banking.

Economic reforms in many countries have encouraged inflows of capital by dismantling restrictions and controls on capital outflows, deregulating domestic financial markets, liberalising restrictions on foreign direct investment, and improving their economic environment and prospects through the introduction of market-oriented reforms.

Piggy identified key roles of IFIs below:

Consumption smoothing

- Banks profitability shifting towards dollarisation-IH

- Piggy’s Trading & Investing Tips: IFIs contribute to economic growth

- Swimming in debt: The bane of resource-backed loans in Zim

Keep Reading

Access to banks in other countries may allow a country to engage in risk sharing and consumption smoothing, by allowing the country to borrow in “bad” times (during a recession or a sharp deterioration in the country’s terms of trade) and lend in “good” times.

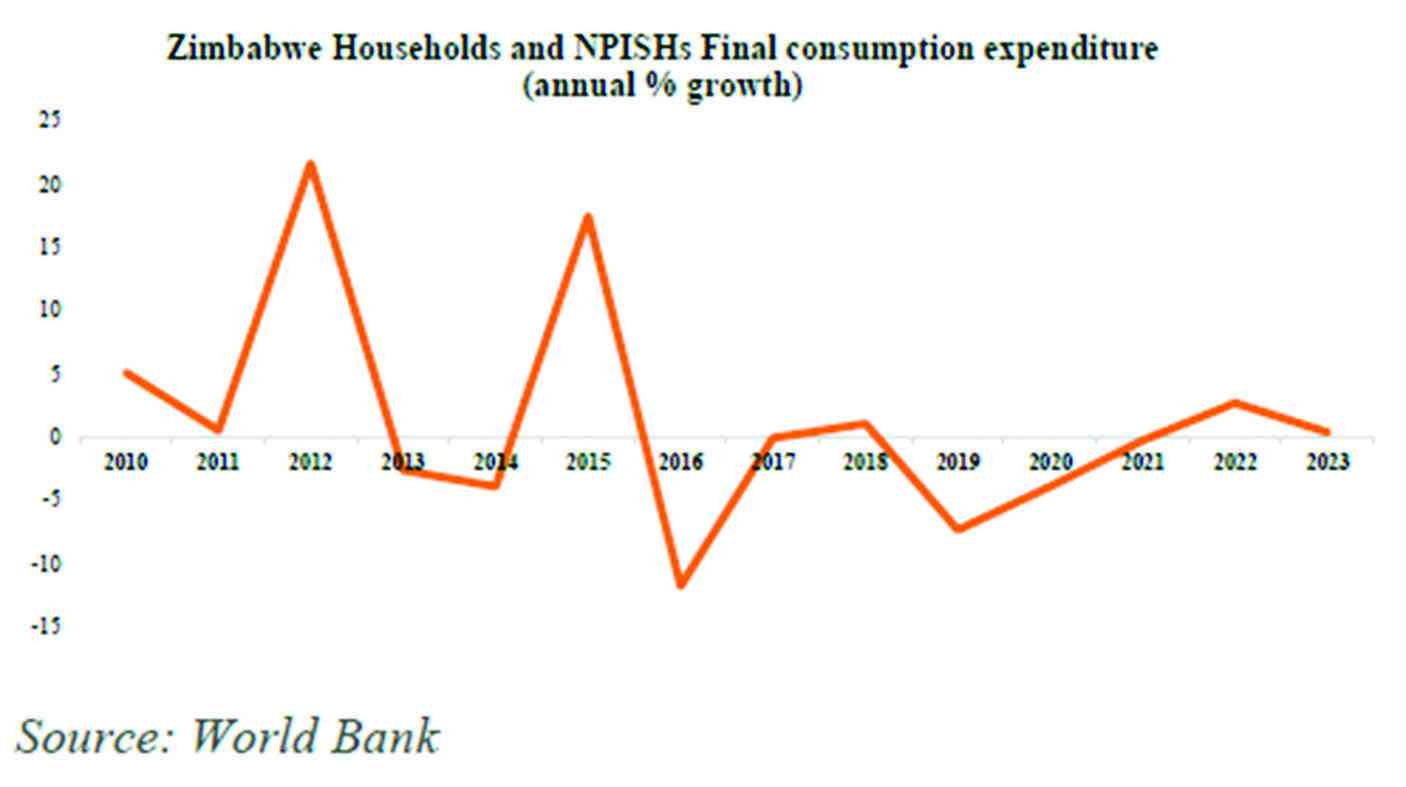

By enabling domestic households to smooth their consumption path over time, capital flows can increase welfare.

Domestic investment and growth

In many developing countries like Zimbabwe, savings are low so international banking grants these countries the opportunity to draw from the international pool of resources, which may also affect domesticinvestment and growth.

Net foreign resource inflows can supplement domestic savings, increase levels of physicalcapital per worker, and help the recipient country raise its rate of economic growth and improve living standards.

Enhanced macro-economic discipline

According to the endogenous growth models, greater policy discipline translates into greatermacroeconomic stability, which may also lead to higher rates of economic growth.

This stems from the fact that capital flows freely across borders to economies that pursue more disciplined macroeconomic policies and thus reduce the frequency of policy mistakes. Thus, an open capital account may encourage macroeconomic and financial stability, ensuring a more efficient allocation of resources and higher rates of economic growth.

Banking system efficiency

Foreign bank penetration may improve the quality and availability of financial services in the domestic market, by increasing the degree of bank competition and enabling the application of more sophisticated banking techniques and technology (such as more advanced risk management systems).

The inflows of international capital may contribute to the stability of the domestic financial system and reduce volatility in capital flows.

In addition, foreign banks may also contribute to an improvement in the overall quality of loanportfolios of domestic banks.

Infrastructure, regional integration

Infrastructure development is one of the biggest focus areas of IFIs such as the African Development Bank (AfDB)as it enables economic growth and production.

TheAfDB has a strategic plan that recognises infrastructure development as the main priority when it comes to lending.

Effective crisis management

IFIs have been able to effectively manage several global crises that are a could harm the economies of developing countries.

A good example are the IMF SDR Allocations. Following the devasting effects of the Covid-19 pandemic, the IMF announced it would allocate a record-breaking amount in SDR allocations with a grand total of US$650 billion (SDR 456,49 billion).

The intention was to help soften the blow to IMF members from the socioeconomic disruption caused by the Covid-19. In conclusion, there is indeed a long run relationship between international financial institutions (IFIs) and economic growth in developing countries.

There is, therefore, a strategic logic for developing nations like Zimbabwe to engage and re-engage with the international community to open lines of credit through IFIs.

- Matsika is the managing partner at Mark & Associates Consulting Group and founder of piggybankadvisor.com. — +263 78 358 4745 or [email protected] / batanai@ piggybankadvisor.com.