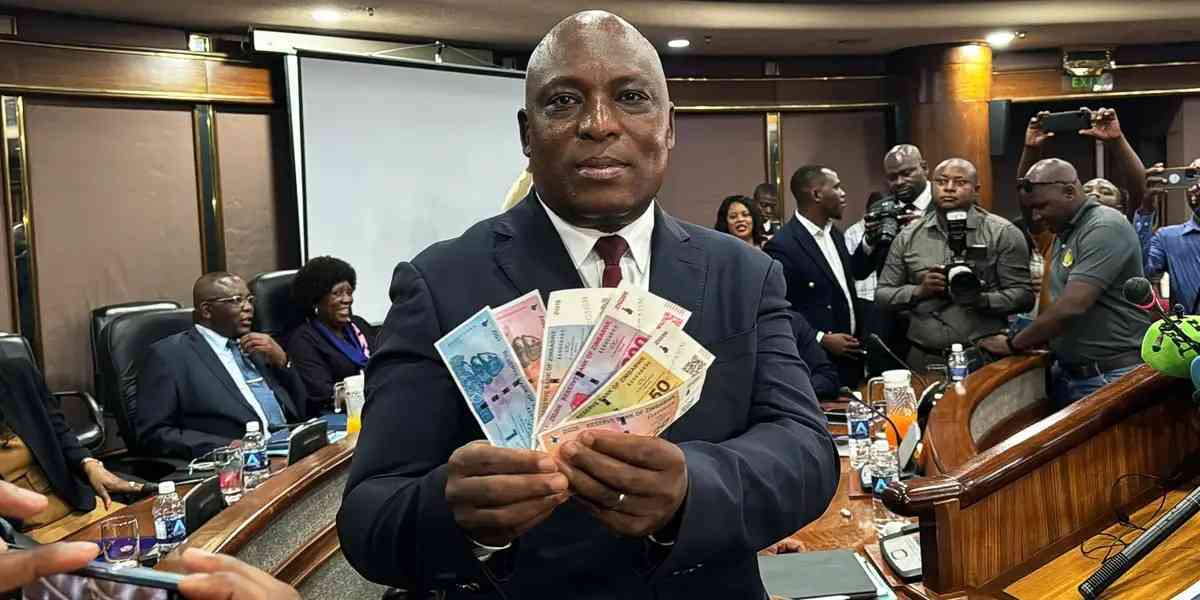

‘I’ll crush the black market’ … RBZ boss vows to smash US$2,5bn menace, bring stability

Local News

By Shame Makoshori | Apr. 12, 2024

Zimbabwe’s black market has so much power and influence to determine the exchange rate, which formal businesses have been whipped into accepting.

China writes off Zim debt deals

Zimbabwe currently owes a combined US$17,5 billion to foreign and local creditors.

By Tinashe Kairiza

Apr. 12, 2024

GMB owes wheat farmers US$35m

By Gamuchirai Nyamuziwa

Apr. 12, 2024

EU wants dialogue on investment climate

By Sydney Kawadza

Apr. 12, 2024

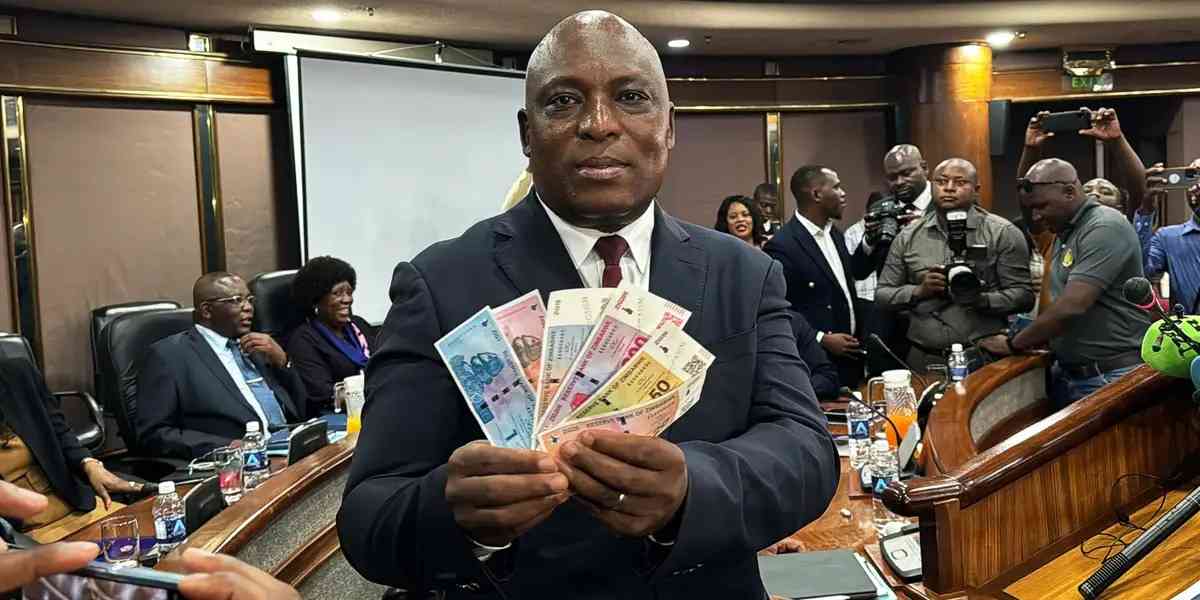

ExecutiveChat: ‘Have been in banking all my life’

Local News

By Faith Zaba | Apr. 12, 2024

ExecutiveChat: ‘Have been in banking all my life’

So what were your major highlights during your tenure as CEO of FBC?

By Faith Zaba

Apr. 12, 2024

Mushayavanhu refutes FBC shareholding claims

By Freeman Makopa

Apr. 12, 2024

GMB owes wheat farmers US$35m

By Gamuchirai Nyamuziwa

Apr. 12, 2024

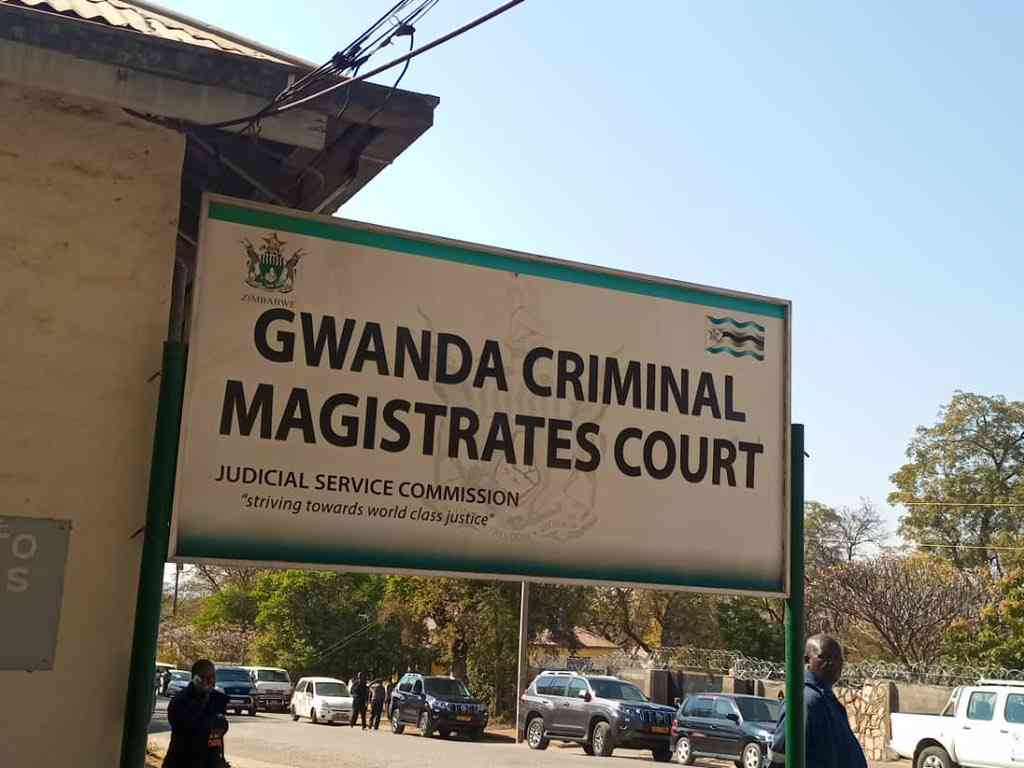

Authorities rally behind ZiG

By Blessed Ndlovu and Belinda Chiroodza

Apr. 12, 2024

Rest, good sleep contribute to better health, happiness

By Admin

Feb. 17, 2023

Everyone eligible is encouraged to donate blood, help save lives

By The Independent

Jun. 10, 2022

2024 monetary policy: Review and analysis

By Zvikomborero Sibanda

Apr. 12, 2024

MPS, outlook conference resolutions

By Batanai Matsika

Apr. 12, 2024

Benefits, concerns of illegal artisanal gold mining in Zim

By Gloria Ndoro-mkombachoto

Apr. 12, 2024

Walking the sustainability talk

By Cynthia Tapera

Apr. 12, 2024

Hope for lifting ban on OM, PPC chips

By The Independent

Aug. 26, 2022

Without planes, AirZim board won’t perform wonders

By The Independent

Aug. 5, 2022

Power crisis needs urgent attention

By The Independent

Jul. 29, 2022

Don’t print cash for projects

By The Independent

Jul. 22, 2022

Exploring the vibrant world of sports betting in Ethiopia

While the allure of sports betting is undeniable, it's crucial to approach it with caution and responsibility.

By Theindependent

Mar. 11, 2024

Satewave churns out power solutions for Zim

Satewave Technologies director Xiao Feng said the company has several solar solutions to address the current power challenges.

By Staff Writer

Aug. 15, 2023

Liquid Tech to increase tariffs by 50%

By Staff Writer

Mar. 31, 2023

Jotter: Students develop an integrated learning app

By Staff Writer

Mar. 17, 2023

Innovative crowd-investing app ‘PiggyBankAdvisor’ launched

By Staff Writer

Mar. 17, 2023

Meta gives up on NFTs for Facebook and Instagram

By The Verge

Mar. 15, 2023

Reasons To Buy Bitcoin From A Trading Platform

Another fundamental reason behind getting the coins from this particular space is that it provides

By Theindependent

Mar. 2, 2023

Why do banks not want people to rely upon cryptocurrencies?

Cryptocurrency transaction volume is much less than the fiat currencies, leading to a lack of liquidity in the market.

By Theindependent

Feb. 9, 2023

Warriors back in Afcon draw

Mapeza is likely to preside over the next set of matches after he was roped in as an interim coach last month.

By Kevin Mapasure

Apr. 12, 2024

Book Review: African decolonisation in Southern Rhodesian Politics, 1950–1963

By Anotida Chikumbu

Apr. 12, 2024

Moozy captivates audience at homecoming showcase

By Khumbulani Muleya

Apr. 12, 2024

Women take over the stage at Sofar

Cites that hosted Sofar shows on the same day included Taipei (Taiwan), Riga (Latvia), Toulouse (France) and Quito in Ecuador.

By Staff Writer

Mar. 28, 2024

Japanese pop culture comes to life in Harare

By Khumbulani Muleya

Mar. 22, 2024

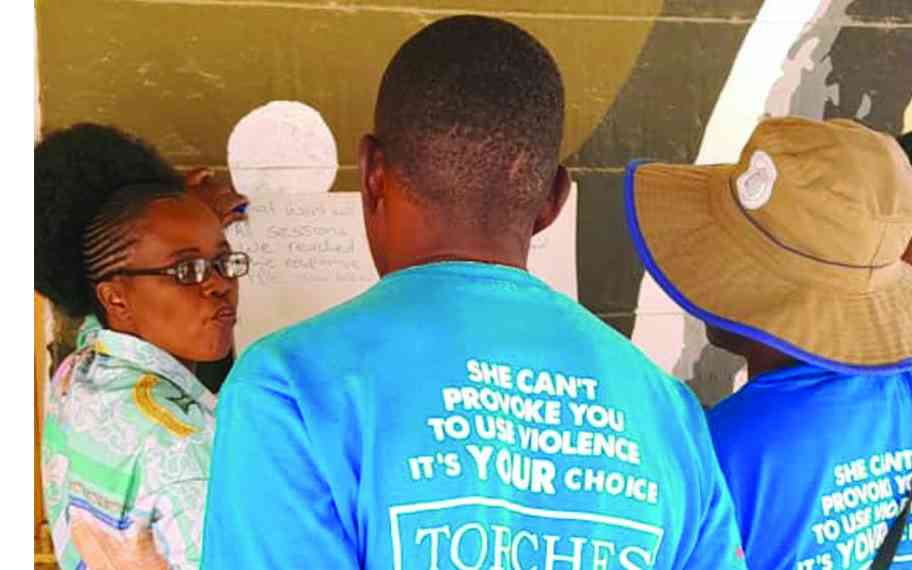

Fawezi wraps up GBV prevention initiative

By Khumbulani Muleya

Mar. 15, 2024

New children’s book a magical adventure

By Khumbulani Muleya

Mar. 15, 2024

Herbicides: Bad news for local food security

By The Independent

May. 27, 2022

Dumpsite: Gweru feels the heat

By The Independent

May. 13, 2022

Zim to pay 100% of international hunting revenue to communities

By The Independent

Jun. 10, 2022

.

Videos

Pamela Marwisa In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

Job Sikhala, Zimbabwean Opposition Politician In Conversation With Trevor

By The NewsDay

Feb. 28, 2024

ExtremeWeather: Parts of Harare experienced flash floods on Sunday

By The NewsDay

Dec. 21, 2023

Harare motorists negotiate the city’s treacherous roads

By The NewsDay

Dec. 21, 2023

Solomon Guramatunhu Day 1

By The NewsDay

Dec. 14, 2023

Sengezo Tshabangu - In Conversation With Trevor

By The NewsDay

Dec. 5, 2023

Welcome to Alpha Media Holdings Zimbabwe - NewsDay - The Standard - The Zim Independent

By The NewsDay

Dec. 5, 2023

Dock sheep tail to maintain weight

The most common way of docking tails is by using an elastic and expandable latex ring. The rubber ring is expanded with an elastrator and put over the tail, where it is released.

By Kudakwashe Gwabanayi

Mar. 22, 2024

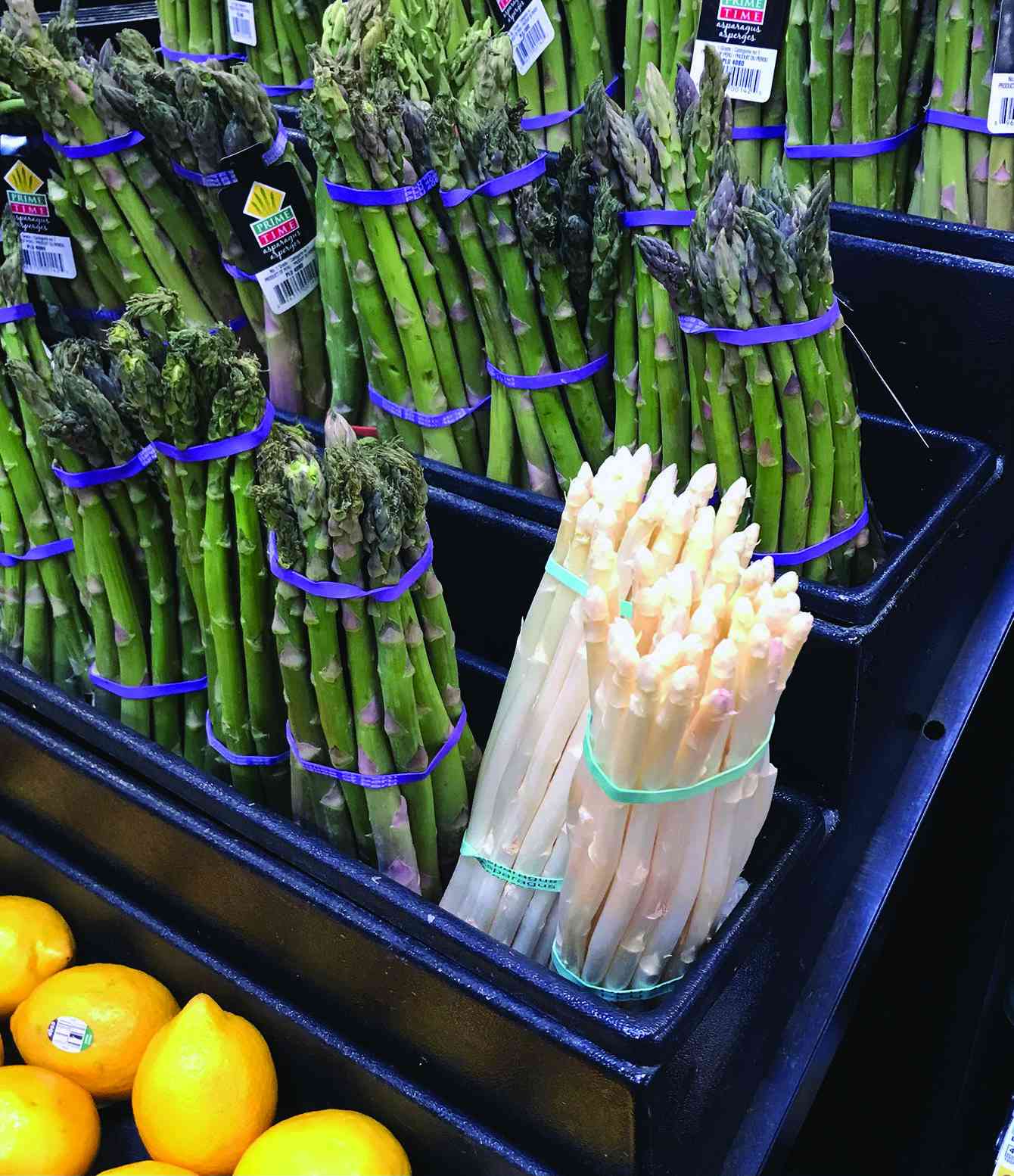

Asparagus worth your while (II)

By Kudakwashe Gwabanayi

Mar. 1, 2024

Why it makes sense to farm meat goats

By Shane Brody

Jul. 7, 2023

How to start a fish farming business

By Kudakwashe Gwabanayi

May. 26, 2023

Climate change is real, be alert

By Kudakwashe Gwabanayi

May. 12, 2023

Lady Chevrons vie for World Cup place

The top two sides from each group sail through to the Global semifinals with the two finalists booking a ticket to Bangladesh.

By Austin Karonga

Apr. 14, 2024

Youth move in to get slice of construction industry cake

Chihota gave thumbs up to the parent association, ZBCA, for coming up with such an initiative.

By Staff Reporter

Apr. 14, 2024

Makarati boost for DeMbare

By Henry Mhara

Apr. 14, 2024

Scores arrested for booing Auxillia

By Kumbirai Mafunda and Everson Mushava

Apr. 14, 2024

Champions Ngezi Platinum snatch point from Bosso

By Munyaradzi Madzokere

Apr. 14, 2024

Govt fails to pay civil servants for blitz

By Miriam Mangwaya

Apr. 14, 2024

Overflowing toilets a health time bomb

A member of the ward development committee, Kholwani Mtuliki, expressed concern over the poor sewage system.

By Jerssie Mpofu

21h ago

NGO mobilises sanitary wear for women in prison, girls

Garura said the initiative would see young girls attending school and avoiding missing classes due to lack of food and sanitary wear.

By Patricia Sibanda

21h ago

Byo humanitarian honoured in Africa

By Margaret Lubinda

Apr. 17, 2024

Valve vandalism worsens Bulawayo water crisis

By Innocent Magondo

Apr. 17, 2024

Residents ramp up fight against drug abuse

By Patricia Sibanda

Apr. 17, 2024

China Impacting Regional Stability And Autonomy Of Maldives

Since assuming office in November of the previous year, President Muizzu, who is viewed as having pro-China inclinations, had requested India to withdraw its troops from Maldives.

By The Singapore Post

12h ago